Triumph Financial (TFIN) Q4 Update

Efficiency, focus, and growth at the forefront heading into 2026

Disclosures: Long TFIN

Prior posts:

Initial Deep Dive December 2022

Triumph has increasingly placed focus on its expense run rate, now at roughly $100 million/quarter. The bank expects to leverage efficiencies, including AI, to drive growth on top of this base (+20% in transportation in 2026), leading to expanding margins and profits. All of this is happening amid the longest trucking recession in history, now close to its fourth year.

Graft’s Q4 letter to shareholders highlighted areas of retrenchment and focus. For example, it reported a $14.3 million gain from the sale of the office building the bank purchased in 2024 and never occupied and a company aircraft.

The bank is also exiting its asset-based lending and liquid credit businesses. These businesses were once seen as opportunistic areas for capital allocation. Now, working through some credit issues, they are viewed as distracting from the bank’s core mission of serving the transportation industry.

I view this renewed focus on transportation as a favorable development.

As Graft noted on the Q4 call, the bank is serving three classes of investors: those focused on growth, those focused on efficiency, and those focused on balance sheet strength and credit quality. Graft rightly views all three as important and places all three in the context of the bank’s mission to help the trucking industry transact confidently.

Payments

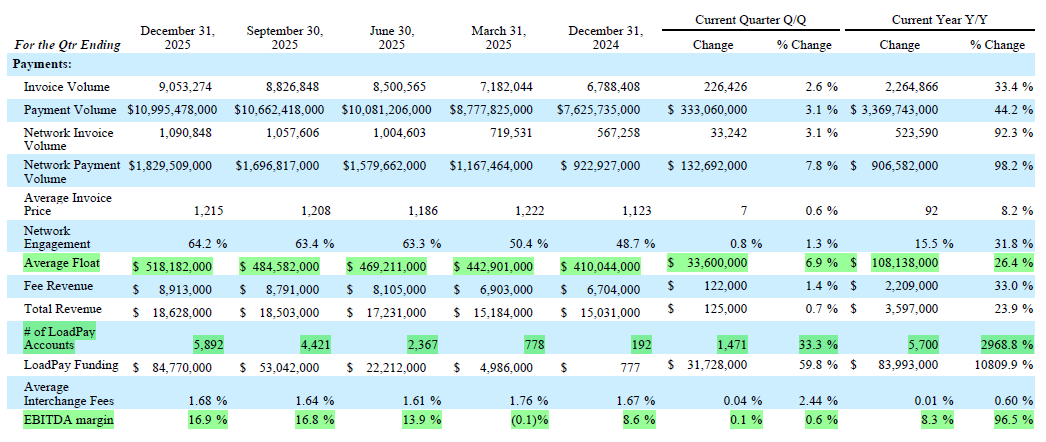

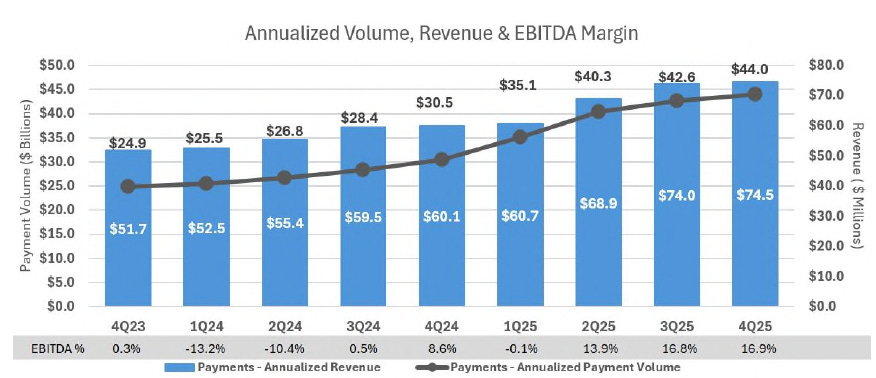

A lot is going on here; however, a few numbers stand out:

Average float: This business creates short-duration float (a few days to a week) from the time it holds onto customer funds while in process. This is cash that will work to lower the bank’s cost of funds over time.

Load Pay accounts: This is a relatively new business that not only allows truckers to be paid 24/7 but works to increase NIB deposits as the cash still sits on the TFIN balance sheet instead of going out to a factor. The bank added 1,500 accounts in Q4 and expects to add between 7,000 and 12,000 additional accounts throughout 2026.

EBITDA margin: Included in the 16.9% margin isthe drag from LoadPay startup costs. Excluding LoadPay, EBITDA margin for Q4 was 29.5%. Graft thinks Payments can achieve a 50% EBITDA margin, including LoadPay, at scale.

There’s a lot more work to do in payments. But fortunately, there’s a lot more work to do in payments. The results achieved so far include 67 out of the top 100 brokers, and will include JB Hunt going forward. Yet, only a fraction of customers use other offerings across payments, audit, and intelligence. There’s room to improve cross-sell and deepen relationships and profits.

Lastly, because of introductory pricing, just 35% of payment customers were charged a fee as of Q4. That increased to 38% in December. Now that Triumph has proven its network, turning on fees becomes easier. They already have the customers and are doing the work, so turning on the fees will fall right to the bottom line, all things being equal (I’d expect some attrition, after all).