BrightView Holdings (BV)

A first look into a landscaping services play

Watchlist Subscriber Meetup: This Friday, January 16, 2025 @ 11AM EDT

I’ll send out a link to paid subscribers tomorrow and a reminder on Friday morning. See you then!

Disclosure: None

Note: This first look is not intended to be exhaustive. This is my first time looking at the company. This post is intended to share my findings, both positive and negative. The overarching goal is to learn about a new company and put it on both our radar screens.

Overview

BrightView is the largest provider of commercial landscaping services in the United States. Such language evokes a behemoth, but BV is a relatively small company in absolute terms.

For its fiscal year ended September 30, 2025, the company reported revenue of $2.7 billion. Its market cap is just $1.25 billion.

BV operates in an extremely fragmented industry. Its “largest provider” status was achieved with a 1.7% market share of a $113 billion commercial market that includes landscape maintenance ($88 billion) and snow removal ($25 billion). This is to say nothing of the residential market.

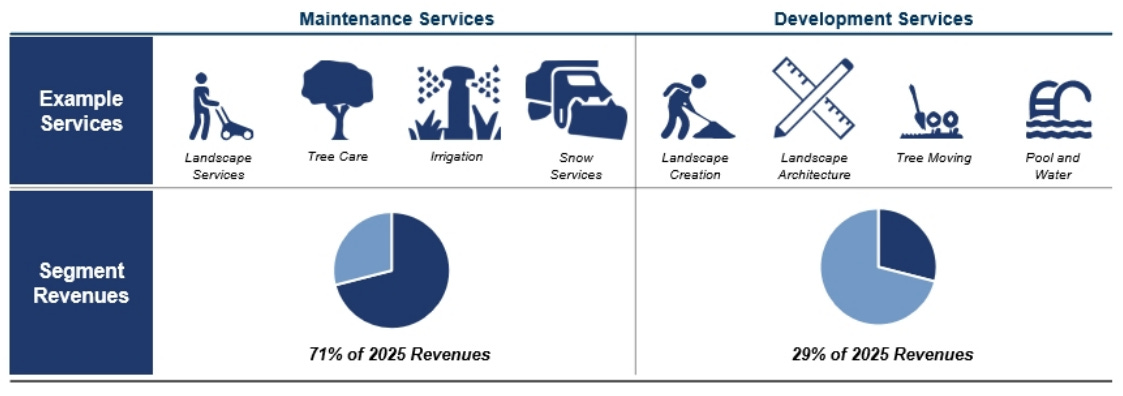

The company operates in two segments: maintenance services and development services, as detailed in this snapshot from the 2024 annual report:

Focusing on the commercial segment allows BV to leverage its sales force to acquire larger customers (lower CAC) and develop recurring revenue.

The company is executing a fairly standard consolidation playbook of centralizing certain functions and standardizing equipment across the enterprise.

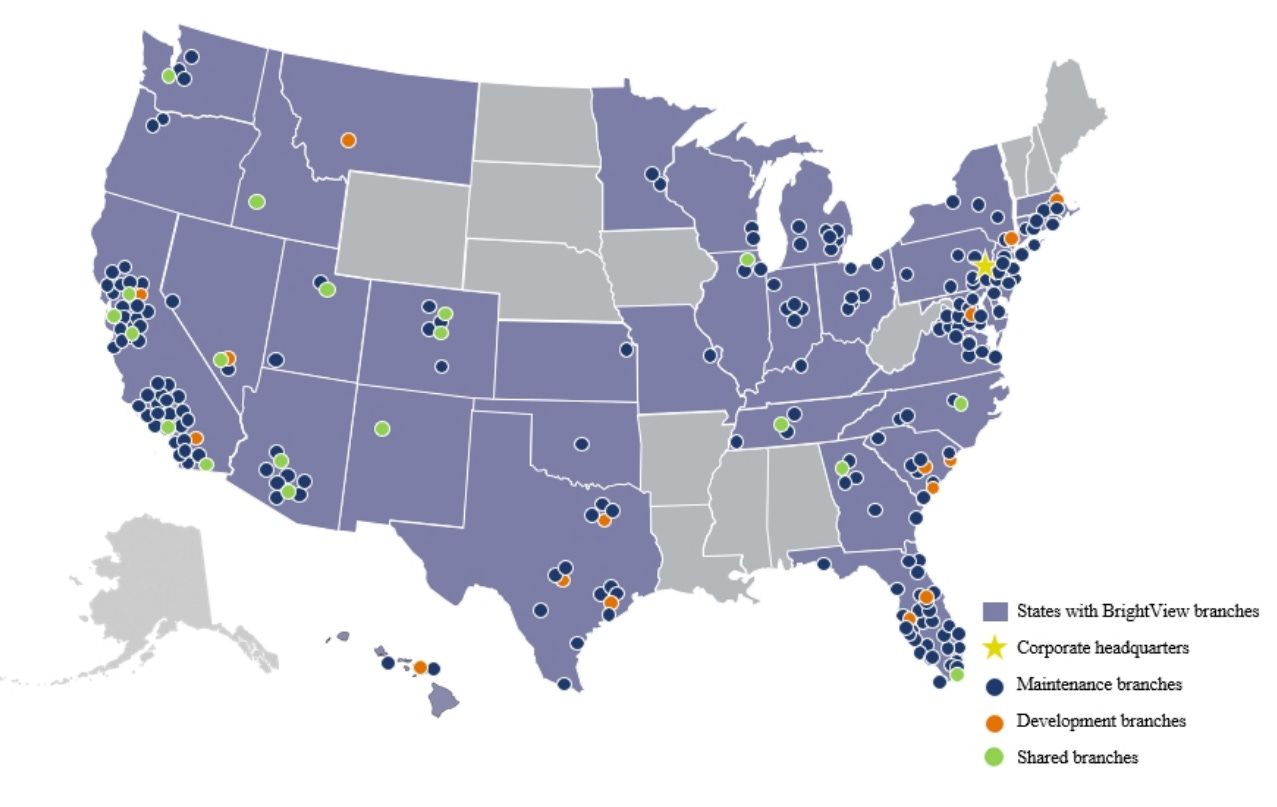

As seen below, its footprint remains sparse, highlighting an opportunity for future expansion and consolidation.

Northern markets are classified as seasonal markets that typically include snow removal, while southern markets are “evergreen” requiring landscape maintenance all year.

Branch Model

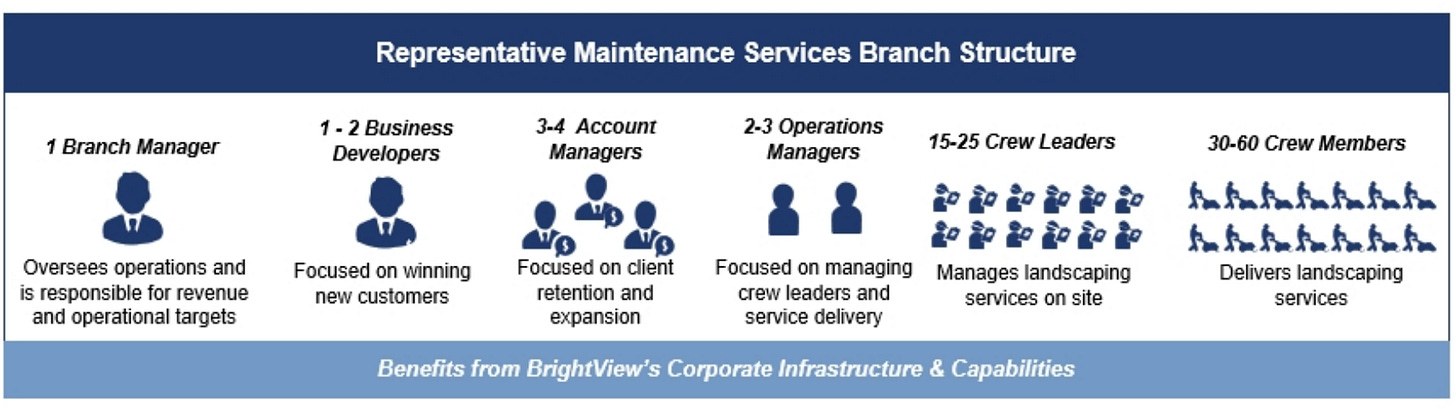

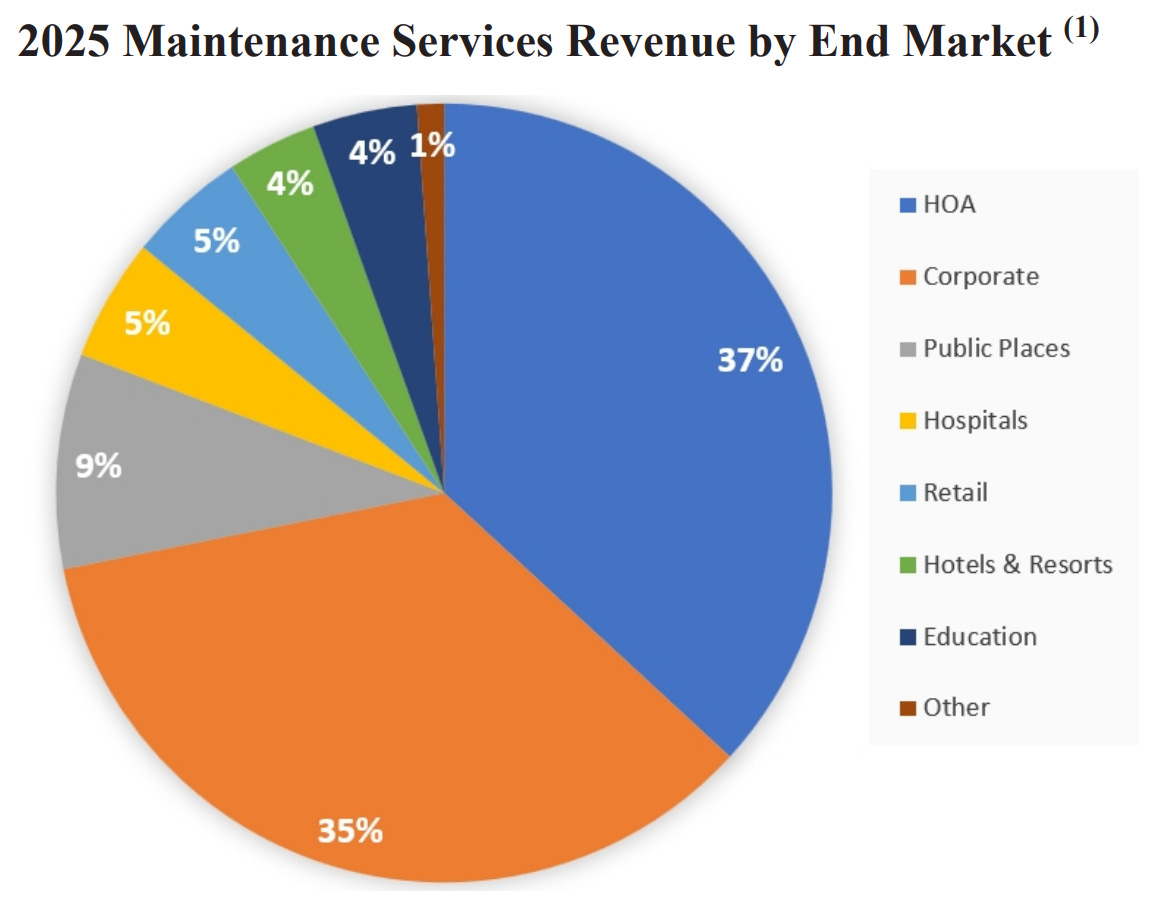

BV’s branch model delivers services to corporate and commercial customers, HOAs, public parks, hotels and resorts, hospitals, educational institutions, retail establishments, golf courses, and more, through its 280 branch network.

The company boasts 11,700 office parks and corporate campuses, 10,000 residential communities, and 700 educational institutions, and serves as the "Official Field Consultant” for Major League Baseball (whatever that means).

Branches serve both maintenance and development customers. Each branch services between 25 to 100 customers across 50 to 250 sites and generates between $2 and $22 million of annual revenue.

Here’s 2024 maintenance services broken down into end market:

The company’s development services segment is more project-based. Projects can range from $100,000 up to $10 million, with an average size (2024) of $1.3 million. BrightView may be hired by a general contractor on larger jobs, and on these and other projects, it manages downstream services providers such as fencing installation.

A Short History of BrightView

2013; Affiliates of KKR acquire Brickman Holding Group, an entity with roots dating to 1939.

2014: Acquisition of ValleyCrest (founded in 1949), which doubled the size of the company. Changed its name to BrightView.

2018: July initial public offering.

2023:

August: $500 million preferred equity investment by One Rock Capital Partners to support deleveraging and expansion.

October: Dale Asplund becomes president and CEO (Oct. 1).

November: The company launches One BrightView to transform the business.

2024: Divested its US Lawns subsidiary for $51 million cash

2025: Board initiates $100 million share repurchase program

As of September 2024, the company had 19,100 employees with 15,750 in maintenance services, 2,950 in development, and 400 corporate.

Management / Ownership

CEO and President, Dale Asplund has been in his role since October 2023. He served as COO of United Rentals since 2019 and was with that company since 1998. In 2024, Asplund earned a base salary of $950,000 and a bonus of $1.235 million. He was granted $4 million worth of RSUs and PRSUs in November 2024.

Chairman of the Board is Paul Raether, a senior partner at KKR.

Directors earn about $100,000 in cash compensation plus $120,000 in stock awards.

Ownership is as follows:

Investment funds affiliated with KKR: 22.1%

Investment funds affiliated with One Rock: 36.2%

Directors and officers: 2.2%

The Series A Preferred Stock held by One Rock is convertible into common shares at a rate of 105.9 common per preferred share at a price of $9.44.

Financial Analysis

Note: September 30 Fiscal Year End

Right from the start, we have a dilemma of sorts. BrightView has grown through acquisition and has a huge amount of goodwill and intangibles on the books. At the end of FY 2025, goodwill was over $2 billion, and intangibles amounted to $66 million.

This dynamic is the result of a highly acquisitive company paying a premium for good properties. This is how I square that circle…