“One person said to me, 'I have a list of 300 potentially attractive stocks, and I constantly watch them, waiting for just one of them to become cheap enough to buy.' Well, that's a reasonable thing to do. But how many people have that kind of discipline? Not one in 100.” – Charlie Munger

What is Watchlist Investing?

Watchlist Investing is an extension of my investment philosophy. That, in turn, was and continues to be heavily influence by Warren Buffett and Charlie Munger.

Be The 1 in 100…

Charlie’s quote above speaks to my general philosophy. The name Watchlist Investing comes from the idea of building a watchlist of stocks. The idea is to patiently find and follow a select group of companies until one becomes attractive enough to buy.

… Not like everyone else

Some investors look at the daily/weekly lows lists for ideas. But that’s like arriving at the scene of a fire and having to quickly determine whether to offer the homeowner a deal. Will it burn down? Is the fire department right around the corner?

I’d rather take the time to get to know a company/industry first and then trust that inevitably Mr. Market will serve up a good price.

Filings-First Analysis

I Read The Footnotes: My approach is built on using primary sources for analysis. I use 10K’s, 10Q’s, transcripts, and other primary material as sources.

My Focus Areas: I’m drawn to founder-led compounders. My circle of competence includes:

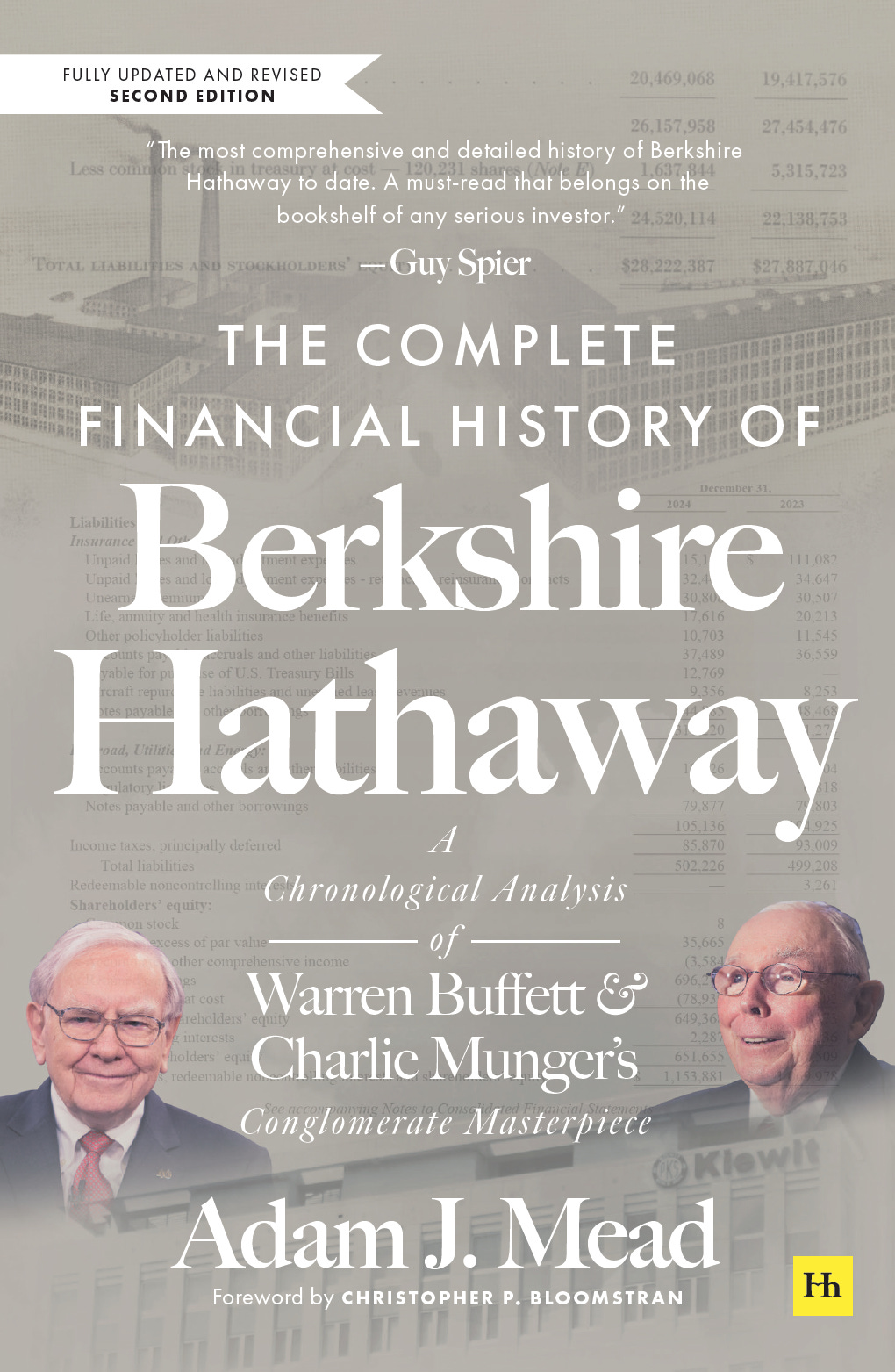

Berkshire Hathaway (I even wrote a book on the company)

Banks (I spent over a decade in commercial credit)

Beer

Logistics

I’ll stray outside of these industries if something looks interesting, and to expand my curicle of competence. In short, I’m always learning.

Subscriber Benefits

Live Berkshire Hathaway valuation model, updated quarterly

Full access to the archive dating to 2021

Deep dive coverage of quality companies

Subscriber-only Google Meetups and replays

NOT INVESTMENT ADVICE!!!

NOTHING - and I mean nothing at all - of what I write, imply, link to, comment on, etc. should be considered investment advice. This newsletter is intended as a general publication for information/educational/entertainment purposes and is not and should not be considered investment advice or an offer to buy or sell securities.

I’m licensed as a registered investment advisor and have a fiduciary duty to put clients first. That means ahead of all subscribers and myself. Subscribers are NOT my clients. All of that said, I will endeavor to let subscribers know when I or clients own the securities I discuss, but I have no duty to keep you informed if anything changes. Good morals (and the law) also mean I won’t use this publication to tout or pump and dump securities. I don’t want to go anywhere within 500 miles of that gray line.