Old Dominion & Saia Update

Shares are down by half but patience is warranted

Disclosure: None

Prior posts:

Enticing Price Drop

Shares of my two favorite LTL trucking companies, Old Dominion and Saia, are down by half from their 52-week highs. Old Dominion is off by 40% while Saia shares are down 53%.

It’s tempting to scream “bargain!” on the price action alone.

Is Old Dominion's common equity really worth $29 billion? Is Saia really worth $7.8 billion? I don’t think so —yet—but it’s worth keeping up with developments.

Industry Update

Here’s a graph showing the market share of industry leader, FedEx, and Old Dominion and Saia. The raw data is included in the appendices below.

Of particular note:

FedEx announced in December 2024 that it would spin off its LTL business in the first half of 2026. Back then, prices were sky-high, and it’s unclear whether the plan will still move forward.

Yellow’s bankruptcy in 2023 helped the remaining players, allowing them to pick up organic volume and purchase terminals on the cheap.

Market share of the top players (second chart) remains stable, boding well for the industry long-term.

LTL companies have fared much better than their full truckload peers owing to the unique nature of LTL and its capital-intensive distribution network.

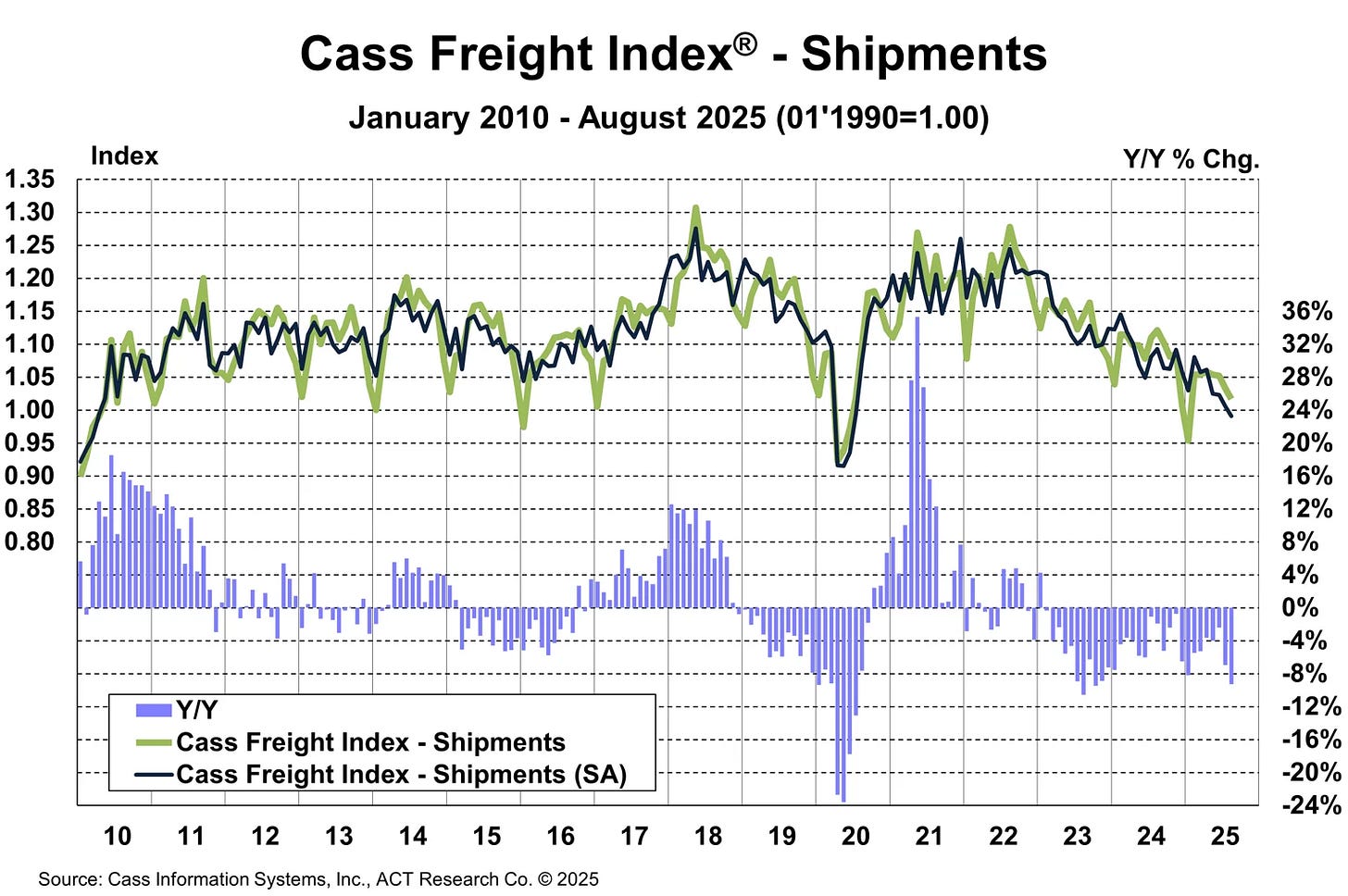

Cass index shipments are down…

…but pricing has stabilized…

Operating Assessment

Comparing the P&L of Old Dominion and Saia, it’s clear that the Old Dominion system is not only larger but more efficient.

Old Dominion boasts an operating margin in the mid 20s, while Saia is at about 15%. Margins, although down from the 2022 pricing bonanza, have remained structurally higher than pre-pandemic levels.

Old Dominion’s operating margin has remained stable through the first half of 2025, while Saia’s is down about five points due to a harsh winter, cost inflation, and a drag from expanding its terminal network.

What’s different about the companies is Old Dominion’s more mature network compared to Saia’s relatively new national network.

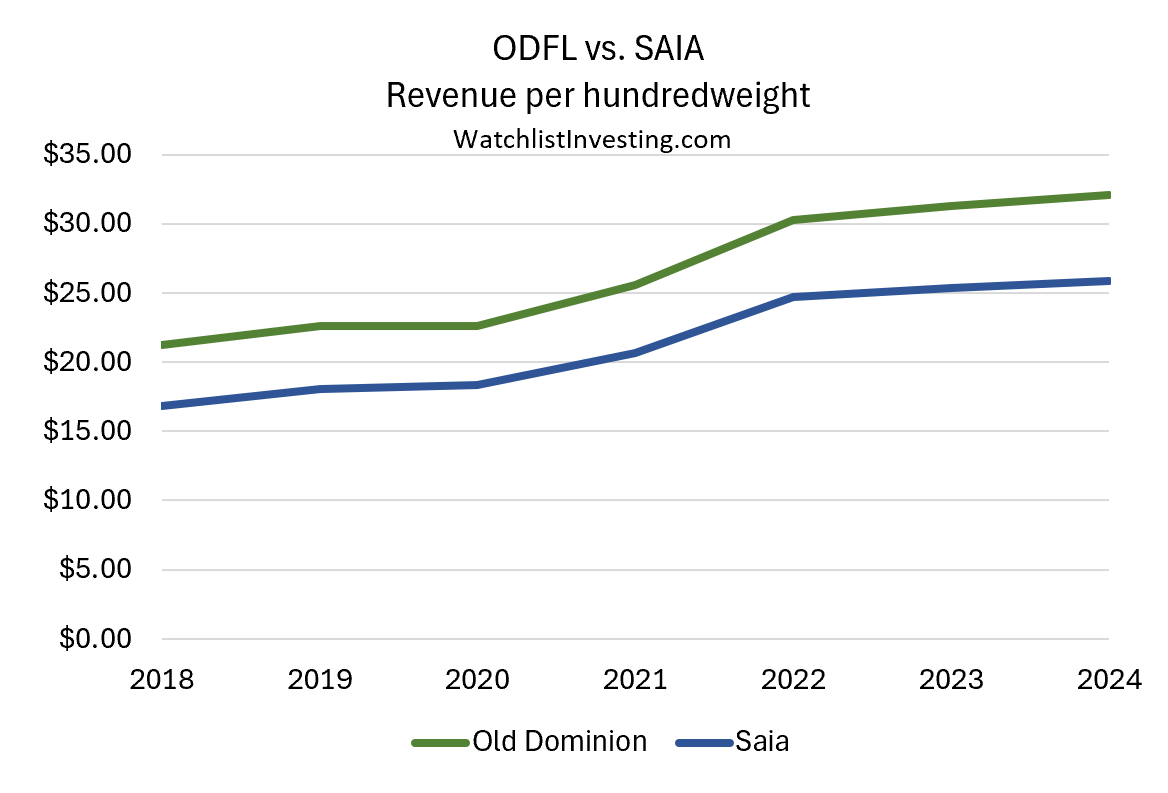

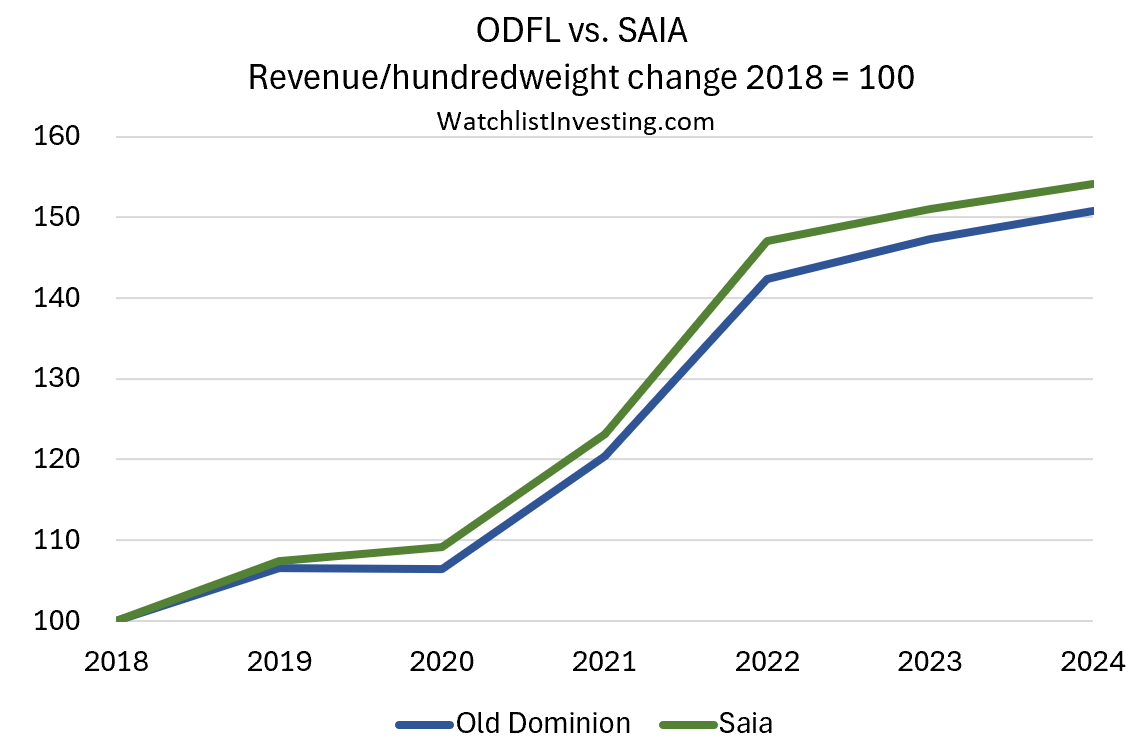

While Old Dominion clearly enjoys a degree of consistent pricing power (first chart), the delta has remained relatively consistent (second chart), demonstrating that Saia is benefiting along with the industry when it comes to pricing.

The jump in LTL pricing from 2020 to 2022 is abundantly clear.

Capital Allocation

Both companies have invested significantly in growth capex during the seven years under review.

Old Dominion increased its net PP&E from $2.75 billion at the end of 2018 to $4.5 billion by 2024 (+64%). Saia’s increased from $893 million to $2.56 billion (+186%).

Both companies have grown organically without any acquisitions in the traditional sense (both picked up some Yellow terminals).

Saia, in growth mode, invested all of its net income and then some in growth, taking on some debt in the process.

Old Dominion, by contrast, has returned cash to shareholders in the form of dividends and buybacks. Given the extreme valuations seen over the last few years, I have to conclude that Old Dominion erred in its use of share repurchases and overpaid.

Return on Capital

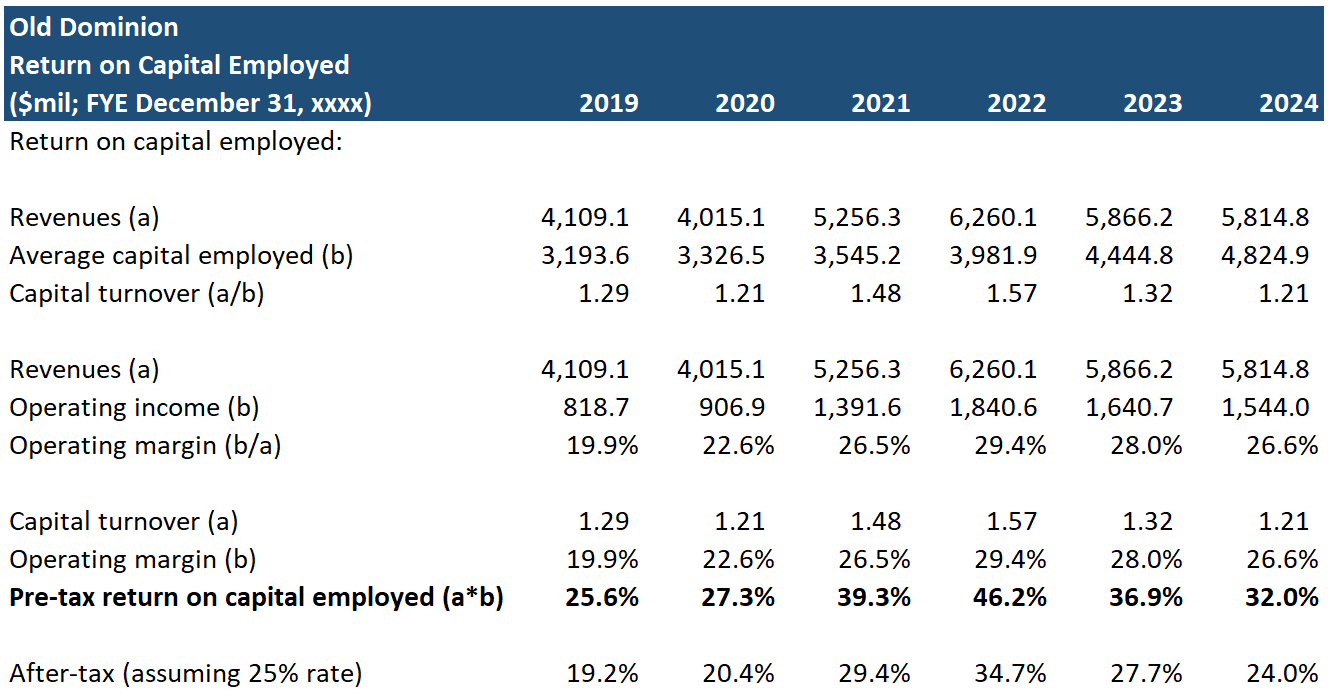

We can see Old Dominion’s maturity in its relatively stable capital turnover ratio of around 1.20 to 1.30 times—the bump in 2021 and 2022 coming from the post-pandemic industry tightness and pricing power.

By contrast, Saia has seen its turnover, which is notably higher than Old Dominion’s (because of its less dense network), decrease as it ramps up investment in infrastructure.

Operating margins, as noted above, are miles apart at mid-20s for Old Dominion and mid-teens for Saia.

Put turnover and margin together and you have Old Dominion earning pre-tax returns on capital in the low 30s range, while Saia is in the high teens.