Lifco AB - A Dividend-Paying, Focused Conglomerate

A first look into the Swedish serial acquirer

Disclosure: None

Note: This first look is not intended to be exhaustive. This is my first time looking at the company. This post is designed to share my findings, both positive and negative.

The overarching goal is to learn about a new company and put it on both our radar screens.

Overview

Lifco is one of those companies that keeps drifting in front of me without so much as a cursory glance. The “I’ll get to it” starts now…

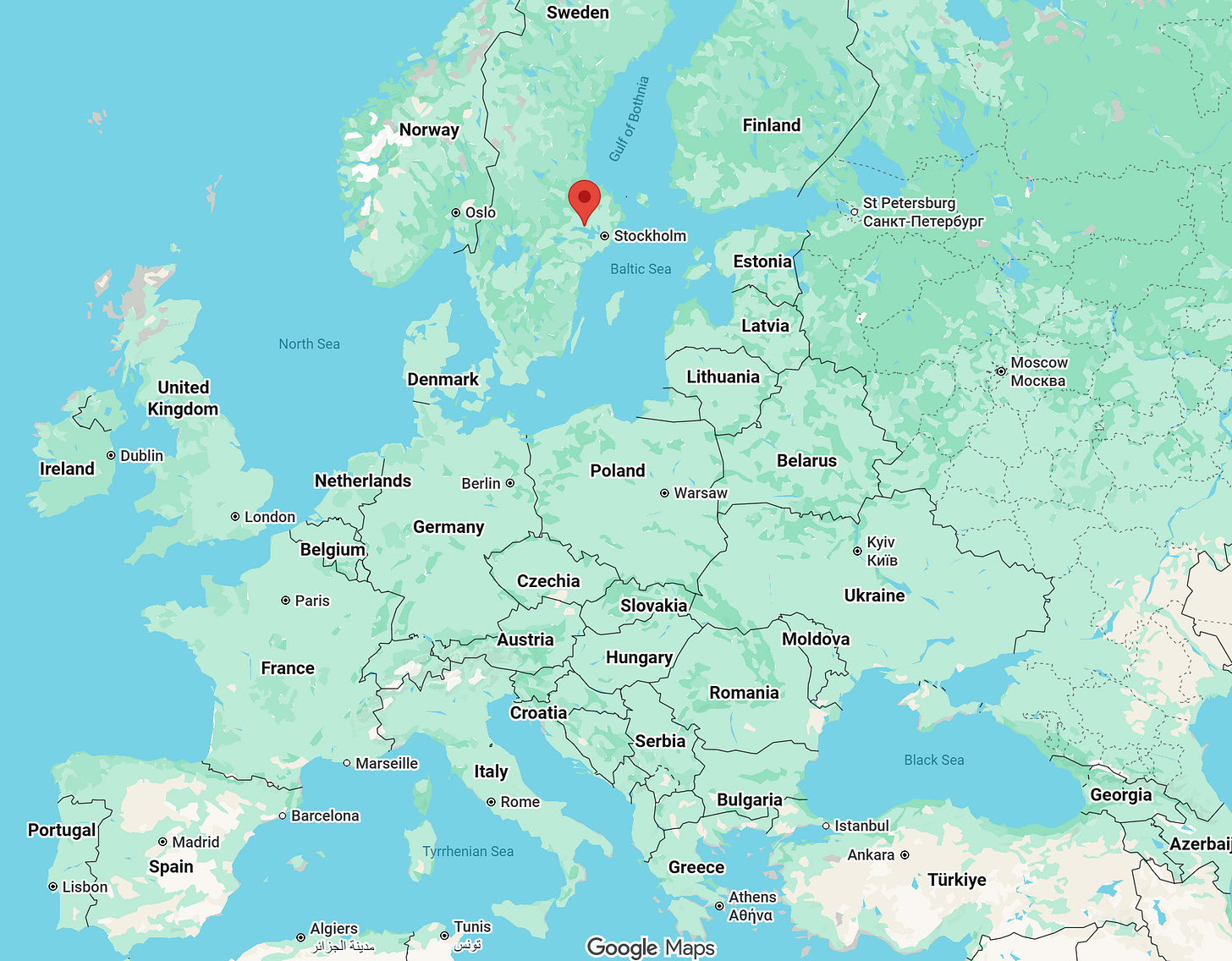

Lifco is Swedish, based in Enköping, northwest of Stockholm (see map below). And it’s a serial acquirer, meaning its business model is based on a system of continual acquisitions.

In terms of size, Lifco is fairly small with 2024 sales of 26 billion Swedish Krona (about $2.5 billion).

Lifco has an impressive track record: 21.2% CAGR in FCF per share since its 2014 IPO, accomplished with minimal reliance on debt. Since 2006, sales have grown at a 10.9% CAGR and EBITA (notice there’s no “D”) at 14.5% over that time.

My short study of Lifco leads me to classify it as a dividend-paying, focused conglomerate.

Dividends - Unlike, say, Berkshire Hathaway or Markel, or some other conglomerates, Lifco pays out about 30% of its earnings as dividends.

Focused - In two ways:

Business lines - Lifco operates many businesses under three umbrellas (more on these below):

Dental

Demolition & Tools

Systems Solutions

Operational metrics - The company focuses on keeping things simple operationally (Lifco embraces decentralization) and centered around growth in cash flow and return on capital. (Unlike BrightView, the company we looked at last week, return on capital, including goodwill, is in the 20% range while return on tangible capital is north of 100%.)

Here’s how Lifco describes itself:

Here’s a taste of the three verticals and the companies inside each one. But before digging into the details, including the financials, let’s talk about Lifco’s history.

History of Lifco

Note: I was aided in my initial understanding of Lifco by this Colossus podcast from 2024:

Mid-1900s: According to the Lifco website, its roots date to 1946 when a Swedish government body created an entity to centralize the purchase of medical equipment and services.

1993: A management buyout in conjunction with a Nordic VC firm, Procuritas, took the original entity private and renamed it Lifco (I couldn’t determine if the name means anything).

1995: Lifco is acquired by Getinge Group, a publicly traded medical technology company.

1998: Lifco is spun off to Getinge shareholders and listed on the Stockholm Stock Exchange.

2000: Carl Bennet, already controlling 50.1% of the voting interest, launched a takeover bid to restructure the company.

2001: Lifco divested its health and self-care operations, a huge restructuring amounting to 40% of sales. It turned its focus to growing its dental products distribution business.

2006: The company acquired its former sister company, Sorb Industri AB, another company controlled by Carl Bennet (this feels like Berkshire’s mergers with Diversified Retailing and Blue Chip Stamps). Sorb brought today’s Demolition & Tools and Systems Solutions areas into the fold.

2014: Carl Bennet sold 49.9% in an IPO.

Financial Analysis

Let’s go a bit deeper into Lifco’s divisions and its financials, and then we can turn to valuation.

Note: Currency is Swedish Krona (SEK), which is 0.11 USD