Hingham Savings (HIFS) Q3 Update

Progress is apparent heading into 2026 amid industry credit uncertainty; valuation remains attractive

Disclosure: Long HIFS

Prior Posts on Hingham

Substack

Legacy Analysis:

Q3 2025 Update

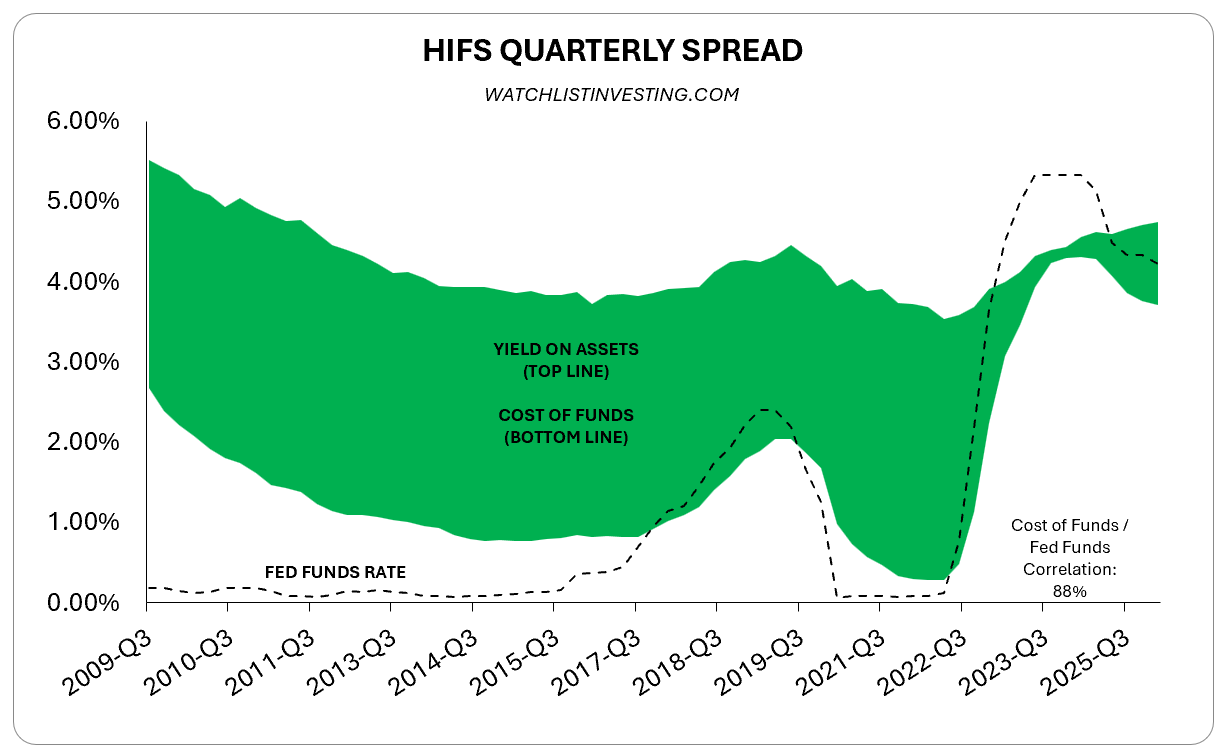

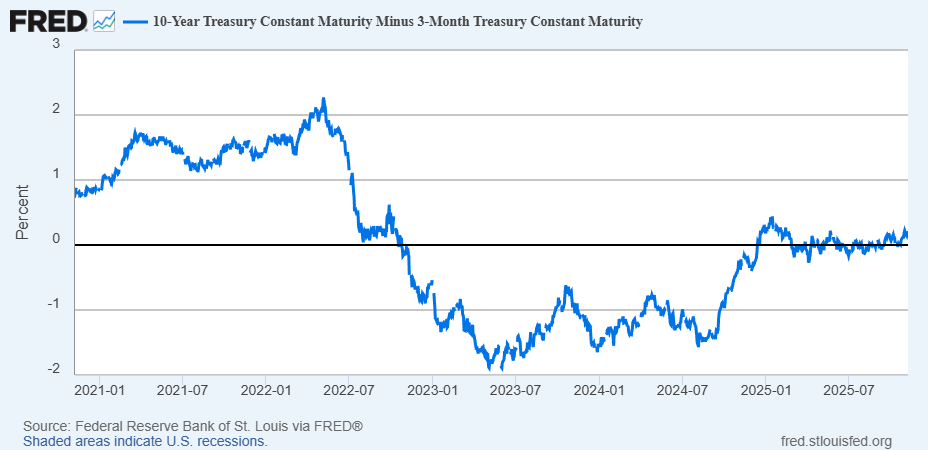

Net interest margin reached 1.74% in the third quarter, up 50bps from the end of 2024. The bank noted that NIM was 1.77% annualized in September 2025.

Average spread climbed to 1.04% after bottoming at just 0.13% six quarters ago.

Net loans increased 1.4% (annualized) YTD and 1.3% over Q3-2024

Deposits decreased 0.4% (annualized) YTD and increased 0.7% over Q3-2024

Non-interest-bearing deposits increased 12% (annualized) YTD and 20.9% over Q3-2024. NIB deposits now account for 17.3% of total deposits — the highest since at least 2011 (compared to FYEs) — and 9.6% of total assets. (All of this done, mind you, while keeping overhead below 70bps.)

Together with equity capital at 10.2% of assets, Hingham has nearly 20% of its assets funded with capital carrying no explicit cost of funds.

Cash flow hedge: The bank put its first derivative on the books in Q3 with an interest rate collar that effectively locks in a cost of funds on a $25 million tranche of SOFR-based FHLB funding between a 1% floor and 4.5% cap for 2.5 years beginning in March 2026.

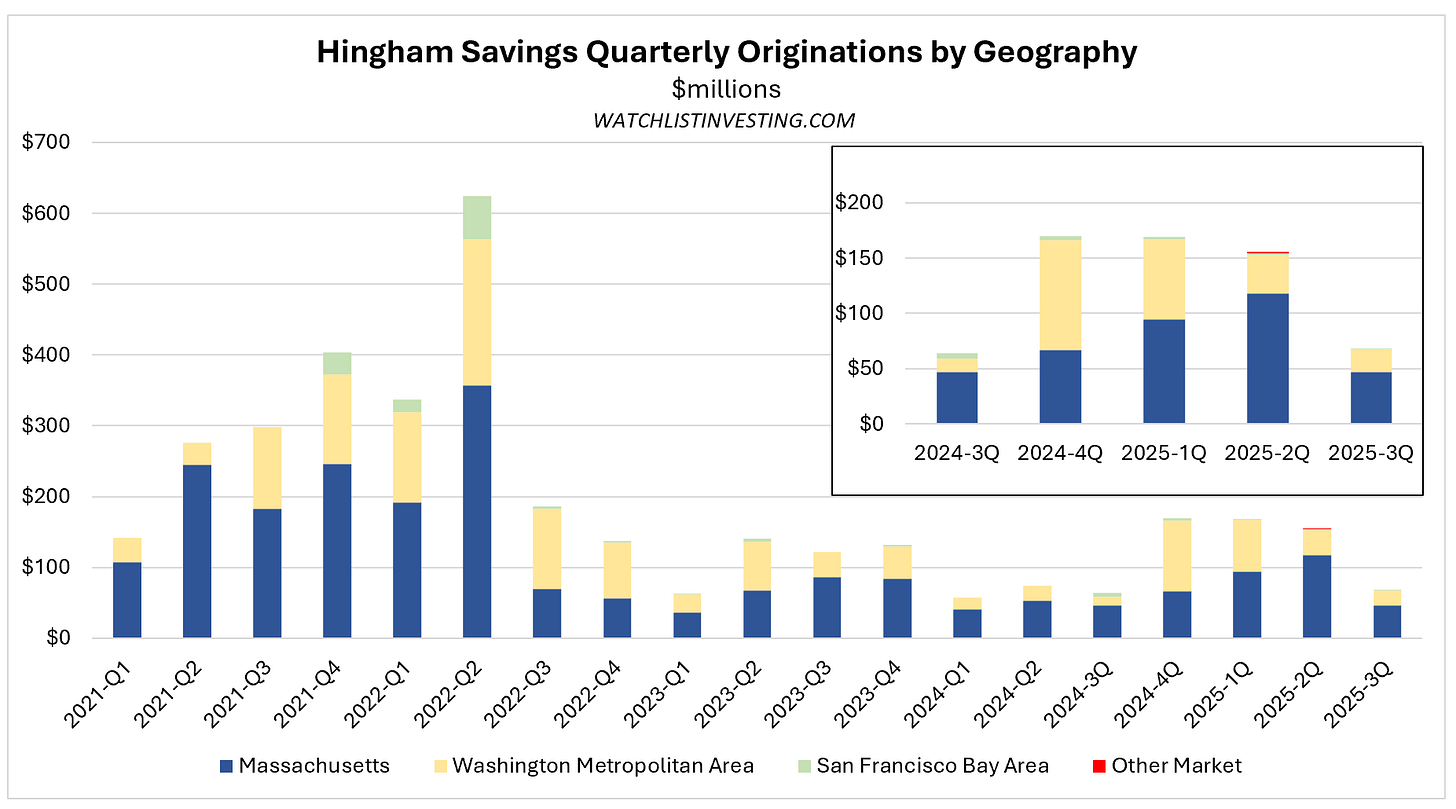

TTM loan originations grew to $562 million in Q3, the highest since Q1 2023.

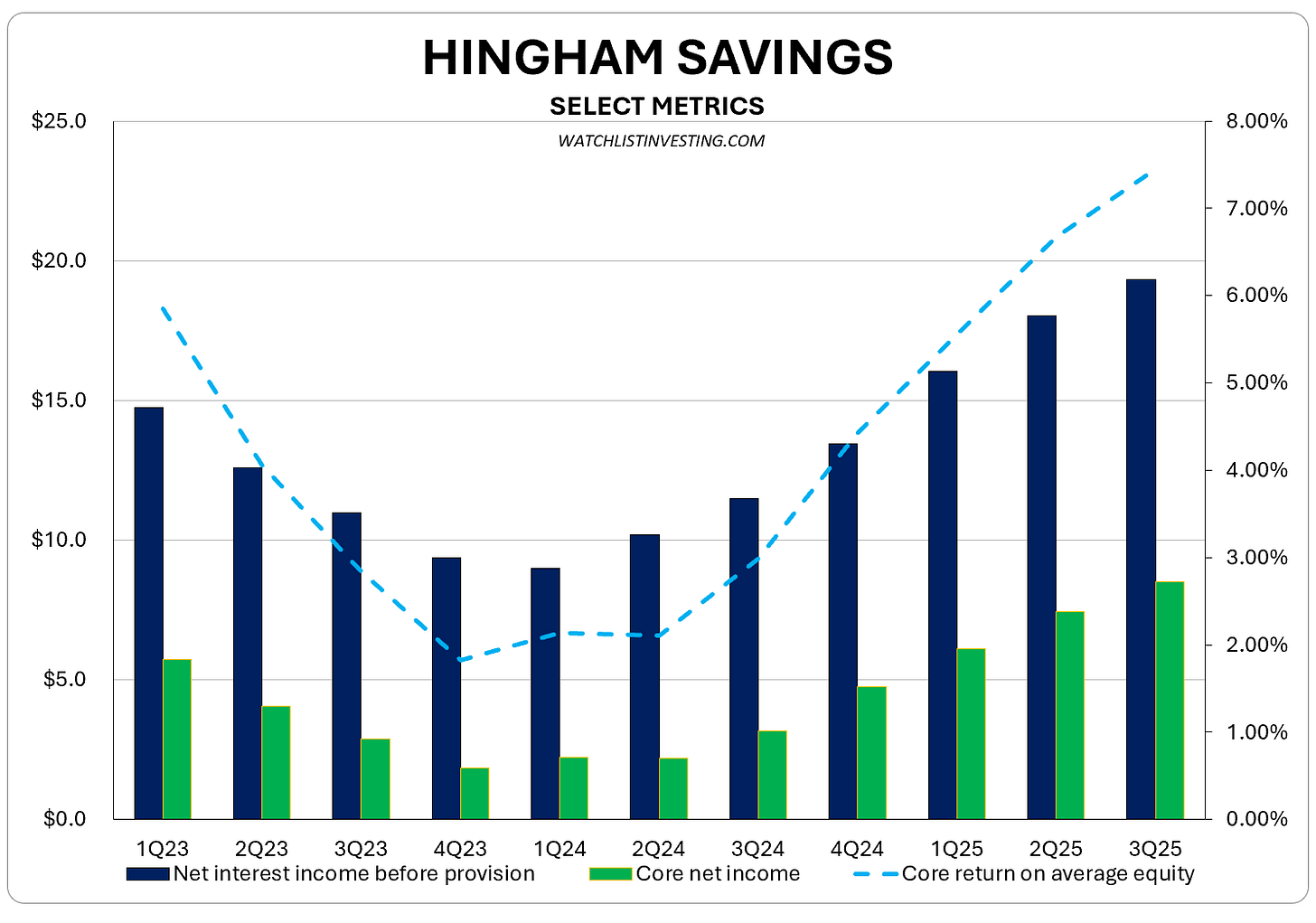

The bank’s core metrics continue to improve with the improvement in NIM and expenses held in check.

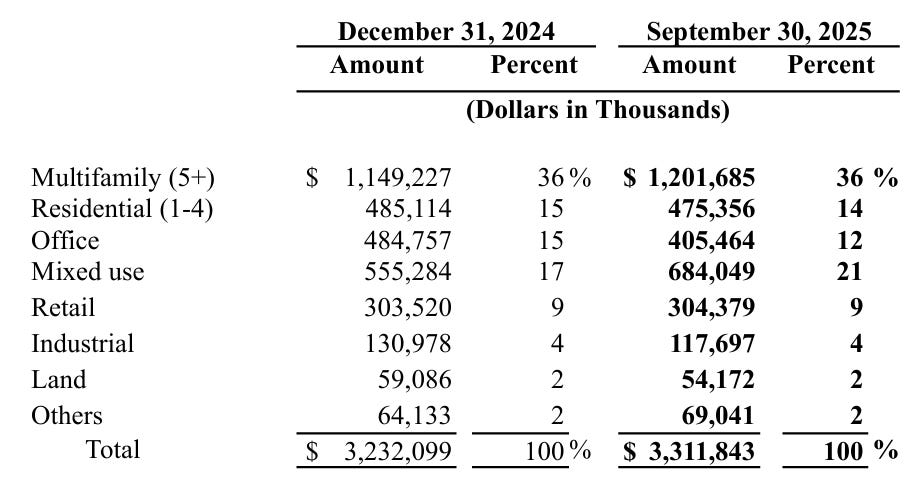

CRE loans by loan type:

On the credit front non-performing loans to total loans ratio increased from 0.04% (basically nil) to 0.81%.

Hingham placed a $30.6 million CRE loan on nonaccrual in the second quarter. From the press release:

In the second quarter of 2025, the Bank placed a commercial real estate loan with an outstanding balance of $30.6 million on nonaccrual, after the borrower failed to make the full payment due at maturity. This loan is secured by an entitled development site for a significant multifamily development in Washington, D.C. and has an associated conditional guarantee from a large national homebuilder and an affordable housing developer. The Bank is working actively to identify a resolution that protects the Bank’s interests.

The 10Q goes deeper: The loan is secured by an entitled land development site for the second phase of a multifamily development known as Banner Lane or Sursum Corda. Real estate taxes are guaranteed by the developers — a joint venture between Toll Brothers and L+M (a NYC-based low-income housing developer); however, payment is not unconditionally guaranteed.

Looking at the table of loans by risk rating in the 10Q gives two pieces of important information:

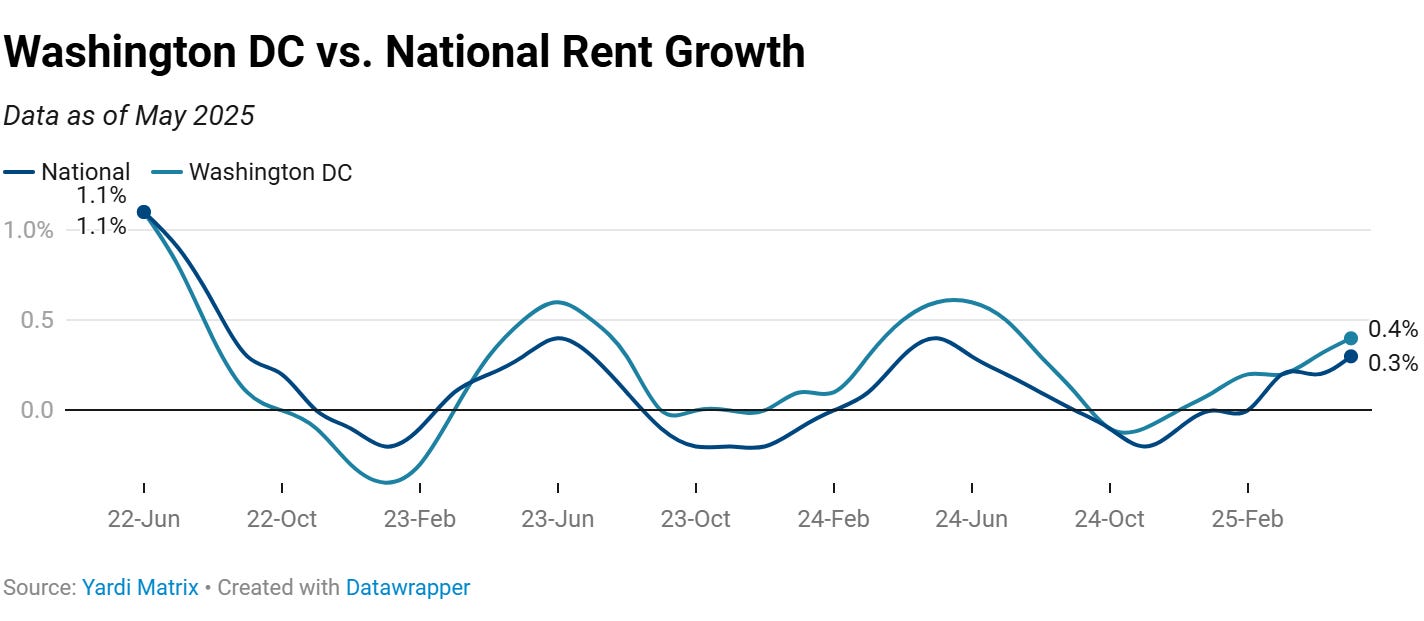

The loan was originated in 2021, a time of low interest rates. Higher interest rates and higher construction costs will have impacted the project’s economics. According to Yardi Matrix, DC added over 5,700 units through May 2025, nearly 25,000 were under construction, and an additional 230,000 units are in planning/permitting. Such an increase in stock would pressure rents and viability. However, rents in the DC market appear in line with the national average.

The loan is rated 4 on the bank’s risk rating scale, corresponding to “special mention”, which maps to the FDIC category of “other assets especially mentioned”. Said another way, the loan is NOT in the 5, 6, or 7 categories, which would indicate a probable loss.

Additionally, the 10Q states that, “Management believes that its loans classified as non-accrual are significantly collateralized, pose minimal risk of loss to the Bank…” Given management’s track record and ownership, I don’t think this is wishful thinking — if anything, my guess is they’d be more conservative with specific reserves, if deemed necessary.

The fact that the borrowers are seeking to extend the entitlement period by a year suggests that they aren’t handing over the keys and that it makes economic sense for Hingham to play nice.

Hingham’s conservative underwriting will have protected the bank from the very worst downside scenarios. The property is well-located with large, experienced borrowers in a long-term, structurally advantageous market. It will work itself out (pun intended for you bankers) in due course.

Some industry context:

According to the Federal Reserve, CRE loans increased 0.88% from Q3 2024 to Q3 2025.

Total deposits increased 3.8% over the same time period.

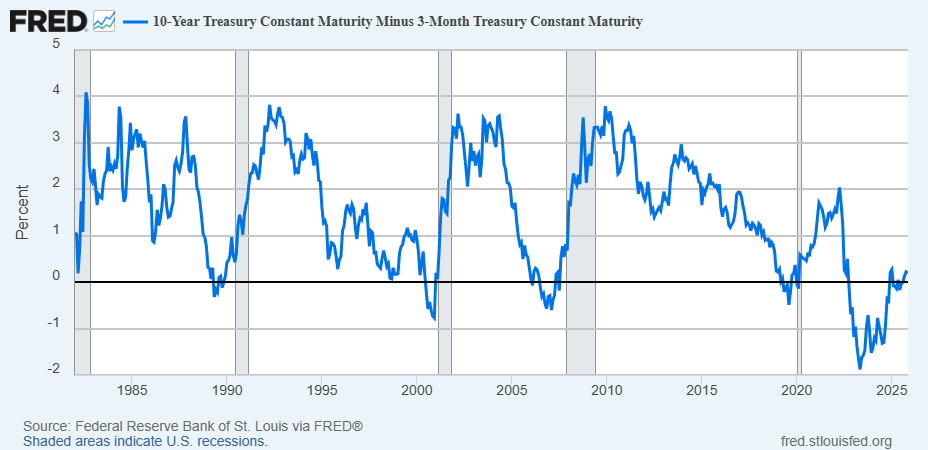

The yield curve remains flat with the 3-10 spread a hair’s breadth above zero, at 0.14% as of the end of September and 0.19% as of November 6, 2025.

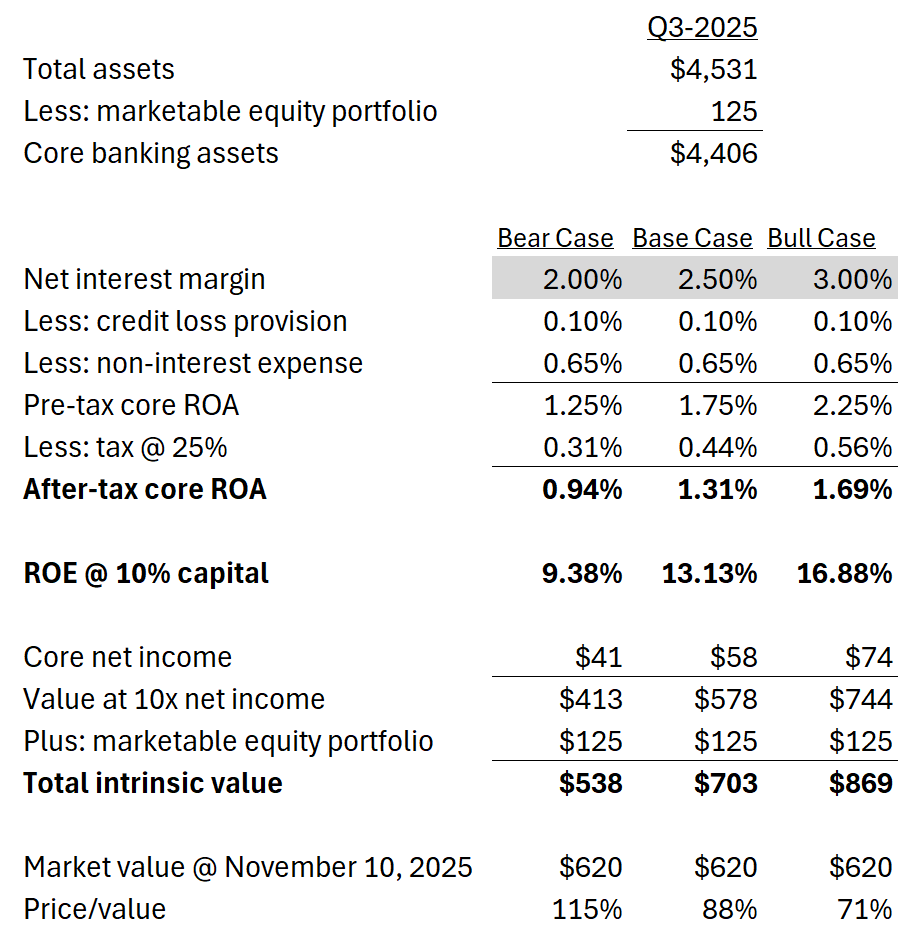

Valuation

See my March 2025 Deep Dive and the March 2024 Deep Dive for more on my valuation approach.

Shares trade at a ~12% discount to my base case scenario and 30% below my bull (though by no means unreasonable) scenario.

All things considered and absent a jump in rates, heading into 2026, the bank has a big slug of loans originated in 2021 and 2022 that will begin to reprice higher or roll off, increasing NIM and edging the bank back to its long-run average.

Paid Subscribers: Help me improve by answering a short, two-question survey.

Thank you!

Stay Rational!

Adam