Heartland Express (HTLD) Q2 Update

Lots to like: Share repurchases, insider buying, and a compelling valuation.

Disclosure: Long HTLD

Prior Posts on Heartland Express

Substack

Q2 2025 Update

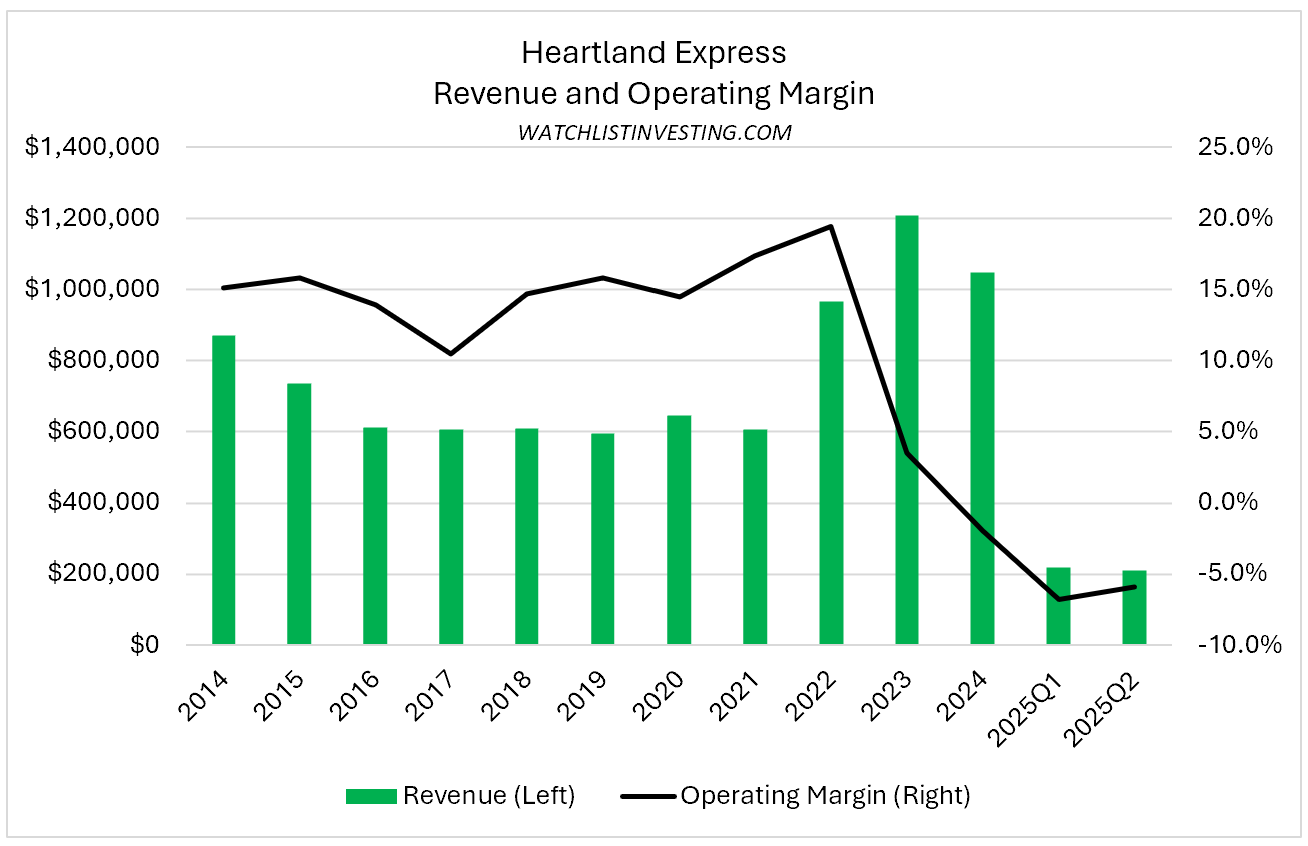

Heartland continues to report modest losses but positive operating cash flow as it weathers the deepest and longest freight recession.

Q2 net loss was $10.9mm, bringing the YTD net loss to $24.7mm.

The company is selectively shrinking its fleet to right-size it to current demand, and is making operational changes such as exiting unprofitable freight lanes.

Operating cash flow is positive because of depreciation and was 10.9% of revenue YTD. Net of dispositions and capex, free cash flow was $35.6mm YTD.

HTLD repurchased 1mm shares for $8.9mm in Q2 ($8.90/sh or $700mm market cap); repurchases continue into Q3

The CEO and largest shareholder is buying shares

Shares appear attractive at current levels (valuation discussion below).