Heartland Express (HTLD) Q3 Update

Turnaround in sight?

Disclosure: Long HTLD

Prior Posts on Heartland Express

Substack

Q3 2025 High-Level Updates

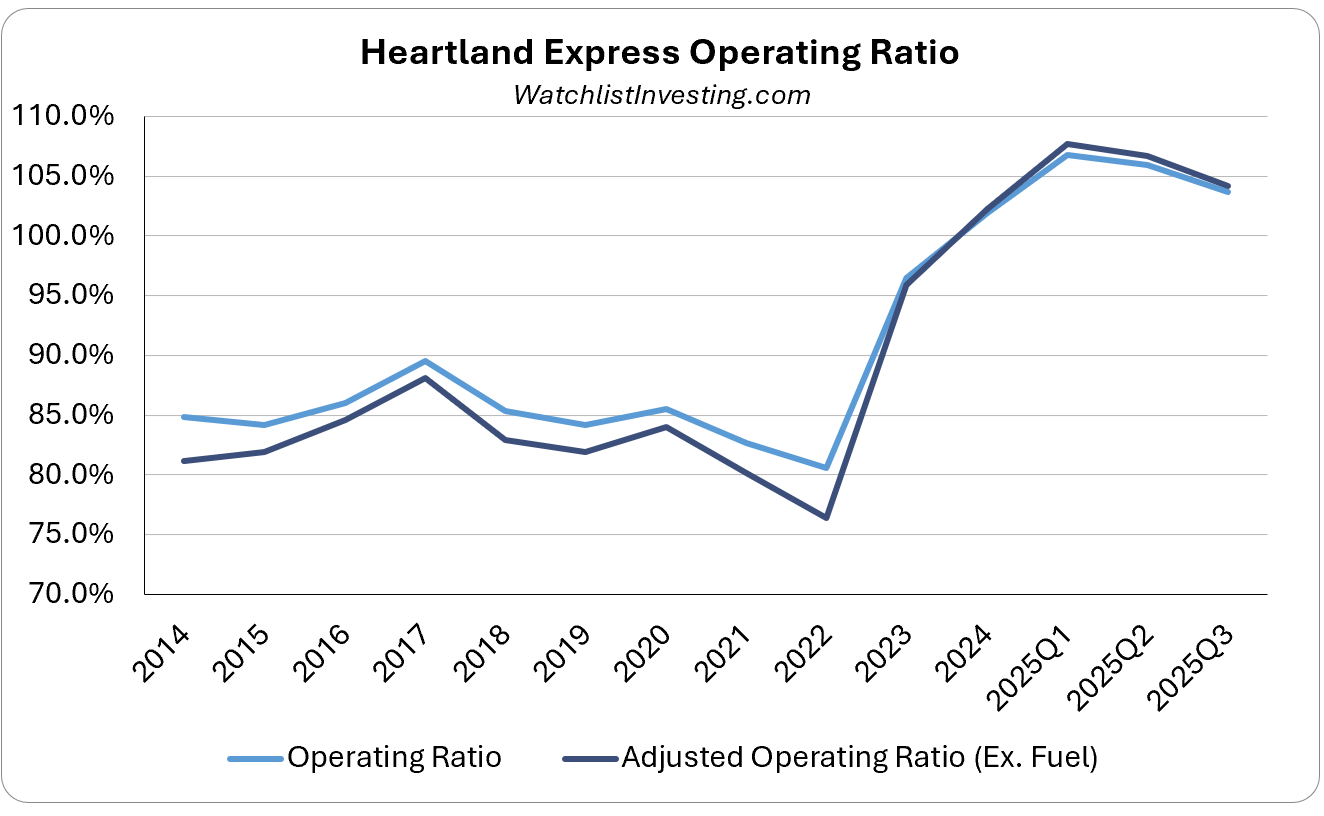

Q3 net loss of $8.3 million represents a sequential improvement over Q2 ($10.9mm) and Q1 ($13.9mm)

YTD 2025 net loss of $33 million compared to a net loss of $28 million YTD 2024

YTD free cash flow positive 50.0 million

$1.4 million or 175,000 shares repurchased during Q3 at an average price of $8.16/share

Quarter-over-quarter gross debt reduced by $10.4 million to $188.1 million

Q2 to Q3 net debt reduced by $20 million to $155.4 million

Importantly, Heartland Express, Millis Transfer, and Smith Transport brands were profitable during the quarter; overall results suffered from weakness at CFI. This is an improvement from Q2, when only the Heartland Express brand was profitable.

Valuation remains attractive

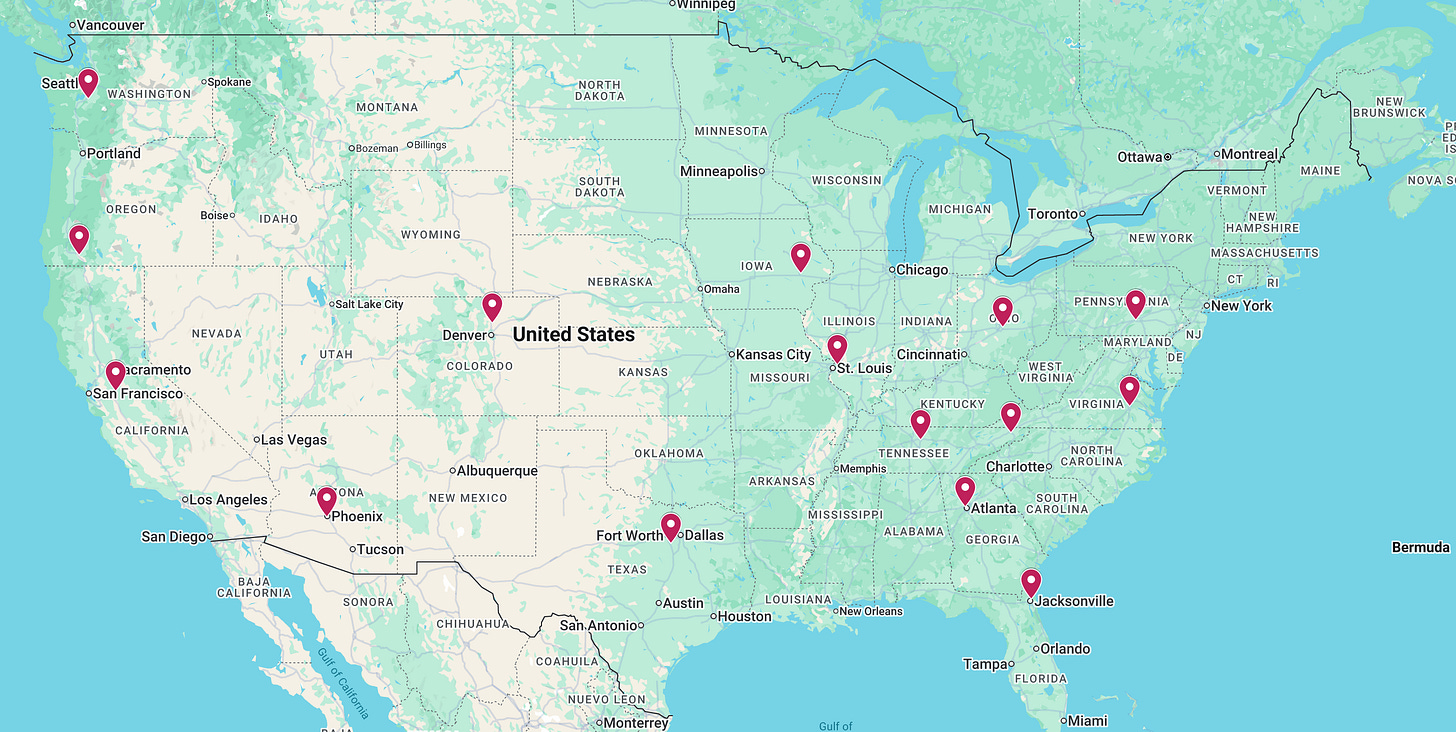

Driver Service Terminals: