Nanocap Bank Earning 12% ROE at 0.85x BV

A $15 million US-based bank

Disclosures: None

This one is small enough that I’m going to limit it to paid subscribers for now. I’ll discuss my thoughts on valuation at the end.

Here’s what I found:

A $200 million assets US bank

As of December 31, 2025, it had tangible shareholders’ equity of $18 million

It earned net income of $1.9 million in FYE 9/30/25 and $1.6 million the prior FY

It earned $634,000 in Q1 2026 (3 months ended 12/31/25)

On average assets and equity it earned 0.99% and 11.4%, respectively

A bank not heavily reliant on fee income (customer service charges were 7% of pre-tax income)

The bank is Crazy Woman Creek Bancorp. I admit to doing a double-take when I first saw the name. Such names aren’t uncommon in the Western US. This bank is named (not surprisingly) after an actual creek. You can read all about it here.

In any event…

I found CRZY searching through a list of OTC banks. The $15 million market cap and regular dividend caught my eye. A little more digging found a few annual reports.

Crazy Woman Creek Bancorp is the name of the holding company. It does business as the Banks of Buffalo, Gillette, and Sheridan. It’s on the FDIC as Buffalo Federal Bank of Buffalo, Wyoming (FDIC Cert. # 29696).

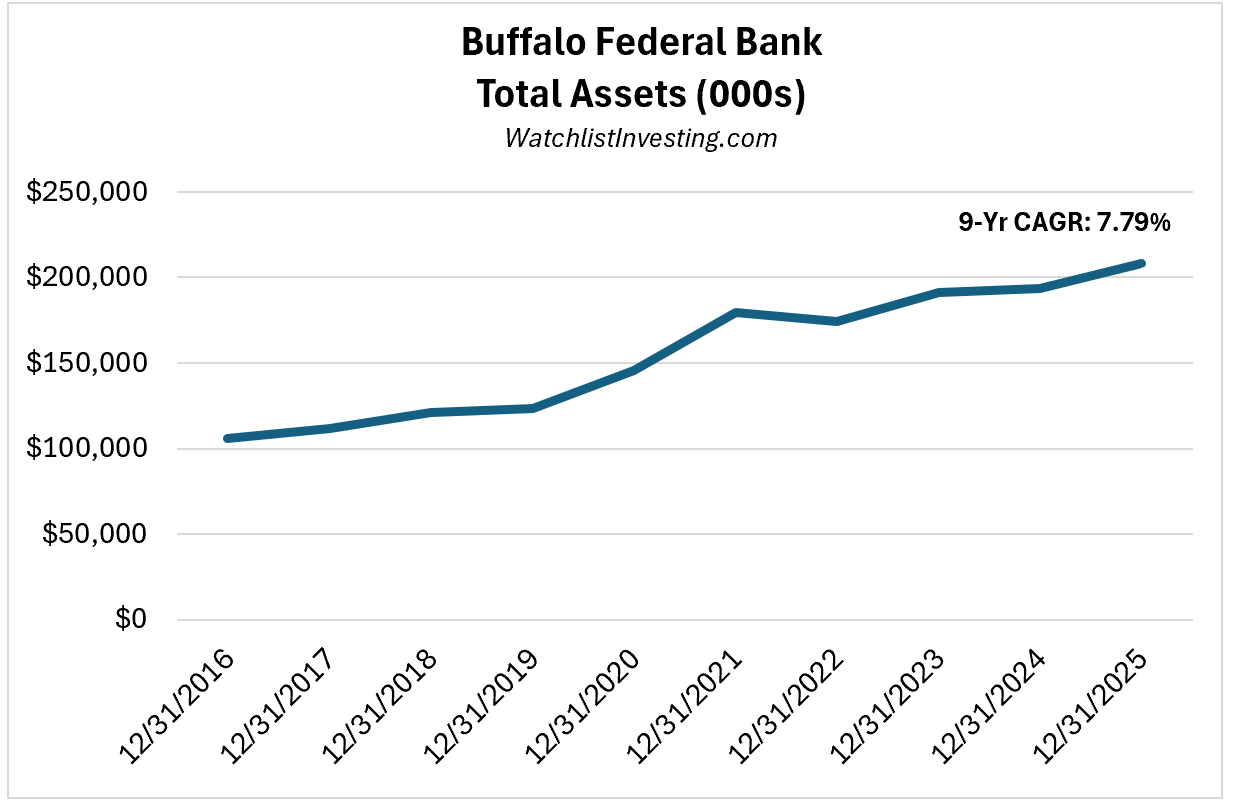

Asset Size

CRZY is very small. As of its latest fiscal year ending September 30, 2025, it had assets of just $205 million. Assets have grown at a CAGR of just over 7% per year over the past 9 years (2016-25).