Medifast (MED) Q3 Update

A net net finding its way in the GLP-1 weight loss revolution.

Disclosure: Long MED

Prior Posts on Medifast

Substack

References:

Strategy Update

Medifast continues to evolve its strategy to adapt to GLP-1 drugs threatening traditional weight loss programs.

I give management credit for swimming with the tide. Going against the powerful combination of actual science (the GLP-1s) and a psychological tendency of consumers to lean toward a quick fix would be a mistake.

Instead, Medifast is positioning itself as a solution to improved metabolic health, with weight loss being a component of a broader health strategy. The company leans heavily on the fact that current GLP-1 medications result in the loss of lean mass and that a majority of patients regain weight after stopping medication. Medifast believes its coaches can help customers form good habits, keep the weight off, and improve their overall metabolic health.

Metabolic synchronization (Medifast’s term) aims to preserve lean mass and muscle while targeting visceral (bad) fat. Key to this strategic shift is the company’s current base of 19,500 active coaches who work with customers on accountability and assist them in purchasing Medifast’s food products directly from Medifast.

The company has also developed a subscription model aiming to incentivize repeat purchases with discounted product. On the Q2 2025 earnings call, CEO Dan Chard stated that he did not expect the Premier+ pricing adjustments to have any appreciable impact on margins, with reductions offset by other incremental actions under the program.

Of note, the company appears to have retreated from its 2023/early 2024 push to enter the $30 billion sports nutrition market. It still carries its Optavia Active products but has dropped language from filings in recent quarters. I view this shift as a positive since Medifast’s coaching base is geared toward a different consumer.

Coaches are Key

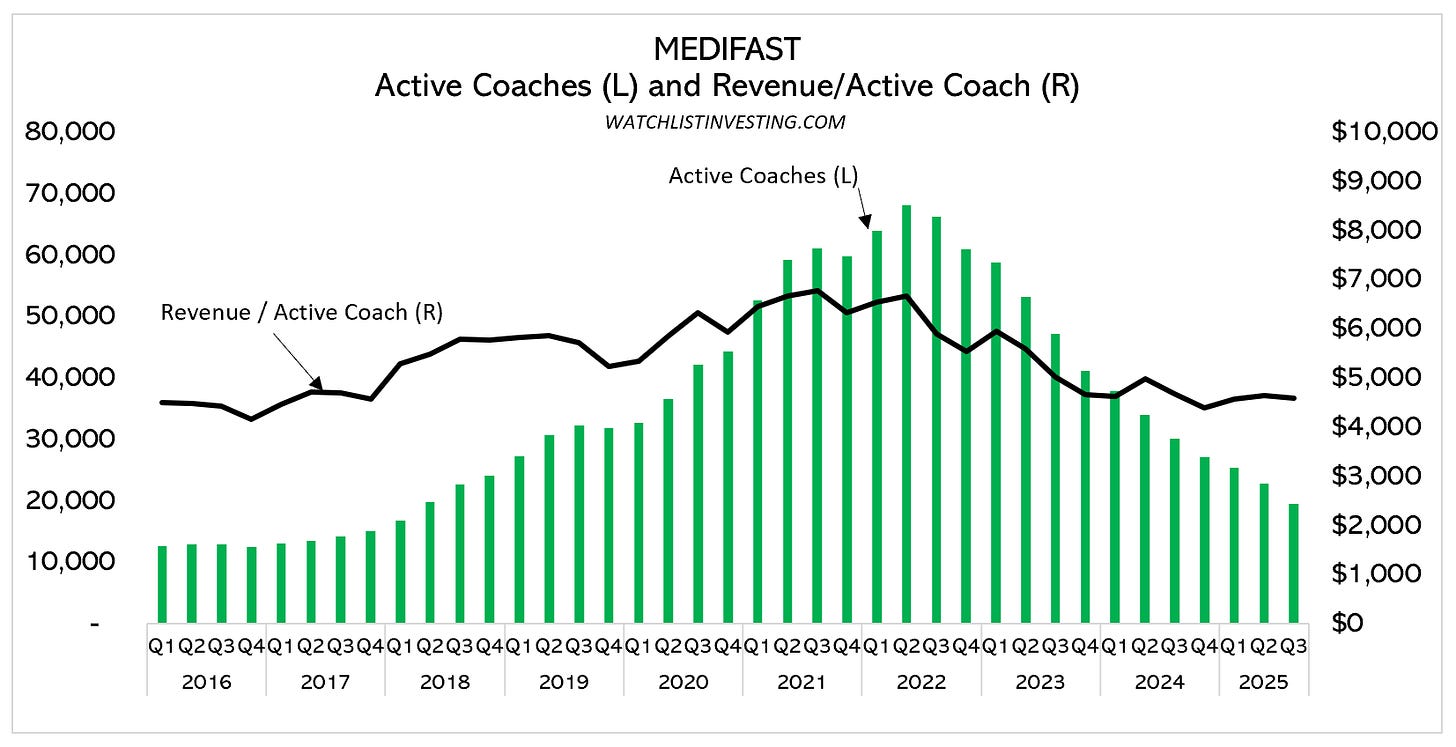

Key to Medifast’s success is its base of coaches, who directly interface with customers (Medifast doesn’t have an internal sales force). The number of active earning coaches and average revenue per active coach have declined sharply over the past several years. Looking further back, today’s numbers are similar to the late 2010s when Medifast was a much smaller business.

Evidence suggests that the decline in both metrics is slowing. While the number of active coaches fell 35% compared to Q3 of 2024, revenue per active coach fell just 1% quarter-over-quarter. This suggests that there is a core base of coaches whose clients find the Medifast system beneficial.

On the Q3 conference call, management said it expects revenue per active coach growth within the next one to two quarters, with the number of coaches beginning to grow 6 to 9 months after that, and company revenue growth one to two quarters after that.

It’s a fairly simple equation: # coaches x revenue per active coach = total revenue.

Variable Cost Structure = Protective

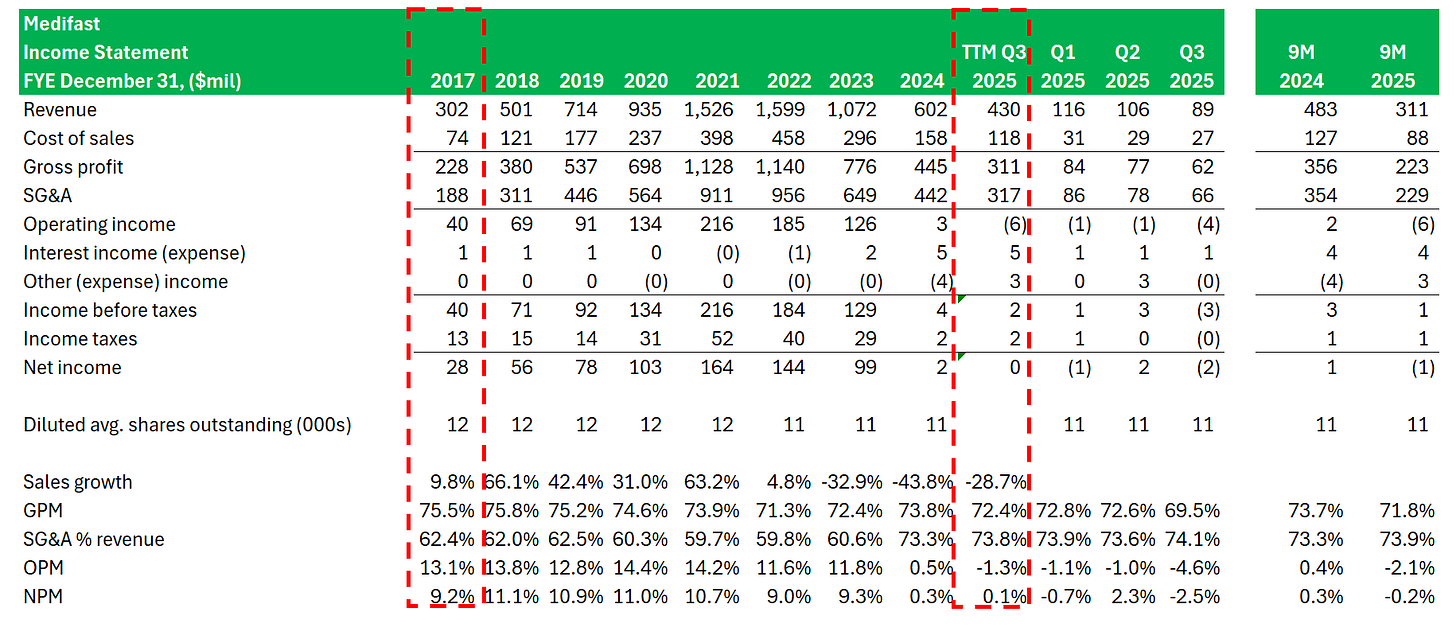

There’s no way to miss the massive decline in sales over the last three years. On a TTM basis, Medifast’s topline is about 75% lower than its peak in 2022.

What I find interesting (aside from cash + investments > market cap) is the highly variable cost structure of the business. Profits have fallen to zero as operating leverage reversed and the company spent money on product development. In other words, a LOT of bad has happened and the red ink is barely visible.

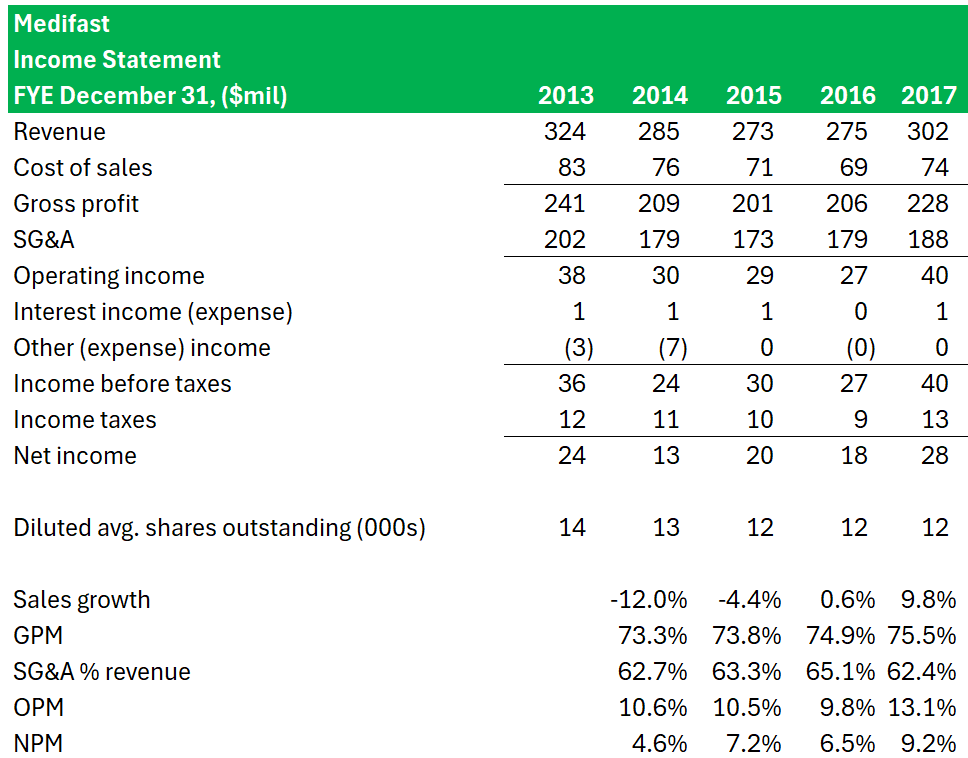

Looking at 2017 and 2018 provides clues to a possible path forward for Medifast. Sales may stabilize and allow the company to right-size overhead to achieve satisfactory margins.

Or, current initiatives may stem the topline decline or even reverse it, leading to operating leverage on today’s fixed cost base.

Looking at the 2013 to 2017 period (below), we can see a profitable company with turnover some 40% below the TTM period ending 3Q2025.

Q4 2025 Guidance

Medifast expects Q4 revenue of between $65mm and $80mm, implying a sequential revenue decline of between 10% and 27%, and a net loss of between $8mm and $14mm, expectations that already appear baked into today’s price.