New Berkshire Spreadsheet Tool

Calculate your share of Berkshire's operating earnings, float, and valuation in Google Sheets

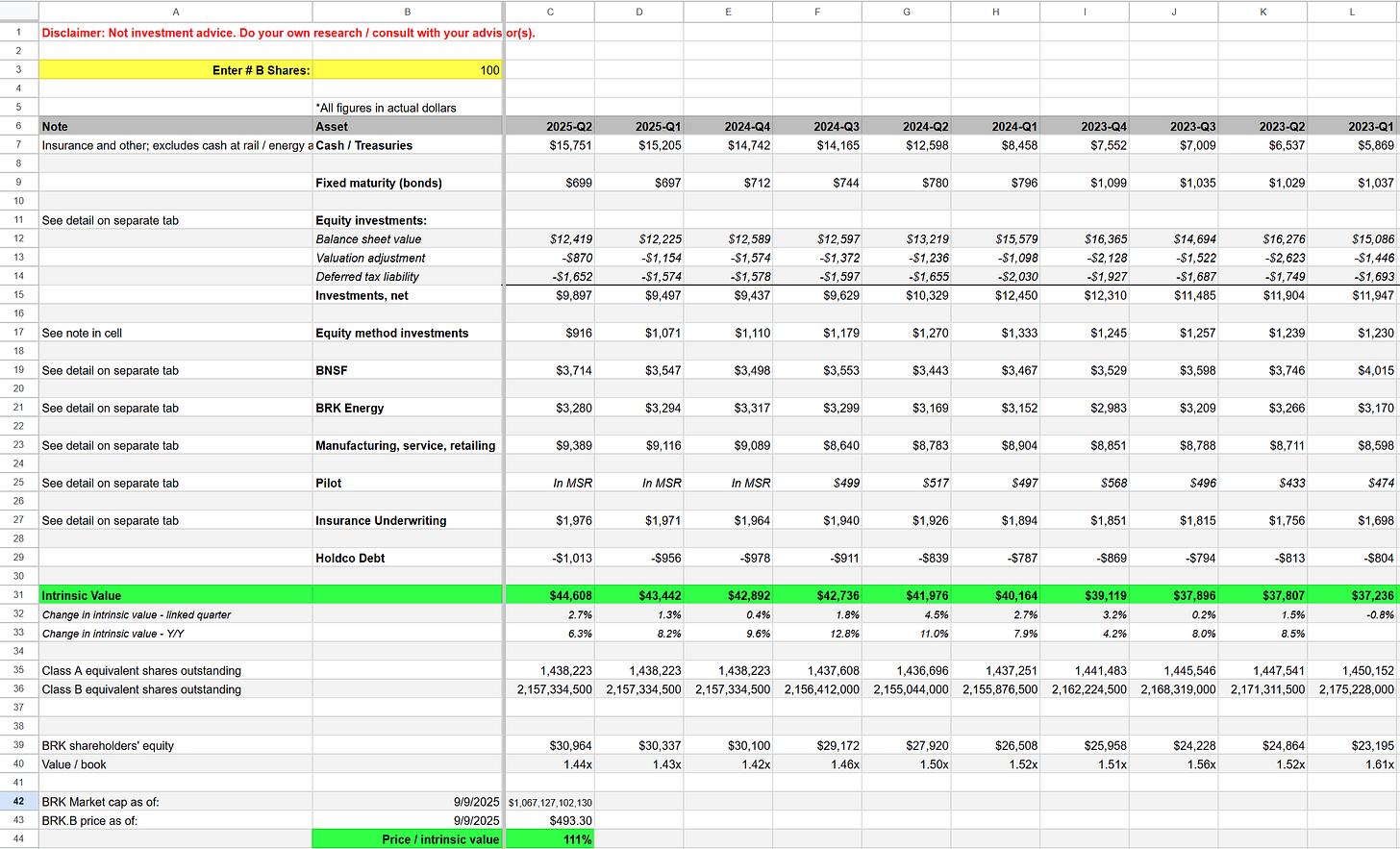

Valuation Spreadsheet

As a reminder, paid subscribers have access to the live Google Sheet detailing my estimate of Berkshire’s intrinsic value, with separate tabs detailing each major component.

New Tool

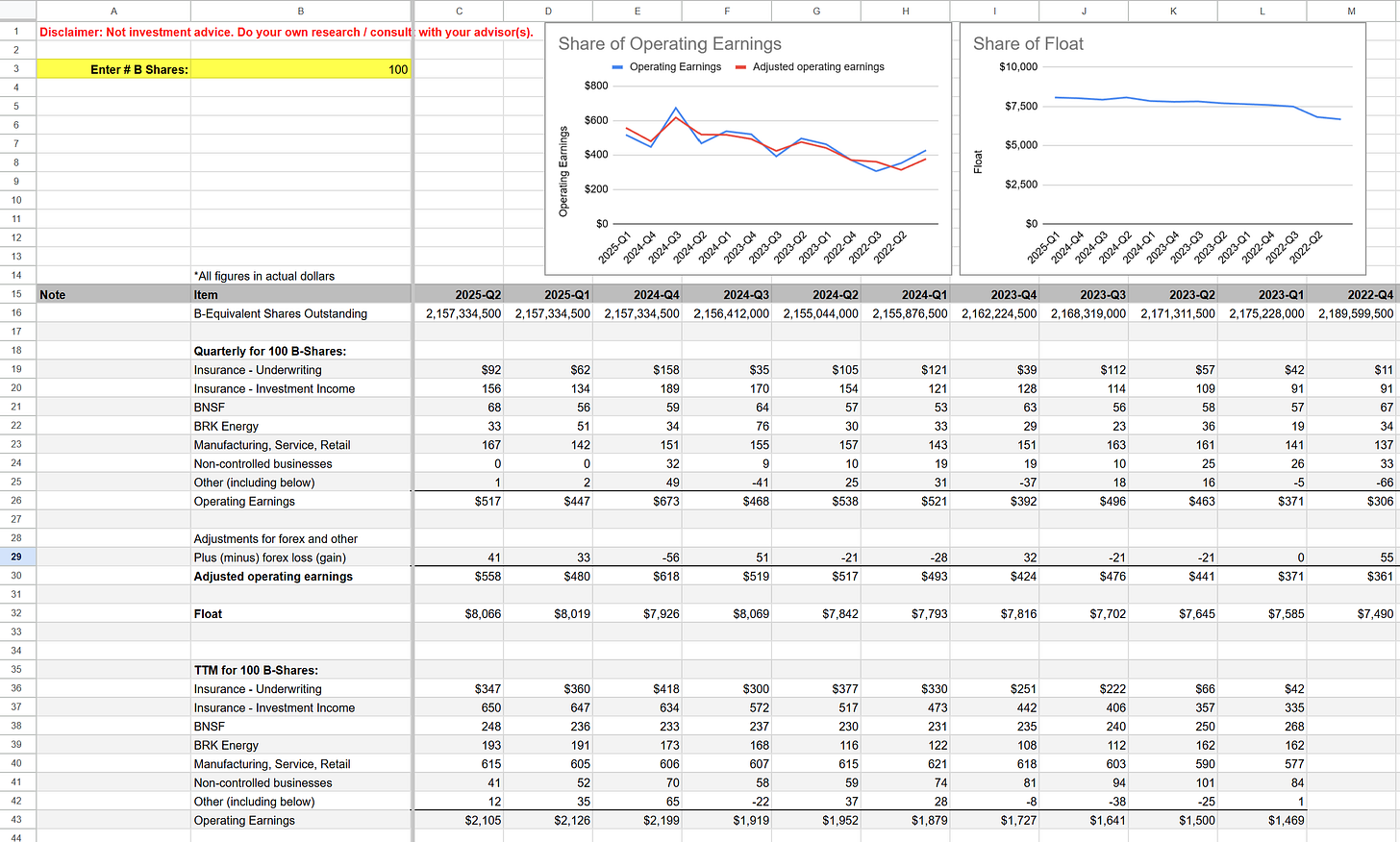

Now you can interact with the spreadsheet after downloading it to calculate your share of Berkshire’s intrinsic value (pulled through from the main page), and you can calculate your share of Berkshire’s quarterly and trailing twelve months’ operating earnings for your particular ownership.

In the example below, you can see that someone owning 100 Class B shares would have adjusted look-through earnings of $558 for Q2 2025 and $2,105 over the last twelve months. This owner also has $8,066 in float attributable to their ownership.

I think it makes ownership more real, more tangible, to see your ownership this way.

I had to resist the temptation to go deeper and include all known subcategories. For example, insurance underwriting could be broken down into GEICO, BRK Reinsurance, and BRK Primary, with additional subcategories in reinsurance, for example. Maybe another day…

Let me know what you think in the comments. Is this a useful tool? What else would you want to see?

Stay Rational!

Adam