Triumph Financial: What's New

A general update on the bank remaking trucking payments

Disclosure: Long TFIN

Prior posts:

Initial Deep Dive December 2022

It’s been a while since I posted on Triumph Financial. Shares have fallen about 50% since peaking at $110 (~$2.6 billion market cap) in December 2024, to $55/share or $1.3 billion market cap today. We’ve seen this story before, as evidenced by the 5-year chart from Morningstar below.

Why the reversal? Several factors come to mind:

Banks: Many people shun banks

Complexity: Triumph has several operating divisions that are symbiotic but can look messy at first glance

Change: Triumph has pivoted as its business has developed

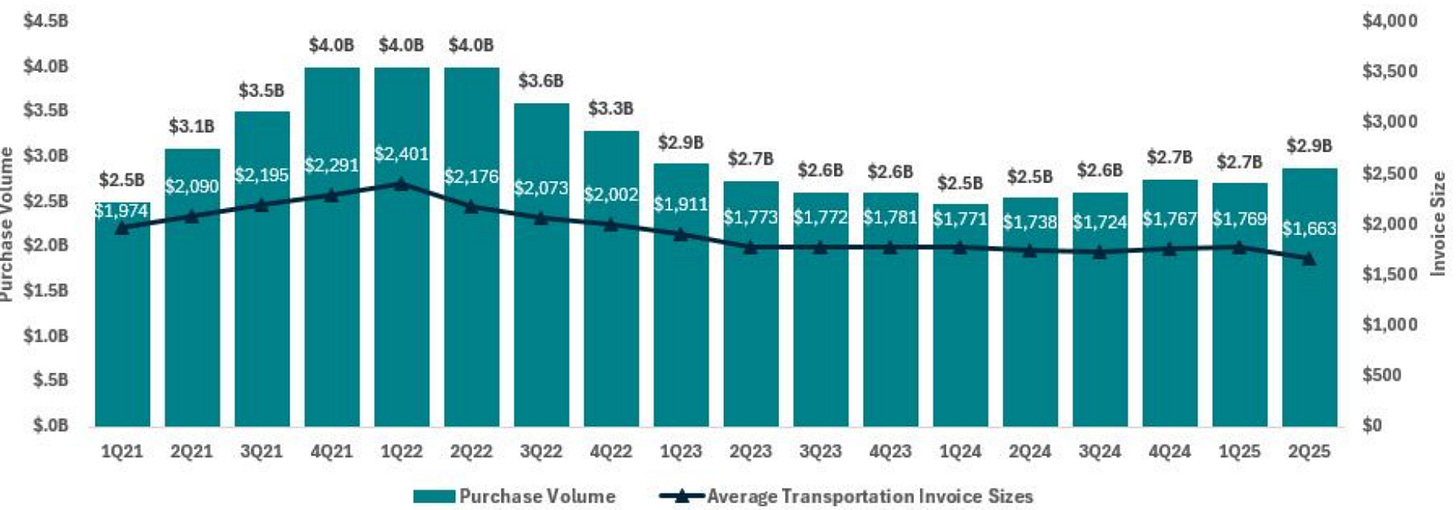

Trucking: Triumph is all-in on the US trucker, a market that remains soft after peaking in 2022

The (incredibly brief) history of Triumph

Triumph started as a reincarnation of a failed bank that saw a way to generate a wide net interest margin by pairing low-cost bank deposits with factored receivables. A focus on transportation receivables led the bank to invest in technology to reduce the labor-intensive processes and costs. This led to the development of a payments network that uses structured data to ensure all parties have reliable information and can transact quickly and seamlessly. Finally, Triumph began investing in ways to monetize its clean, real-time data.

In short, Triumph has become, and is looking to further entrench itself as, an ecosystem of tools and products that aid participants in the trucking payments value chain, from shippers and brokers, to factors, to large carriers, to individual truckers.

Pieces of a whole

Triumph has four segments that stand alone but interrelate in important ways:

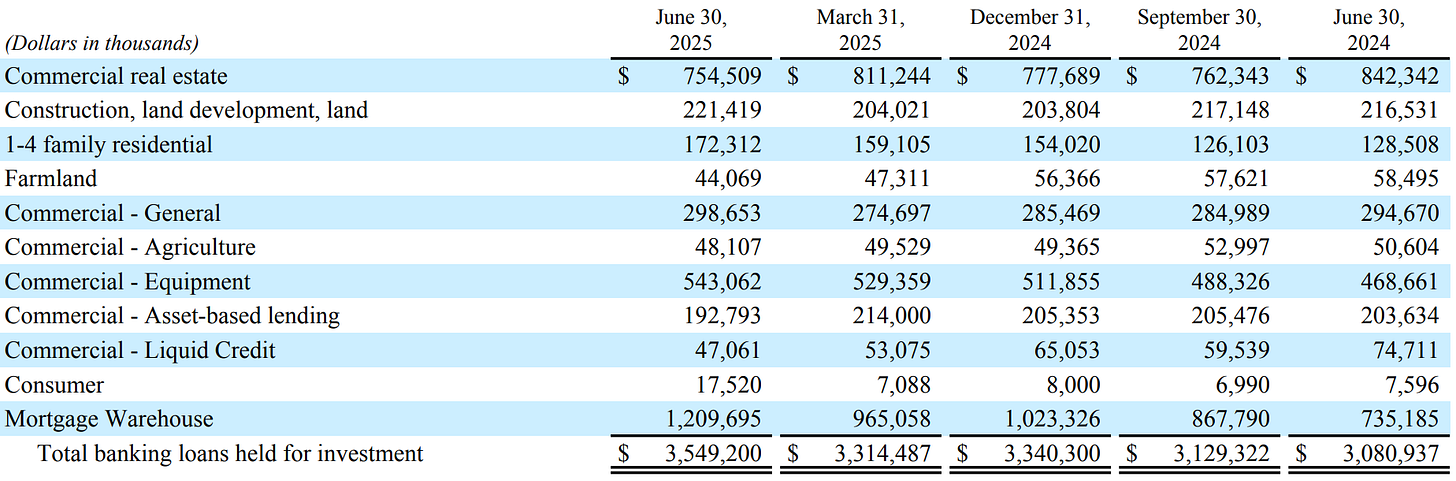

Banking. The $3.5 billion portfolio includes $543 million of equipment loans. The bank provides capital to other segments (primarily factoring) and receives low-cost float from others (payments).

Factoring. In exchange for a small discount and immediate cash to a trucker, Triumph takes ownership of a receivable. It then collects on the receivable in about a month. Of the $1.2 billion 2Q2025 balance, 96% were transportation-related receivables. High yields come from small average invoice sizes ($1,693 last quarter), not credit risk, as is sometimes assumed.

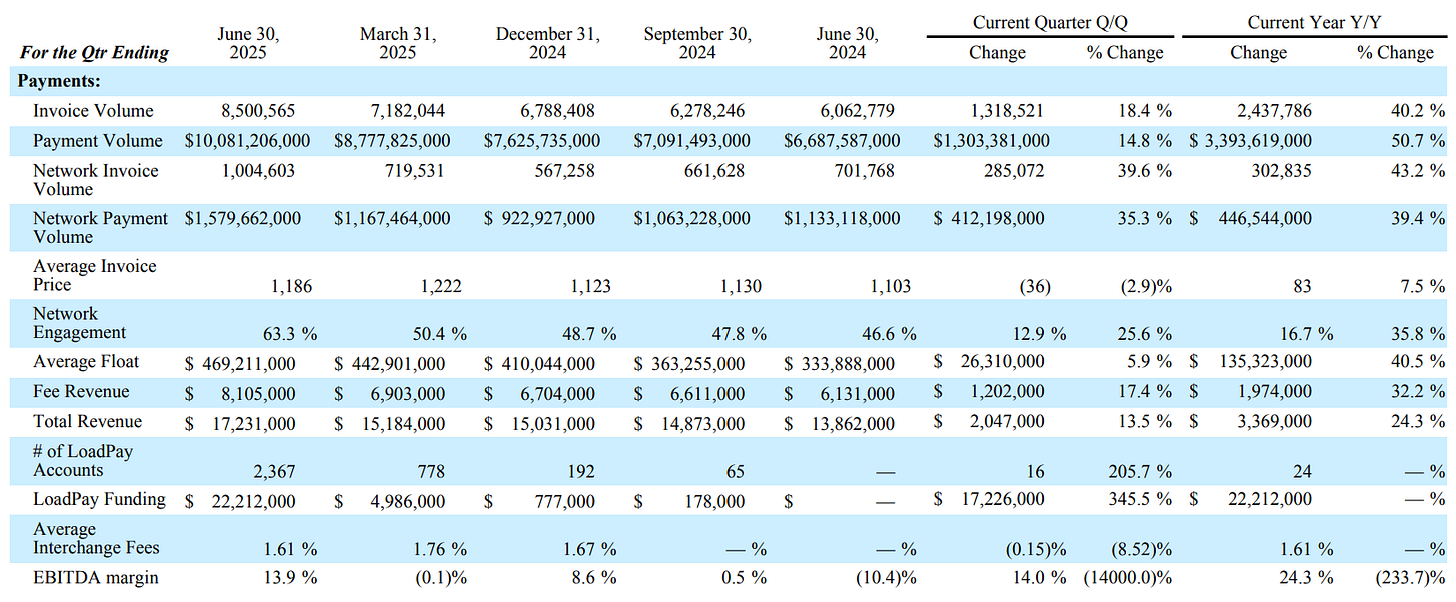

Payments. These are on the Triumph network and act like a credit card network. Triumph facilitates payments for its own factoring portfolio and other factors, and provides other services like audit. Payments processed $10.1 billion worth of invoices in Q2, with $1.58 billion going over its own network, and generated $469 million of average float.

Intelligence. The newest division that will take Triumph’s clean and real-time data and provide it to shippers, brokers, and others. The recent acquisition of Greenscreens.ai forms the backbone of this division.

Corporate and Other. It’s important to view total overhead costs, not just those allocated to the operating divisions.

Let’s dig into each…

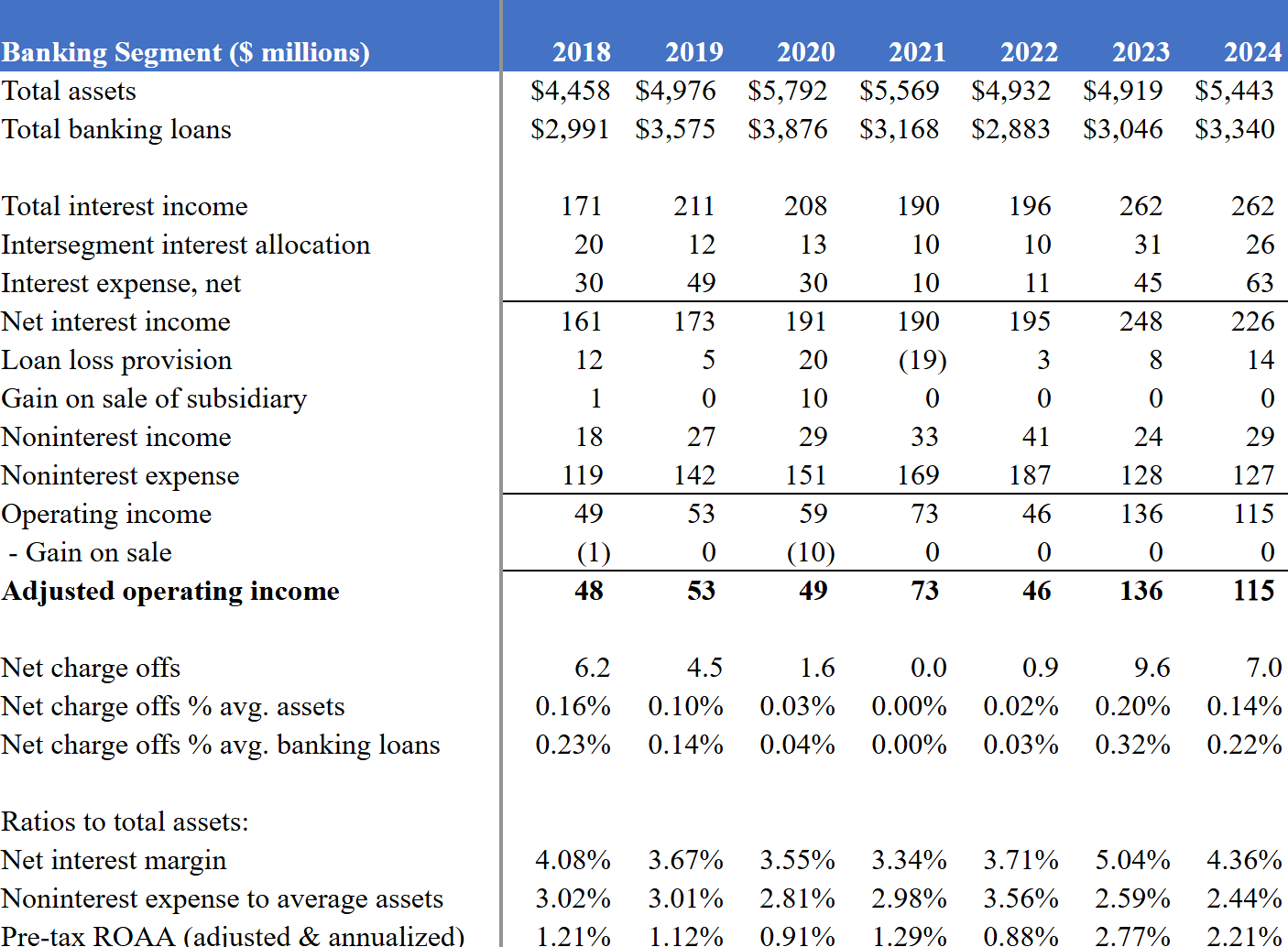

Banking

The banking segment is Triumph’s “legacy” or first operating segment. The jump in profitability in 2023 reflects an accounting change to reallocate expenses to a corporate segment.

We’ll capture that expense as it relates to value (contra) below. But two years of history under the new accounting and H1 results that show a $53 million operating profit suggest the earning power of this segment is somewhere around $100 million pre-tax.

Of particular note, the bank finally collected on its long-running saga with the USPS on a $19.4 million misdirected payments receivable.

Loan growth has primarily come from a half-billion-dollar increase in mortgage warehouse lending.

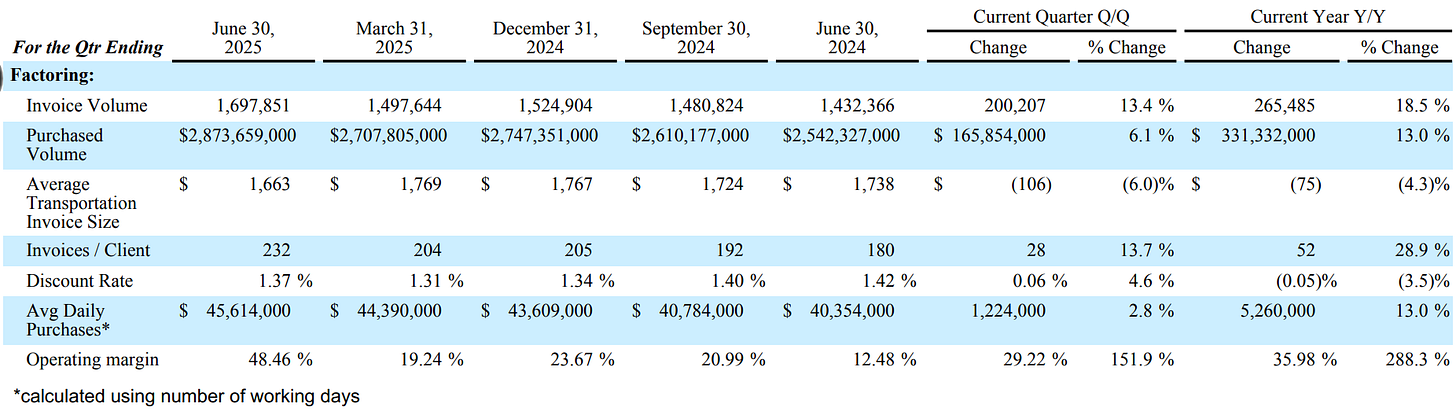

Factoring

Viewed broadly, Triumph’s factoring business has doubled since 2019. Back in 2019, it purchased $5.7 billion of receivables and had a period-end balance of $573 million. Its operating expenses (non-interest expense) was $52 million.

In 2024, Triumph purchased $10.3 billion and had a period end balance of over $1 billion. Non-interest expense was $79 million, reducing profitability.

This broad comparison misses some important changes in the business. For starters, Triumph isn’t actively trying to grow the segment at the expense of its partners. It views factoring as part of its liquidity solutions, meaning if another factor doesn’t want the receivable, it’ll step up and take it. But it doesn’t want to jeopardize the other parts of its business by being aggressive in factoring, since it has a natural advantage over other factors being plugged into brokers and carriers.

In 2024, Triumph created Factoring as a Service, an offering that provides back-office factoring services to customers such as CH Robinson.

Triumph is also shifting toward net funds employed (NFE) pricing. An NFE model separates the transactional costs of doing business from the capital costs, leading to a more transparent and incentive-aligning model.

Putting a value on the factoring segment isn’t straightforward. If we assume stasis, then it’s earning about $30 million pre-tax per year. H1 operating income was $27 million. I think at worst—ignoring the investments in technology and efficiency and upside gain—the segment should earn $50 million pre-tax. It could conceivably earn $100 million/year under a more typical trucking market.

Payments

At just seven years old, the payments division is beginning to stand on its own. Beginning in 2023 the payments segment became self-funding. The unit now supplies $469 million in float, for which it is credited the Fed Funds rate from the banking division.

The segment has shifted from a more capital-intensive operation with a focus on driving interest income to a fee-driven model aimed at simplifying and streamlining payments within and outside of Triumph. Discounts to some early customers to build the platform are ending as the company applies a consistent pricing model.

Network transactions are those payments where both sides of the transaction are on the T-Pay network. For example, a broker pays a carrier, both of which have the same structured data residing on Triumph’s systems. Network transactions grew nearly 40% year-over-year.

In 2024, the unit began its LoadPay offering. This product is a win/win for truckers and Triumph as it allows truckers to be paid 24/7. Triumph simply credits the trucker’s debit card from its own balance sheet, thereby keeping a carrier or broker payment on its balance sheet longer.

With a lot going on in this segment, I think you can view it through a few key variables:

Total volume. More volume through the system = more float, more interest income, and more fees.

Float. The added benefit of the volume.

Non-interest income and expense to volume. These are lumpy, to be sure, but there’s a clear upward trend in non-interest income to volume and # payments, which means the bank is extracting its share of value from its ecosystem. At the same time, non-interest expense has shown a modest decline over time.

So what’s this bundle of services worth? The short answer is I don’t know and the range is undoubtedly wide.

Clearly, there is value in the services Triumph is providing its payments clients. Payments revenue grew from zero seven years ago to $56 million in 2024 and $62 million TTM 2Q2025.

CEO, Aaron Graft, thinks payments-like margins are possible. Think 50%+. If it did so overnight, that would mean $30 million in operating income and place its value maybe between $300 million (10x) and $600 million (20x).

Another way to view value is through the float. If the division breaks even elsewhere but maintains its float, that’s a huge source of value. For example, $469 million invested into loans at the Q2 average rate of 8.41% would bring $39 million. Cap that at a normalized 10x and you have $390 million.

Intelligence

This segment is a clear next step in the evolution of the business. It undoubtedly has value but it’s probably impossible to quantify at this stage.

Corporate and Other

A negative or contra source of value is the corporate overhead. Total non-interest expense in this segment went from $64 million in 2022 to $84 million in 2023, to $104 million in 2024. YTD it’s at $59 million.

If we treat $100 million of annual corporate costs as a permanent drag, that’s a $1 billion reduction in value (at 10x).

Valuation

Putting it all together:

Banking: The banking segment should earn $100 million pre-tax and we can have reasonable confidence in it. At 10x that’s $ 1 billion

Factoring: With less confidence than banking but with reasonable expectations, the factoring segment should earn $50 million. At 10x that’s $500 million.

Payments: The benefit of float alone is worth some $390 million

Intelligence: Too early to tell

Corporate overhead: $100 million of annual expenses is ($1 billion) in value

Total = $890 million.

The current market price of $56/share implies a market cap of $1.3 billion, about $410 million or 46% above the sum-of-the-parts value detailed above.

What explains the discrepancy?

First, there’s spending ahead of growth. Management has been clear that they aren’t managing current earnings but rather investing for the future.

Second, growth could add significant value. The upside in payments could be enormous once all the pieces are working seamlessly, the trucking market returns to a semblance of normalcy, and market participants judge Triumph as the only game in town for truly credit-card-like speed in transactions.

Intelligence is another wildcard.

Factoring could grow fee income with the FaaS offering outside of growth in volume/balances. A return to normalcy could add $50 million in earnings and $500 million value, bridging the gap from that alone.

Other

Some other tidbits worth mentioning:

The Greenscreens.ai deal (forming the backbone of Intelligence) closed on May 8, 2025. The bank funded the deal with $140 million of balance sheet cash and $20 million of TFIN stock.

An 8K filing on September 11 disclosed that a trucking borrower, Tricolor Holdings, LLC, filed Chapter 7. Triumph holds a $23 million piece of a $60.5 million loan secured by vehicle inventory.

In March, Triumph announced new leadership positions in factoring, payments and banking, and LoadPay. Importantly, those currently leading their divisions were elevated to other positions, so I view this more as a deepening of the bench than a strategic shift. All are TFIN insiders.

Conclusion

Writing this, I am painfully aware of the complexity of the bank. There are not only many moving parts but uncertainty around them, all overshadowed by weakness in the trucking market that seems endless at this point. While management speaks optimistically (how could they otherwise), I’m encouraged by their transparency and candidness in the face of challenges.

Taking a step back, Triumph is attempting to do something difficult in a historically staid industry. Removing friction from the value chain is a winning proposition for the entire industry, and Triumph should be rewarded with its share of the spoils in due course.

Stay Rational!

Adam

Great article Adam. It taught me something I didn’t know about; the factoring business.