Copart Update

Revisiting Copart with a new analysis framework

Disclosure: None

Revisiting Copart

Long an admirer of Copart, I owned shares between 2018 and the end of 2024. I sold because the price reached uncomfortable levels, trading at 43x earnings (a paltry 2.5% earnings yield) compared to 4% on the 10-year Treasury.

Its market cap at the time was about $58 billion. Shares have since dropped by over a third to $37 billion, piquing my interest (and stroking my ego for a good sale).

The company has continued to execute on its long-term vision and has amassed over $5 billion in net cash.

Copart’s $32 billion enterprise value is much more attractive today, though I’ll have more to say about that in the valuation section below.

A New(ish) Analysis Framework

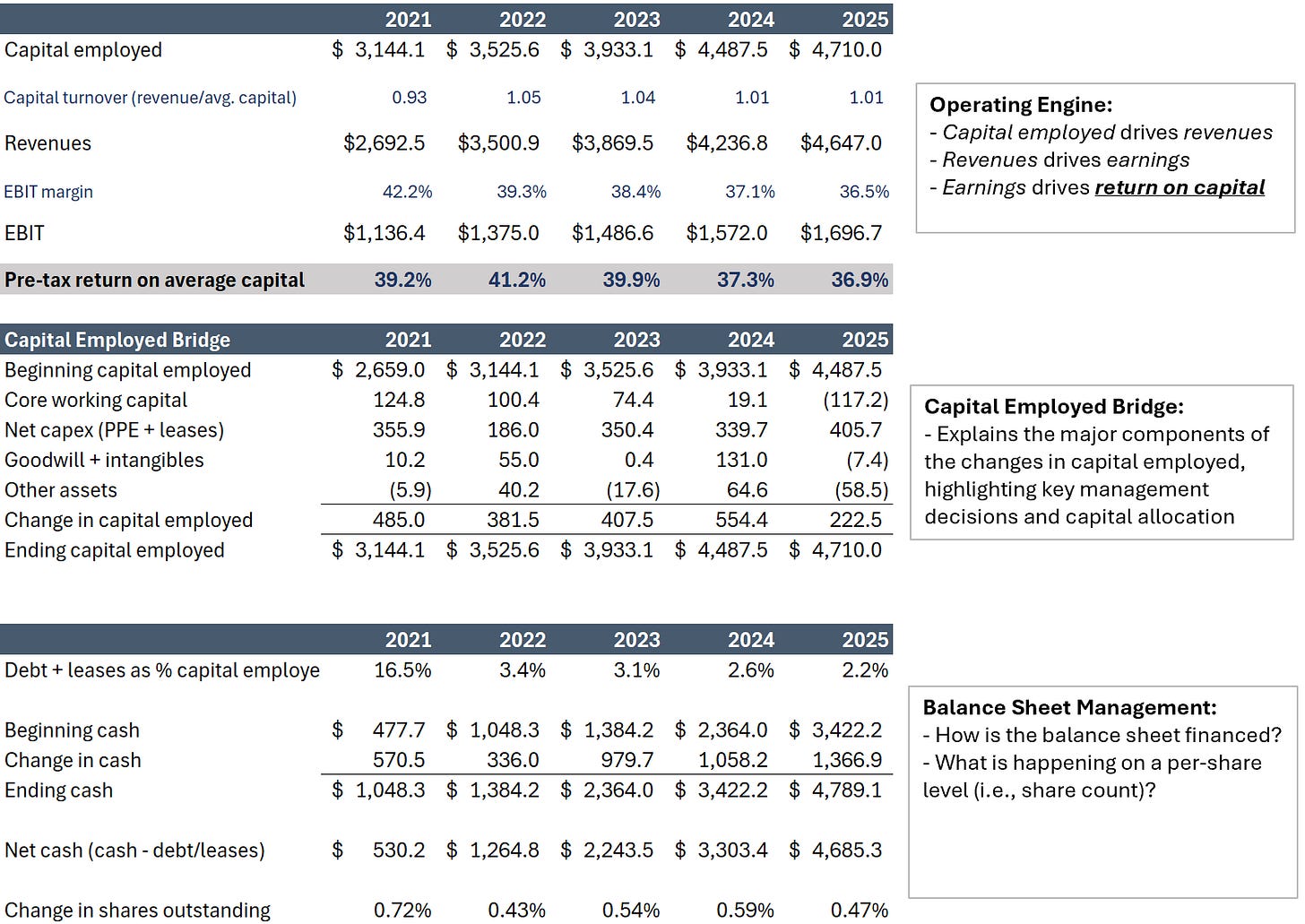

In studying Buffett’s investing approach, I’ve come to believe he uses a simple framework applicable to all businesses. Namely, that most businesses require capital to generate revenues; revenues generate earnings; and earnings in relation to capital indicate the quality of a business.

Clearly, there is A LOT more to it than that, but the basic framework of disaggregating pre-tax return on capital into capital turnover and EBIT or operating margin applies to all businesses and quickly illuminates what’s driving results.

The framework below seeks to expand on the basic framework and tell a company’s story from a 30,000-foot view.

Operating Engine: The basic framework above. How much capital is employed in the business, how much does it turn over (revenues), and what are the margins? All leading to pre-tax return on capital.

Capital Employed Bridge: This component goes deeper, highlighting the changes in capital employed from year to year. We can see key management decisions in the realm of capital allocation, from net capex (the big one) to goodwill and intangibles (highlighting acquisitions), and working capital management.

Balance Sheet Management: Here I want to know how the business is financed. Is management taking on debt or repaying it? Is cash building or going down? Where is the share count headed?

There is much more that could (and maybe will be) added to this framework over time. For example, nowhere are acquisitions or dividends listed. Nor are there any company-specific variables that might tell a better story. That’s ok. The big idea here is to create a framework that prompts questions and deeper analysis.

To demonstrate, let’s go deeper into the analysis of Copart…