BRK Q2 Update

Analysis of Berkshire's second-quarter results and updated valuation spreadsheet

In case you missed it, here is a link to my April 2025 BRK Deep Dive analysis.

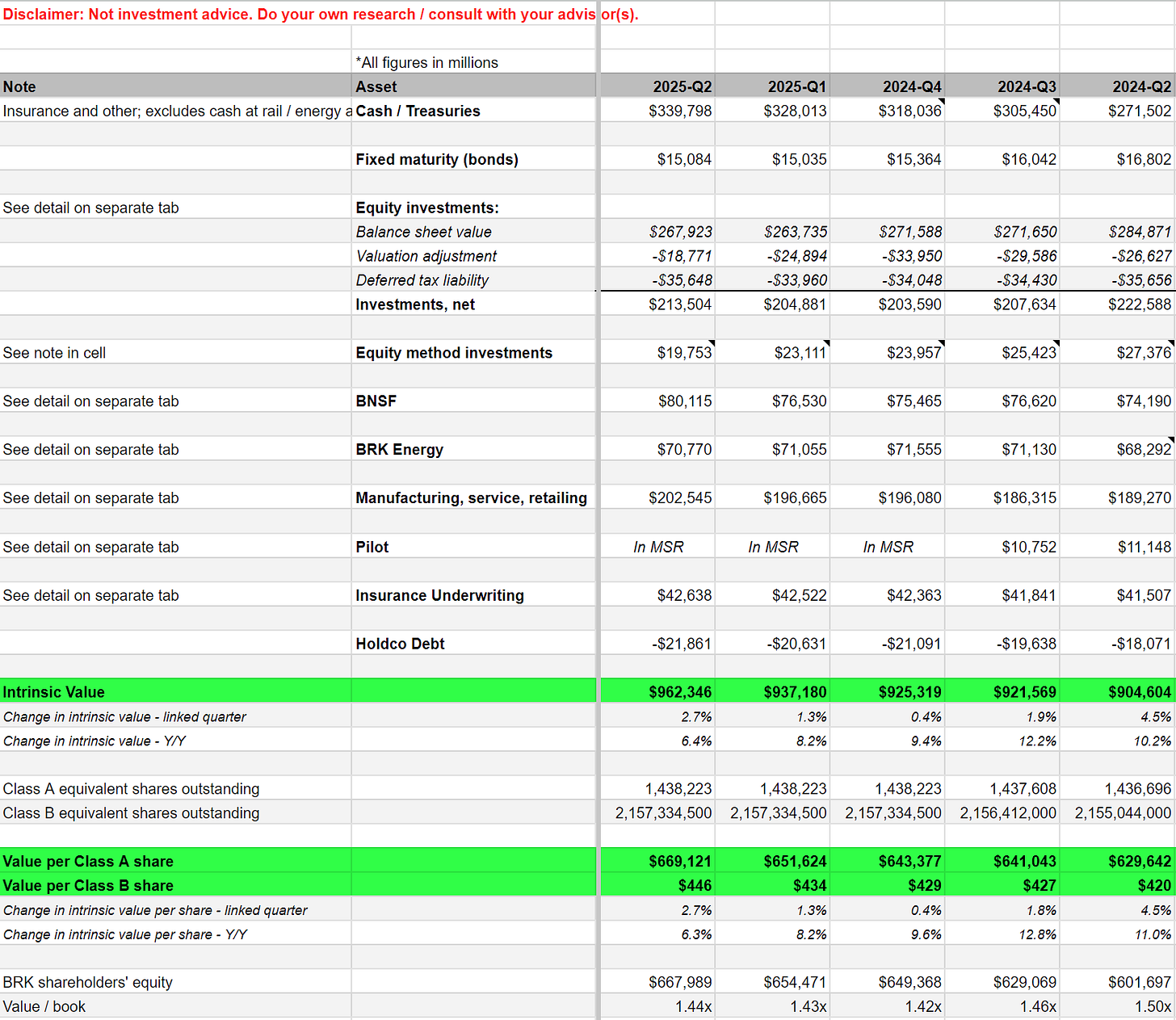

Live BRK Valuation Spreadsheet (Paid Subscribers)

BRK Q2 Analysis

High-Level

Cash (ex. rail/utilities) of $339.8 billion, up from $328 billion at Q1 and $318 billion at YE 2024

Float of $174 billion

Continued net seller of equities; another $3bn in Q2 to $4.5 bn YTD.

Apple is still the largest holding at $66.6 billion, or a quarter of the portfolio

No buybacks, including through July 31, when the 10Q was issued

Additional $1.4 billion Yen-denominated debt to $14 billion, offsetting half of its investment. Importantly, forex losses of $877mm for Q2 and $1.59 billion YTD. These go against operating earnings.

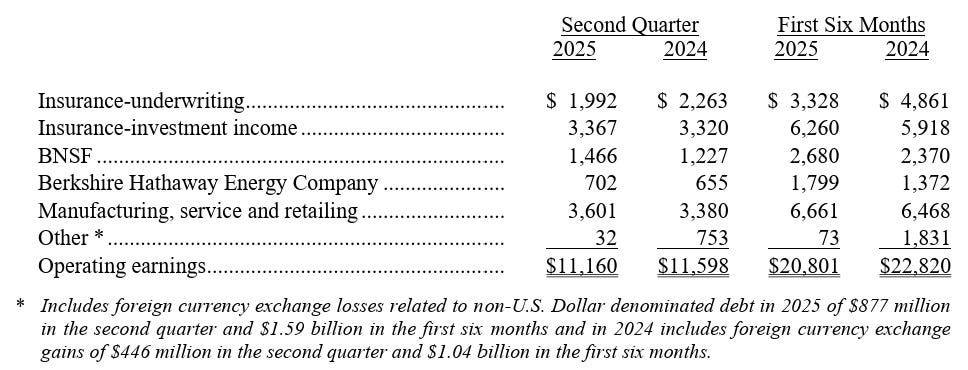

Strong insurance results

Mixed results at BNSF, BHE, and MSR - possibly showing some weakness in the general economy

Operating earnings UP. Properly adjusted for foreign currency moves, Berkshire’s YTD operating earnings increased 2.3% from $21.8 billion to $22.3 billion. Read the footnote to the operating earnings line below carefully.