BRK Q3 Update

Analysis of Berkshire's third-quarter results and updated valuation spreadsheet

In case you missed it, here is a link to my April 2025 BRK Deep Dive analysis.

Live BRK Valuation Spreadsheet (Paid Subscribers)

Note: Analyzing a conglomerate the size of Berkshire can be daunting. With so much detail available, I've pulled out the highlights and most important pieces. There’s no substitute for reading the footnotes to gain the full picture.

BRK Q3 Analysis & Sum-of-the-Parts Valuation

Paid Subscribers: Help me improve by answering a short, two-question survey about this post. Thank you!

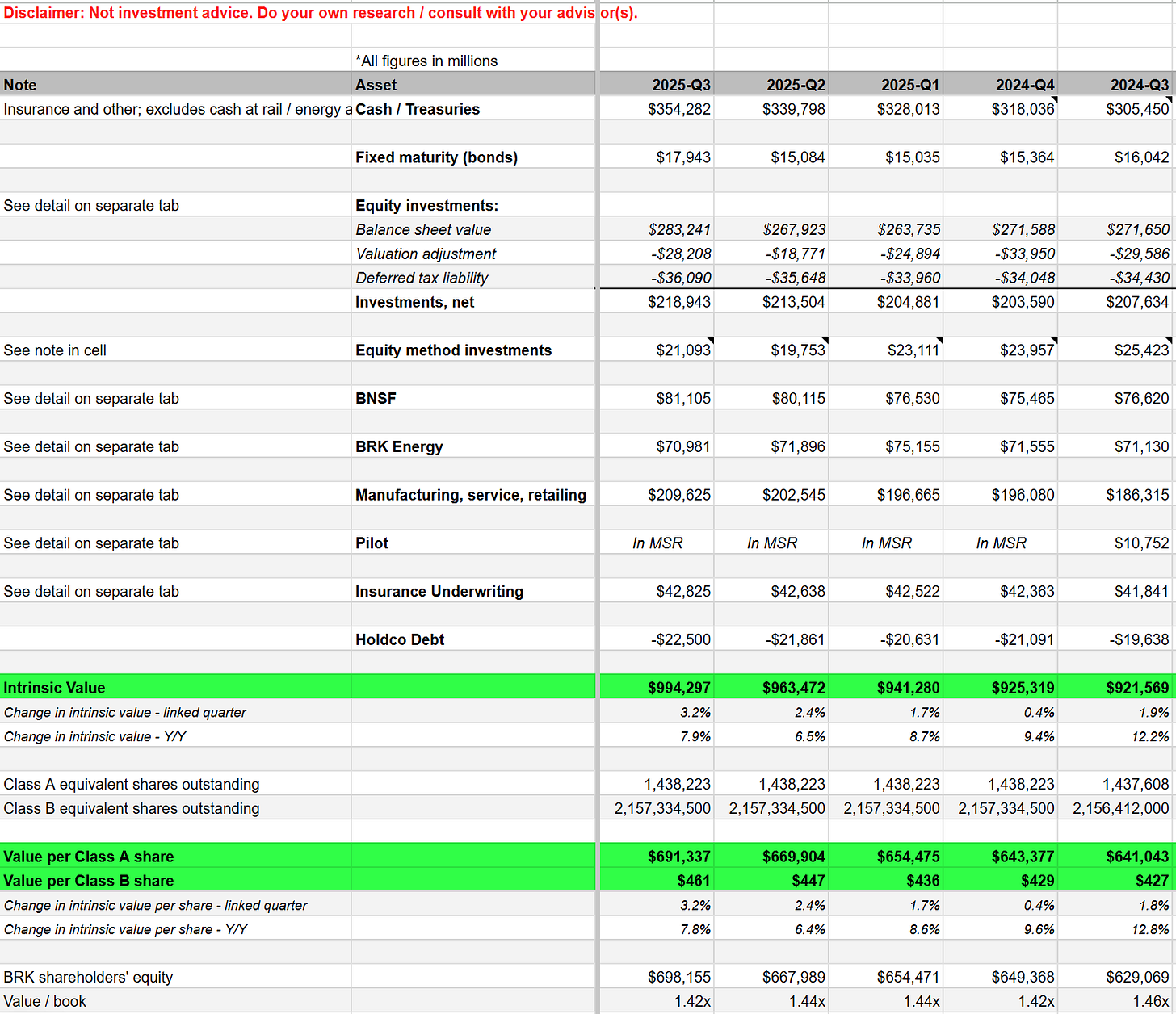

Cash/Treasuries - $354.3 billion

Cash and Treasuries of $354 billion in insurance/other + another $4.1 billion in rail/utilities. Note this grand total of $358 billion is after deducting the $23.2 billion payable for US Treasuries in the liabilities section (accounting fluency matters).

Equity Investments - $218.9 billion

Year-to-date net sales of equities of $10.6 billion, with $6.1 billion in Q3.

Apple remains the largest holding at $71.3 billion as of Q3, or 25% of the portfolio. I shaved off 37% to adjust Apple to 20x earnings.

Net of the Apple adjustment and deferred taxes, the equity portfolio is worth $219 billion or 77% of the reported value.

Equity Method Investments - $21.1 billion

Kraft Heinz at $8.48 billion and Oxy at $12.5 billion, plus $71 million of equity method earnings from Berkadia annualized and at a 10x multiple.

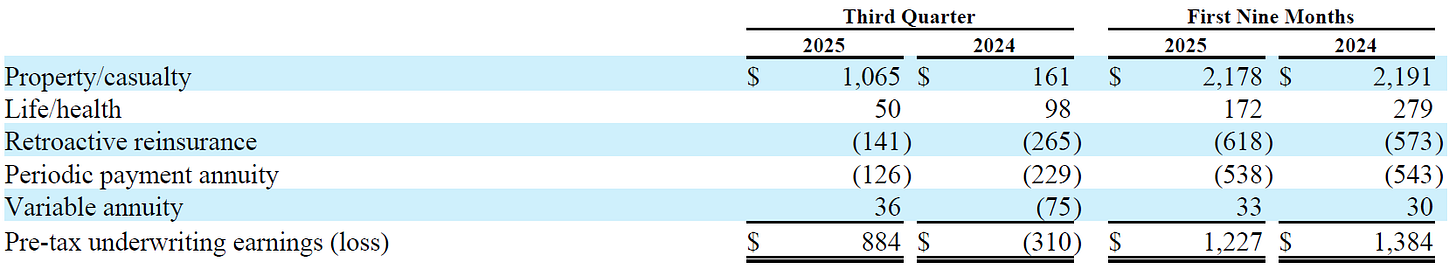

Insurance Underwriting - $42.8 billion

Berkshire’s insurers continue to run hot — and I mean HOT. Their combined pre-tax profit margin was a whopping 14.1% in the quarter and 12.6% in the TTM ended Q3 2025. Such results can’t and won’t go on forever, however. I think a 4% margin is sustainable through the cycle.

Pre-tax profit of $11.3 billion TTM Q3 2025 produced an average cost of float of negative 6.5%. on average float of $173.5 billion. Float ended Q3 2025 at $176 billion, up $5 billion from year end 2024. Take a step back: Berkshire gained the use of $5 billion of better-than-free capital AND earned $11.3 billion pre-tax. Incredible!

GEICO continues to print money. Its combined ration of 84.3% brought $1.77 billion to the bottom line in Q3 alone. Its results for the first nine months are even better at 82.6% with a pre-tax profit of $5.77 billion.

Importantly, GEICO’s results included an increase in policies-in-force. GEICO is back at the advertising game with its 40% increase in underwriting expenses attributable to “increased policy acquisition-related expenses” (read: advertising).

GEICO’s results include a relatively modest $495 million of favorable loss development YTD 2025 compared to $339 million in YTD 2024.

The primary group reported an 89.3% combined ratio in Q3, sufficient to bring the YTD ratio back in positive territory at 97% or $425 million pre-tax profit.

The painful turnaround continues at GUARD with its written premiums down 34.6% as it exits unprofitable lines and tightens underwriting standards. Berkshire noted that a significant portion of the $211 million YTD adverse loss development was due to GUARD.

Reinsurance is working as designed. With modest catastrophe losses, the property/casualty segments reported nice profits and life/health contributed to the bottom line. The remaining three segments are either inactive due to unfavorable pricing or in runoff mode.

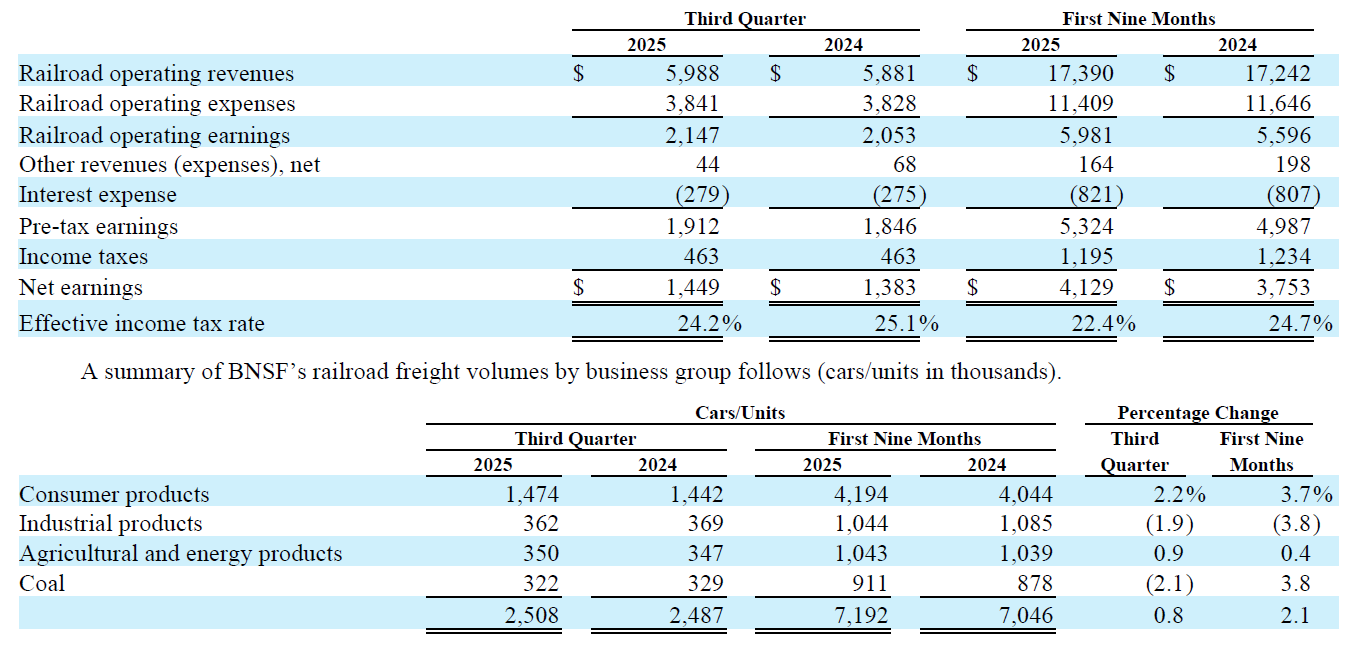

BNSF - $81.1 billion

BNSF moved 2.5 million units in Q3, up 0.8% from 2024. YTD is up 2.1% to 7.2 million units.

Consumer products, led by intermodal shipments and automotive vehicle volumes, drove the growth in units, though pricing fell.

Operating earnings were $2.1 billion in Q3 and just shy of $6 billion YTD. Net earnings were $1.45 billion in the quarter and $4.1 billion YTD. BNSF shipped $3.2 billion or 78% of its net earnings to Omaha as a dividend.

On a trailing-twelve-month basis the rail earned an after tax ROE of 10.5%; adjusting for cash taxes ROE increases to 11.7%.

The operating ratio improved a percentage point to 64.1% in Q3 but remains several percentage points worse than its main competitor, Union Pacific. UNP also improved its operating ratio in the quarter by 110 bps compared to last year, to an adjusted 59.2%.

BRK Energy - $71 billion

Earnings in Q3 included a $100 million pre-tax charge for wildfire accruals, the first such accrual in 2025.

The 10Q notes the One Big Beautiful Bill Act enacted on July 4 that accelerates the phase-out of clean energy projects. BHE’s reported tax benefit amounted to $606 million in Q3 and $1.385 billion YTD. The loss of such tax benefits would be a meaningful hit to BHE.

Additionally, the wildfire lawsuits remain pending.

Volumes increased 9.8% at Mid American Energy due to higher usage from industrial customers. Mid American sits in a favorable position of having some of the lowest rates in the country, which not surprisingly attract data centers and other energy-hungry users.

I’m keeping my valuation methodology unchanged despite the differential to the ~$50 billion implied by the latest and final purchase of noncontrolling interest. $71 billion appears fair given current earning power. But as Buffett noted at the Annual Meeting, the future is uncertain given the political environment.

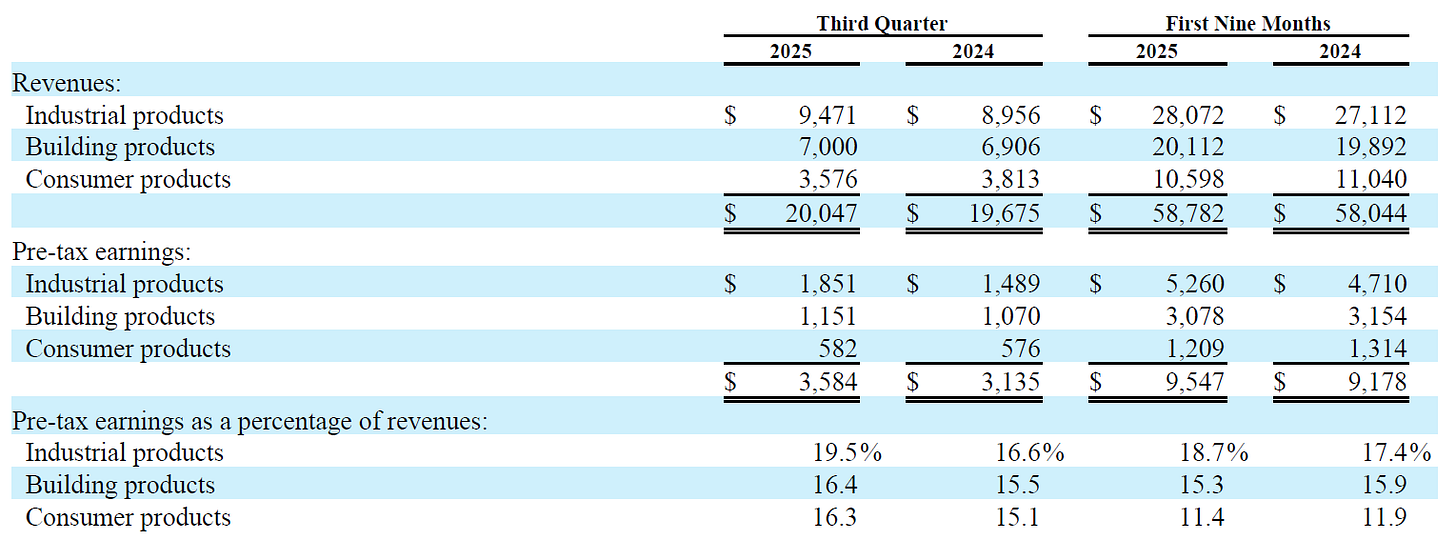

Manufacturing, Service, and Retailing - $210 billion

Manufacturing:

Precision Castparts is (mostly) back: pre-tax earnings increased 36% in Q3 and 38% YTD, on $81 billion of YTD revenue.

Marmon delivered 20% higher pre-tax earnings in Q3 and a 7.5% increase YTD on 4.5% higher revenue - $3.2 billion for the quarter and $9.7 billion for the year. Much of the increase in revenues appears to be volume related and input-price-driven (such as copperprices in the plumbing and refrigeration and electrical groups.

Clayton’s new home sales were flat in the quarter and up just 1.8% YTD. The bright spot at Clayton was it financial services segment, which reported 12% higher revenues in the quarter and 13.6% YTD from higher interest rates and higher loan balances ($28.9 billion at the end of Q3, up 9.4% YoY). Clayton’s pre-tax earnings increased 16% in Q3 and 2.8% YTD.

Results in consumer products included an unspecified amount for advanced manufacturing production income tax credits from 2023 to 2025, all recorded in Q3 of 2025. Berkshire noted that results in consumer products “declined significantly” before the benefit of these credits, with weakness in Jazwares, Forest River, Duracell, and Fruit of the Loom. Brooks was singled out as reporting higher earnings.

Service and Retailing

Service businesses improved results with revenues up 12.1% on the whole, with aviation services up 9.7% YTD, IPS +23.9%, and TTI up 7.9%. Pre-tax earnings for the service businesses increased 19.2% in the quarter and 14.6% YTD, attributed to aviation services and TTI.

McLane’s business has been on a tear. YTD earnings were up 17.3%. Its pre-tax profit margin of 1.40% is significantly higher than the 0.50% seen just a few years ago.

Results in retailing give a snapshot of the health of the consumer. Berkshrie Hathaway Automotive increased its revenues 5.5% YTD on 5.7% higher new and used vehicle sales which included higher prices. On the other hand, the remainder of the retailing group, which includes the furniture and jewelry businesses, saw sales drop 0.9% but pre-tax earnings decline 22.7% in Q3 and 7.4% YTD as sluggish demand weighed on results.

Pilot swung to a rare loss of $17 million in Q3 on $10.9 billion of sales. Pre-tax earnings were off 44% YTD due to lower wholesale fuel and in-store gross margins, couples with higher costs. Berkshire also pointed to “charges from adjustments to certain fuel-related balance sheet accounts” — I’m stumped on that one.

Other / Balance Sheet Items

Parent company debt increased $631 million from Q2 to $22.5 billion at Q3, primarily from an additional $1.0 billion Yen-denominated debt issued in July and repayments on its Euro denominated debt.

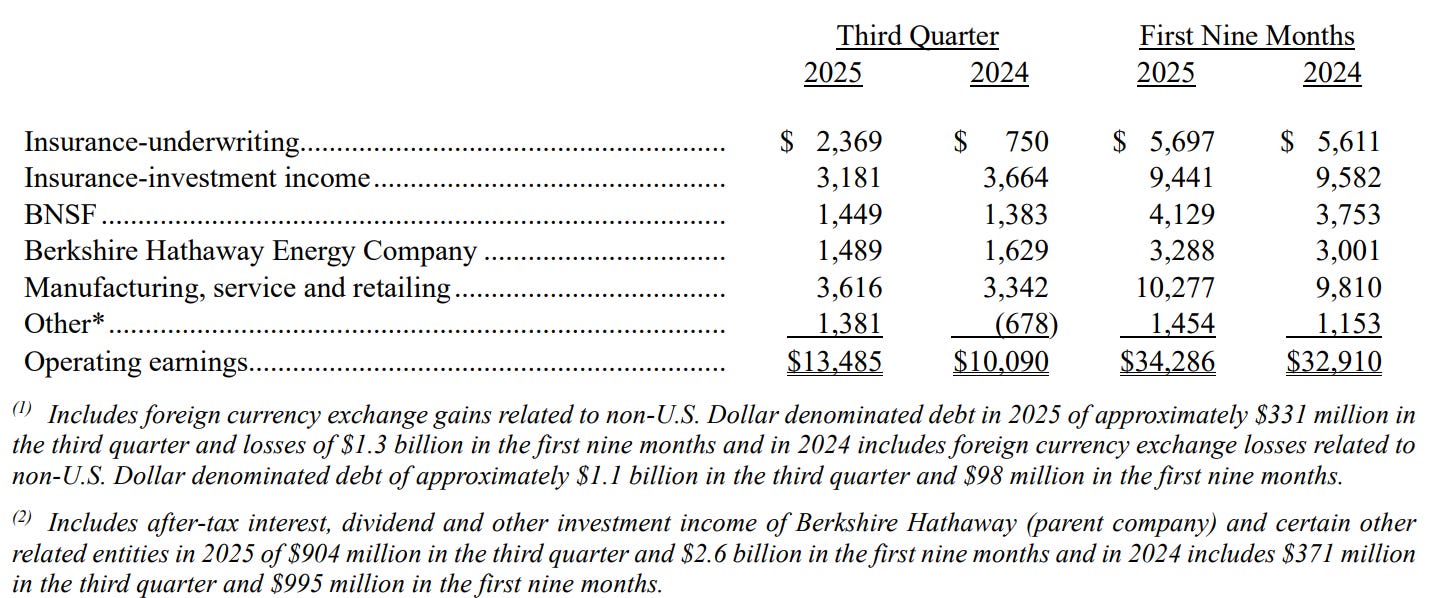

Operating earnings include forex gains and losses on non-US debt. $331 million gains in Q3 and losses of $1.3 billion YTD. Adjusted for these items, operating earnings were $13.15 billion in Q3 and $48.9 billion TTM (+16% from a year ago).

Valuation Update

I think Berkshire is worth just shy of $1 trillion, perhaps just over it if BNSF is adjusted upward. Shares trade at about equal to my estimate of intrinsic value.

Stay Rational!

Adam