Introducing Watchlist Weekly

Links and thoughts for the week; plus some Berkshire history.

Same Watchlist Investing, New Section

I decided to create a new Substack section for a weekly email containing links and thoughts that might be interesting to readers. A “best of”, if you will, of what’s passed my desk during the week.

This also allows you to opt out of these types of emails and still receive my more in-depth content. Here goes!

Swing You Bum! Should Berkshire buy CSX?

I tend to agree with Greg Warren of Morningstar that it would make sense to have two large transcontinental railroads in the US. The question is whether regulators will look at the deals as enabling efficiencies to be passed along to customers in the form of cost savings or a duopoly that will ultimately raise prices. Shippers don’t like it.

Berkshire Director Chris Davis on Bloomberg Wealth (YouTube)

Pair this with a slightly older but very good interview with Farnam Street

Berkshire releases its second quarter earnings tomorrow morning

This week in Berkshire History

July 31, 2001: 90% of MiTek was acquired for $400 million cash. MiTek makes connector plates for building applications and software related to the construction industry.

August 1, 2000: Justin Industries was acquired for $570 million (all cash). Justin was a holding company for Acme Brick and Justin Boots

Excel: Never Die!

If you’re like me, Excel (and Sheets) is ever-present in your life. I’ve found ChatGPT super helpful in creating complex formulas which sometimes amounts to complex coding.

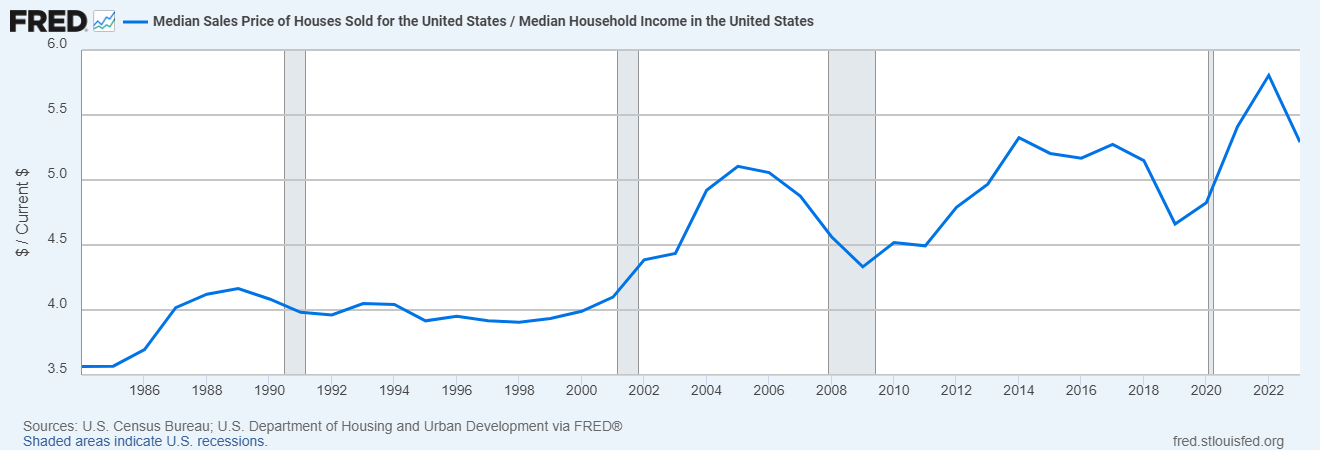

Home Affordability: Median Price to Income

This brief article discusses the contrast between today and 40 years ago. Part of the reason is a roughly 1% per year increase in the size of the average home, in addition to the quality of the home (for example, smart homes didn’t exist 40 years ago, and many didn’t have washers/driers and other modern amenities).

Here’s the longer time series:

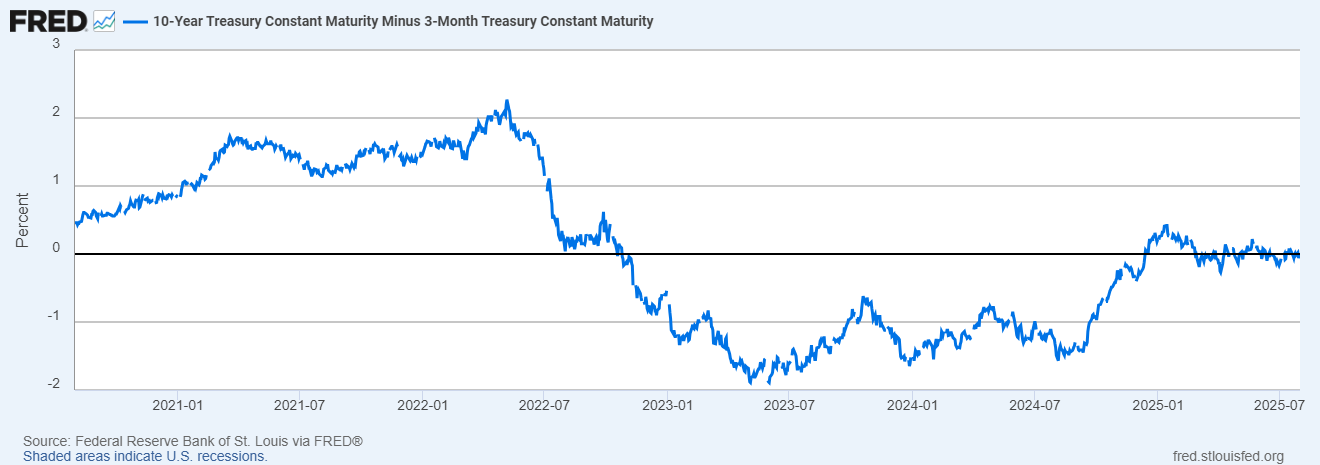

3/10 Split Stuck At Zero

While I was on FRED I thought I’d pull the latest 3M/10Y spread. It’s been pegged around zero since regaining positive territory earlier in the year.

That’s it for this week. Hit reply and let me know what you think. What have you been reading that’s worth sharing? Let me know in the comments.

Stay Rational!

Adam

Love it Adam, great idea!

This is cool, thanks Adam!