Russell Microcaps Rebalancing - Interesting Remainders

Some interesting finds looking through the pile of non-financial companies.

Last week, I looked at some banks in the list of Russell Microcap additions and deletions. That post also described what the Russell Reconstitution event is and included a few charts/graphs.

This week I’m taking a look at everything else. Just a handful of additional companies made the cut of worthwhile ideas to pass along. That’s okay. This is the wide part of the filter for generating new ideas, and it can be hit or miss.

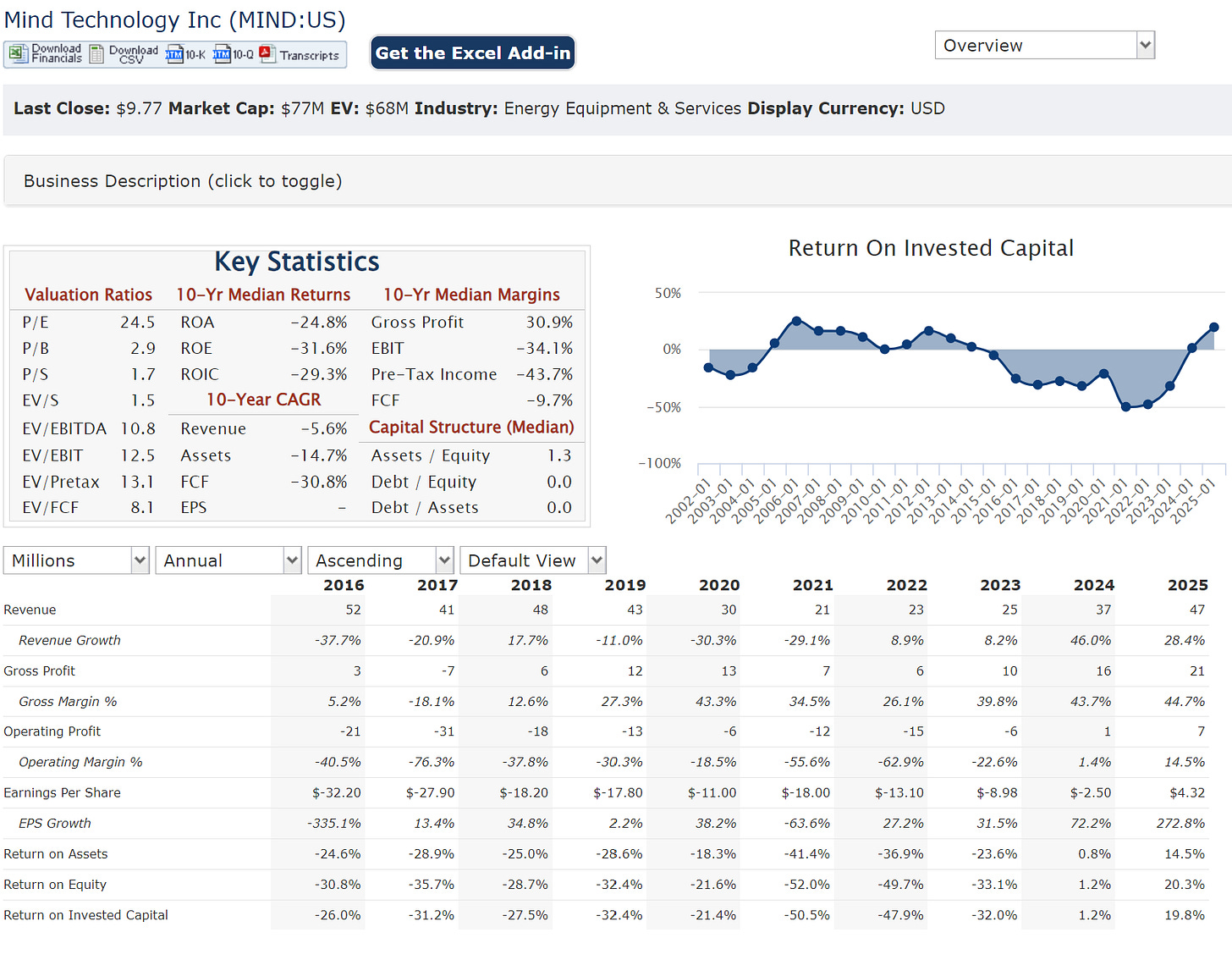

Mind Technology (MIND)

Index Addition

$78mm market cap

Mind probably caught my attention because I just returned from a trip to mid-coast Maine for a family vacation. That trip included a few boat rides. Mind’s products include maritime products that help companies survey, explore, and seismically map the ocean floor. The company just achieved profitability and has a strong balance sheet with no debt. It trades at 3x book value and a high multiple of current earnings. Insider ownership is light, and I’m sure there’s other hair on it. It could be an interesting candidate for someone already knowledgeable of the industry and/or looking for something on the cusp of profitability.

Armlogi Holding Corp (BTOC)

Index Addition

$63mm market cap

BTOC caught my eye because it’s in the third-party logistics industry. It has a short operating history (founded in 2022). It’s expanded revenue considerably since its founding and has been profitable. The company focuses on a niche within the vast 3PL space, handling logistics and warehousing for shipments that are larger than those typically handled by competitors.

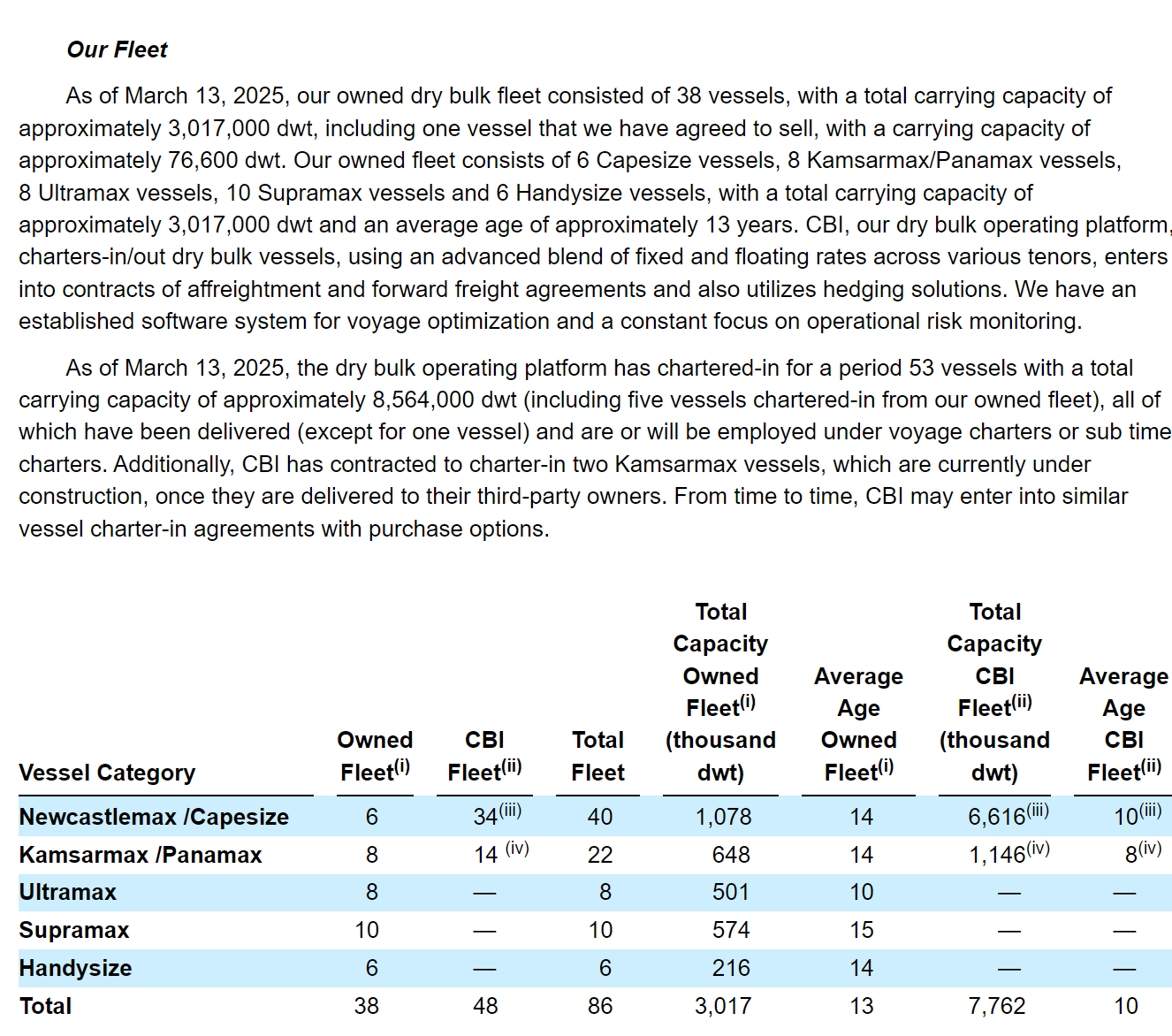

Costamare Bulkers (CMDB)

Index Addition

$221mm market cap

Costamare is a spin-off from Costamare, Inc. that began trading on the NYSE in May 2025. Costamare Bulkers owns a dry fleet of 38 vessels with 3 million deadweight tons of total carrying capacity. It also owns a dry bulk operating platform. The company is majority owned by the Konstantakopoulos family and related entities. Shipping is another industry I don’t know well (if at all), though it would seem reasonably straightforward to make an assessment of the value of its vessels/capacity. Using some rough math, the company has total assets of $1.19 billion, including vessels valued at $614 million ($212/dwt) Debt (including leases) amounts to $622 million. That puts the enterprise value at $843 million or $281/dwt, which, from my little research, appears to be middle-of-the pack in terms of valuation for a fleet of that age.

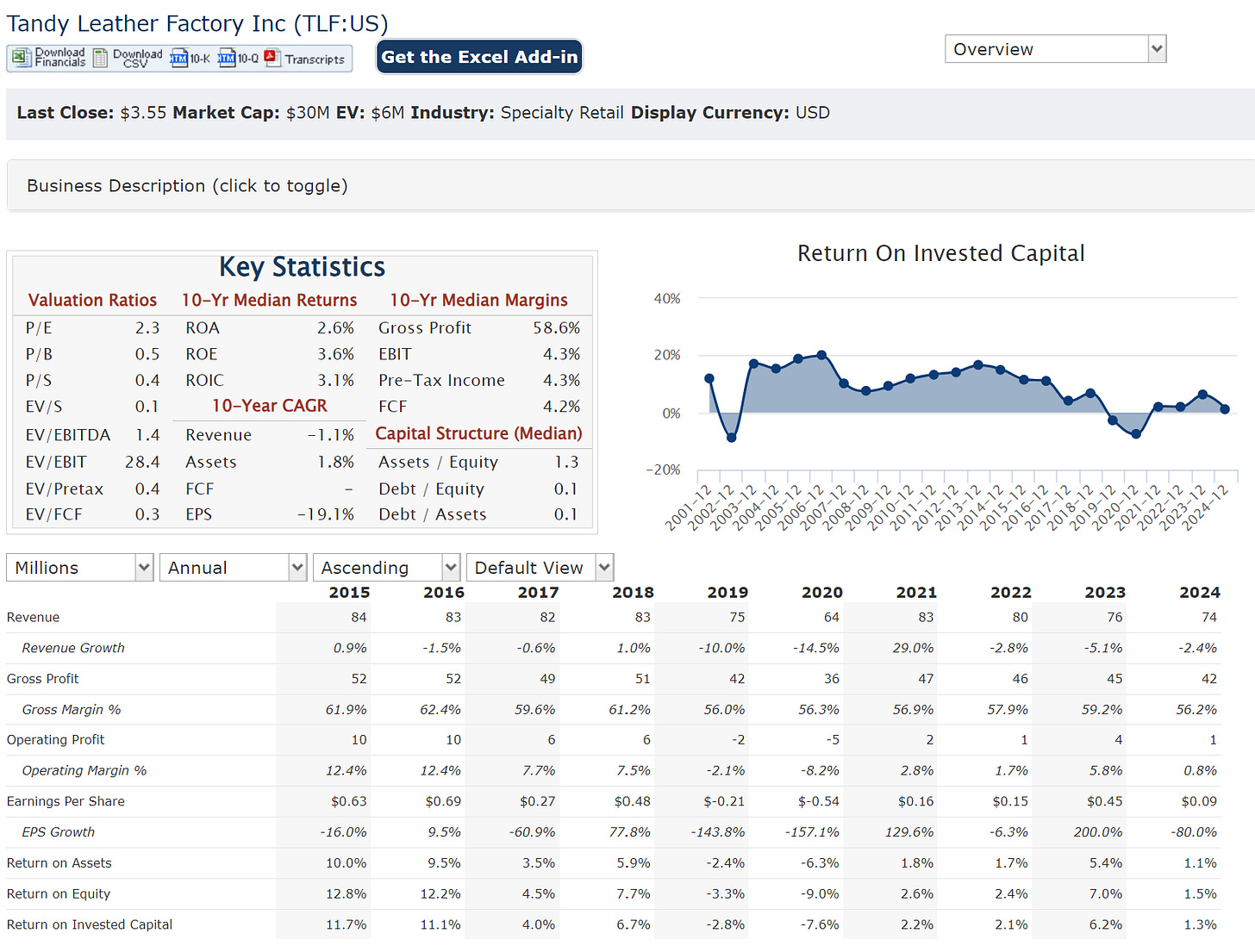

Tandy Leather Factory (TLF)

Index Deletion

$30mm market cap; $6mm EV

I hesitated to put this one in here only because I may still do some work on it. With a $6mm enterprise value and run by a shareholder-friendly group, there’s a lot that can go right here.

Without knowing the leather industry, it’s clear the business has struggled over the last few years. But there are a lot of positives:

Cash of $24mm as of March 31 with just $7.5mm of operating lease liabilities.

Net current liabilities of $46mm

Net PP&E of $6.2mm

About $7.75mm of other long-term liabilities, including the $7.5mm operating leases noted above.

Insider ownership of 50%+

The chairman is Jeff Gramm, who wrote the book Dear Chairman; Gramm’s fund controls 34% of shares

The company just sold its HQ in Texas

Share count has gone down by ~15% over the past decade

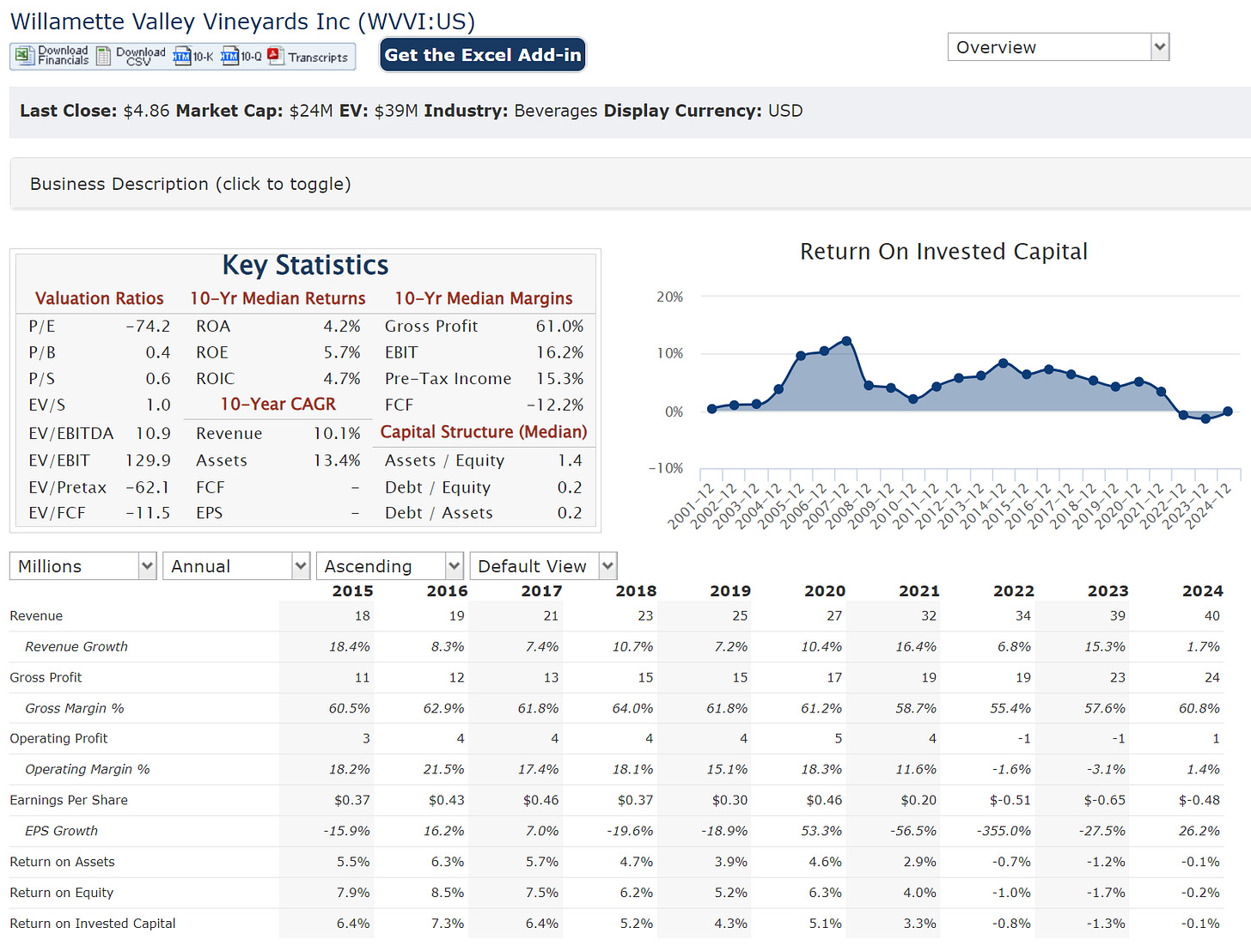

Willamette Valley Vineyards (WVVI)

Index Addition

$24mm market cap

As you may have guessed, WVVI is an Oregon-based vineyard selling wines. Here’s a company trading at 35% of Q1 book value if asset values are to be believed. Perhaps the company deserves its market cap—profits seem to have been illusory for five years. The company made a steady $4-5mm operating profit between 2016-21, then faceplanted with two years of small operating losses.

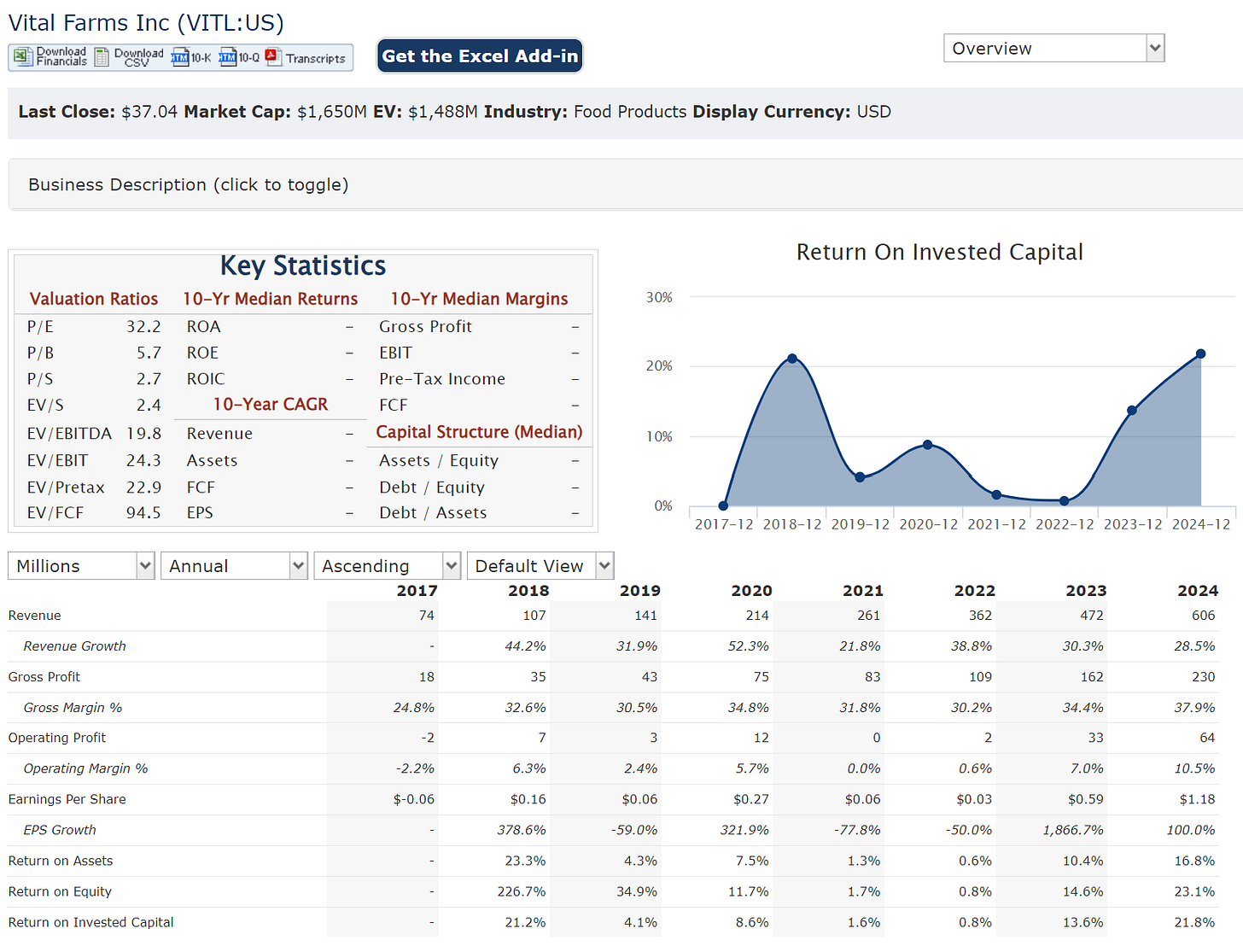

Vital Farms (VITL)

Index Deletion

$1.65 billion market cap

Here’s what looks like an instance of getting kicked out of the index for the right reason. Sales, profits, and EPS have steadily grown since 2017. Vital competes in the $12.5 billion shell egg market and holds a 9.2% market share according to its 10K. Vital sells eggs through 24,000 stores in the US. The company maintains a solid balance sheet despite growing rapidly over the past three years.

QXO, Inc. (QXO)

Index Deletion

$13.9 billion market cap

I include QXO more as a curiosity to note than a potential bargain, though I certainly could be wrong. QXO is a distributor of roofing and building products based in Greenwich, CT. It caught my eye for the sheer size of the market cap, now quite obviously leaving the microcap index.

QXO was founded by Brad Jacobs, the successful billionaire entrepreneur behind XPO Logistics and other roll-up/consolidation-type companies. QXO aims to be a tech-enabled building products company, consolidating and modernizing a large, fragmented industry. QXO’s market cap reached the microcap stratosphere via its recent equity offering, which it used to acquire Beacon for $11 billion. The company is targeting $50 billion of sales over the next decade within the now $800 billion industry.

Stay Rational!

Adam

Great content !