Boston Beer (SAM) Q3 Update

10% of the market cap in cash, aggressive share repurchases, and an attractive valuation amid industry headwinds and a shift to summer-oriented beverages

Disclosure: Long SAM

Prior Posts on Boston Beer

Substack

Legacy Analysis:

Q3 2025 Update

New Chief Supply Chain Officer: Philip Hodges (58) named COO. SAM Chief Supply Chain Officer since May 2023. Over 30 years in the industry: CSO Carlsberg, CSO SABMiller, CFO Kraft Foods International, GM Mondelez Southeast Asia. $800,000 salary. $9M three-year stock options plus $3M RSUs with 3-year vest.

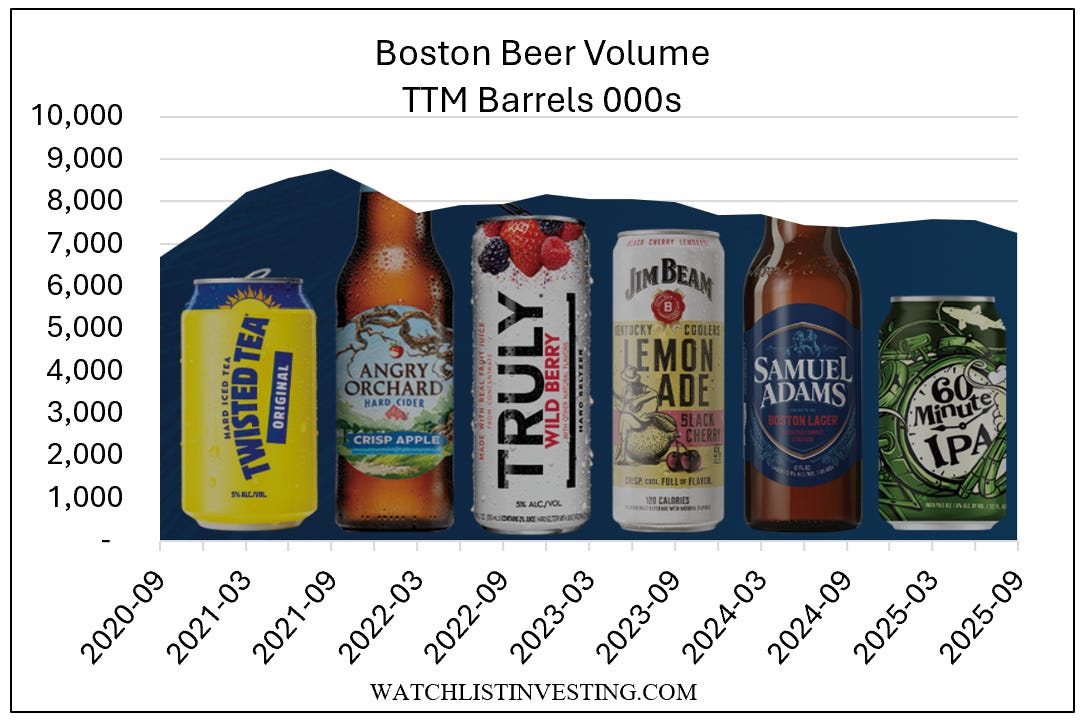

Q3 volume of 1.936 million barrels down 13.7% compared to Q3-2024. TTM volume off 3%.

Revenue down 11.2% to $537.5 million; revenue per barrel $278, up 2.8% from a year ago

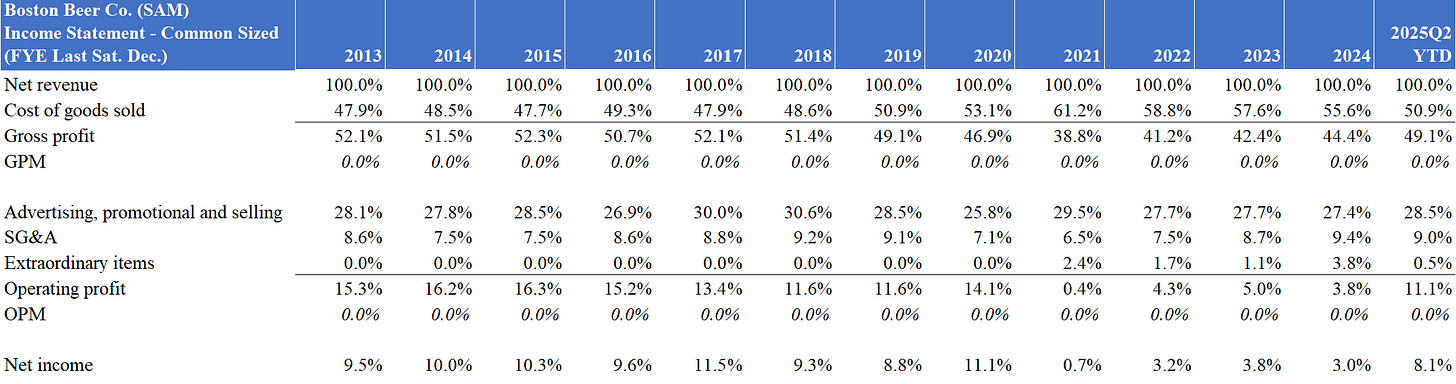

Bright spot was gross margin at 50.8%, the highest since 2018.

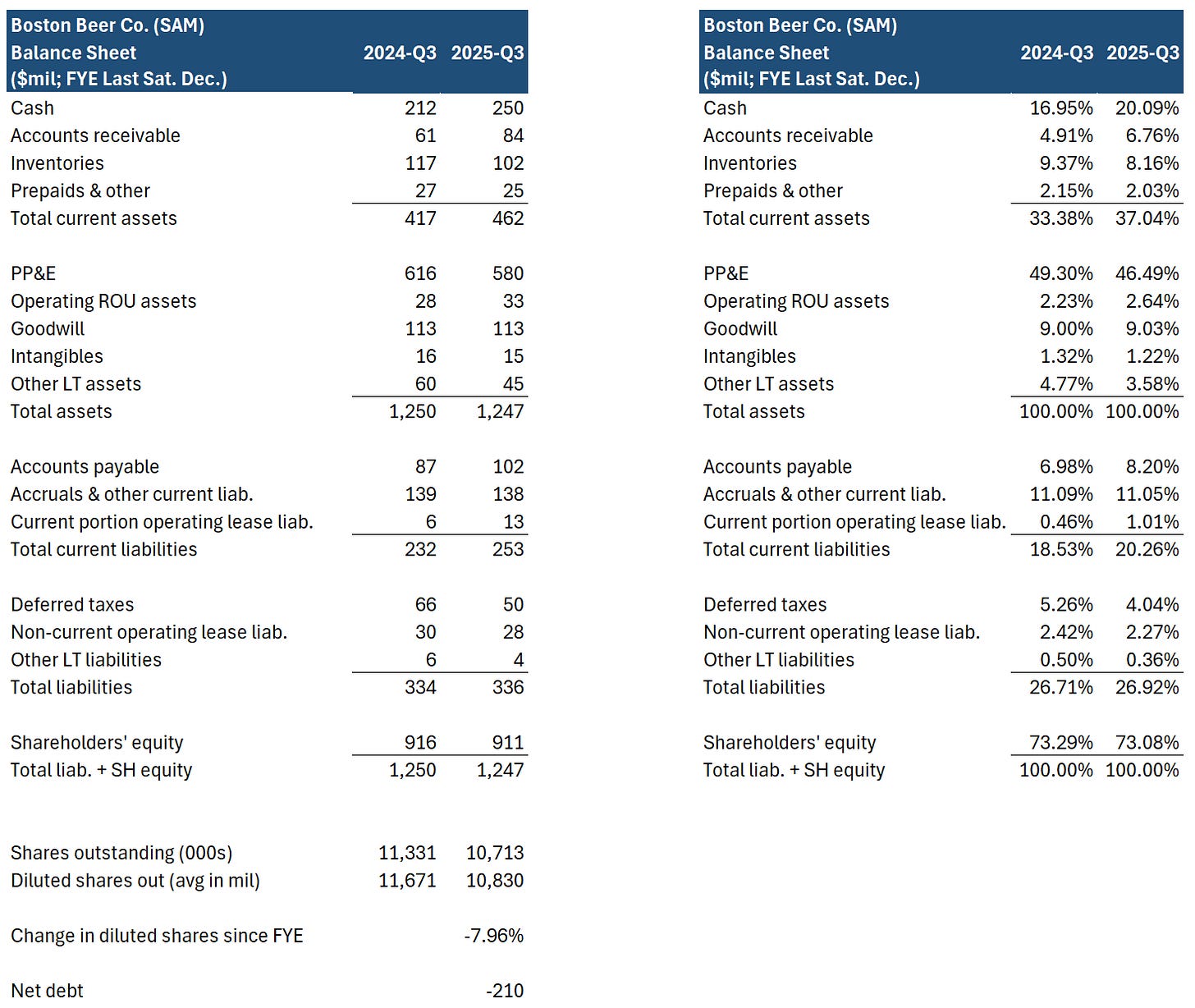

$250mm cash on hand and no financial debt

Repurchased $161 million in 2025 through Oct. 17, which puts diluted shares down 8% since FYE 2024.

Shares appear attractive at current levels (valuation discussion below).

Paid Subscribers: Help me improve by answering a short, two-question survey about this post. Thank you!

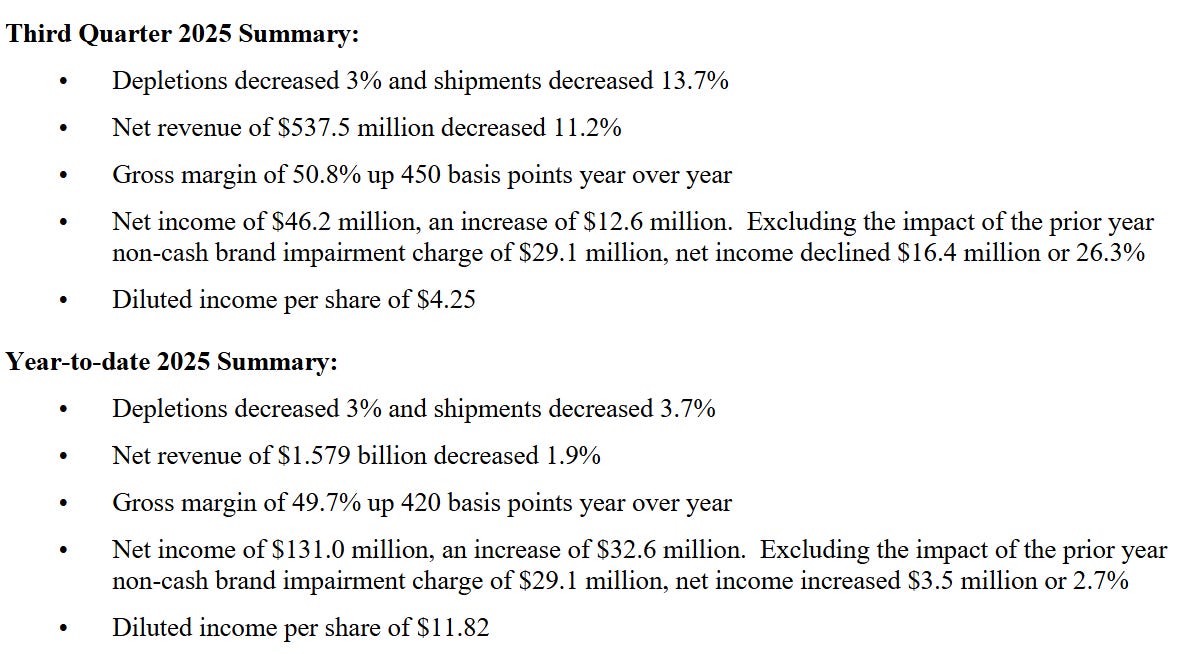

Q3 and YTD 2025 Commentary

Operating Performance

From the press release:

Weak macro factors and cost pressures hit just as the Truly hangover begins to subside. Still, it’s encouraging to see gross margin rebound to more favorable levels at over 50% and the highest GPM quarter since 2018.

SAM produced 90% of its domestic volume in its own facilities in Q3, compared to 66% a year ago.

I like the company’s thinking on third-party production: it’s not just about handling volume, it’s redundancy in the event of an issue with one of the company’s production facilities.

A few notes from the Q3 earnings call:

SAM’s beyond beer cateogory is now 85% of their volume

Twisted Tea is ~$1.2 billion in annual sales (about 60% of annual sales)

Twisted Tea experienced unexpected weakness, down 5% YTD after being up double digits during the first few months of the year; some of the decline is due to cannibalization by Sun Cruiser

Sam and Dogfish Head held market share

Sun Cruiser and Angry Orchard grew

Sun Cruiser expected to grow double and possibly triple digits in 2026 as the the company gets important spring shelf space

Q4 profitability: 5 or 6 years ago, Q4 was profitable, even though it was the lowest in terms of volume; now that the company has shifted toward summer-oriented beverages (Twisted Tea, Truly, Sun Cruiser), Q4 will show a loss. Part of that is ramping up production to handle summer volumes, and part is marketing spend.

GPM “windfall” reinvested into additional marketing spend

Financial Condition

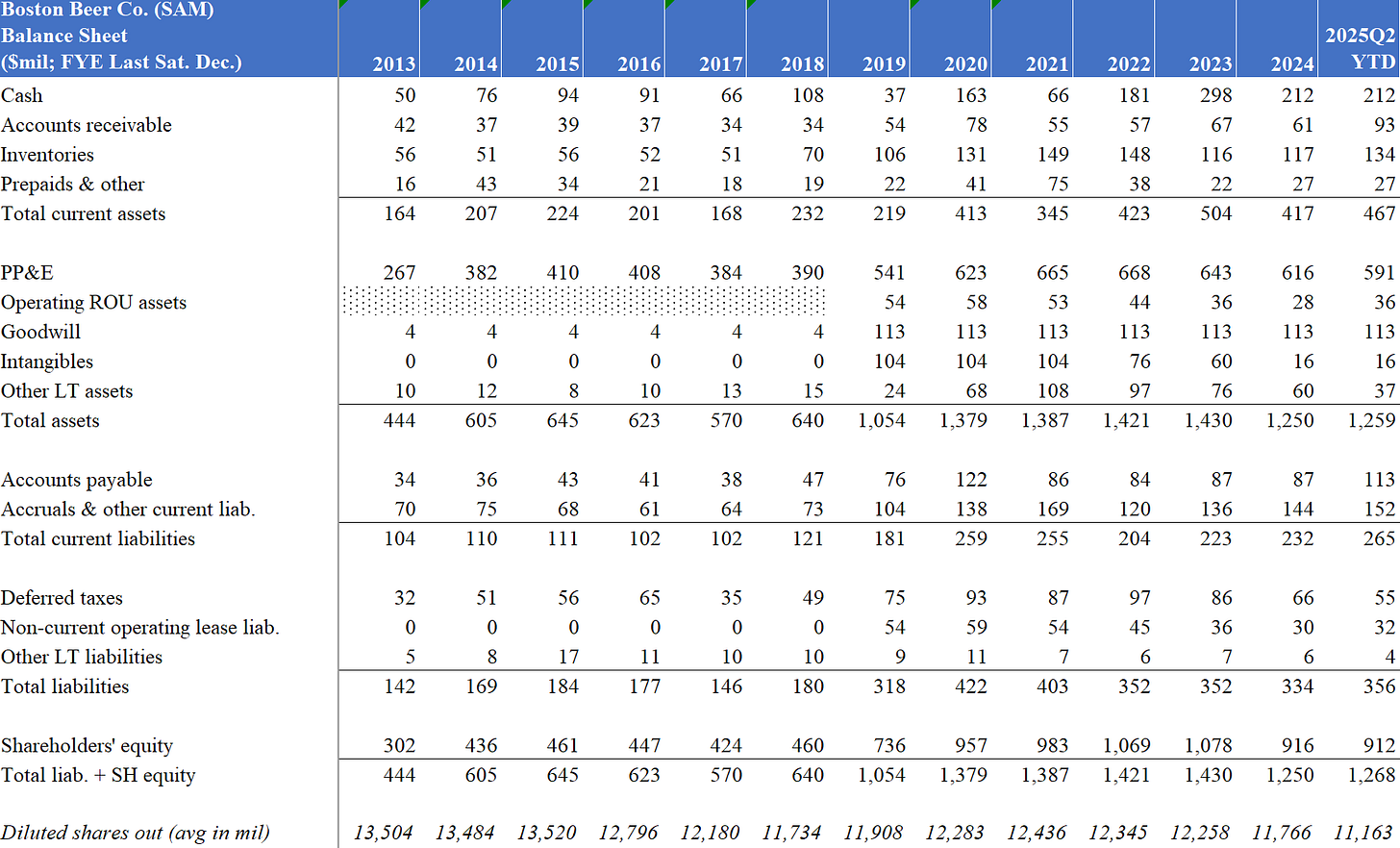

The balance sheet remains pristine with $250 million in cash and no financial debt (plus $41 million of operating lease liabilities).

Capital Allocation

Net PP&E was $580 million at the end of Q3, down $36 million since FYE 2024, as the company adapts to shrinking volumes.

Likewise, core working capital (A/R, Inventories, Prepaids, less A/P and Accruals) is down $9 million to negative $29 million at the end of Q3.

Major capital allocation moves for the first 9 months of 2025:

Net income of $131 million

$30 million shrinkage in PP&E (before $6.4 million impairment of brewery assets)

Share repurchases of $152.4 million. Diluted shares are down 8% YTD.

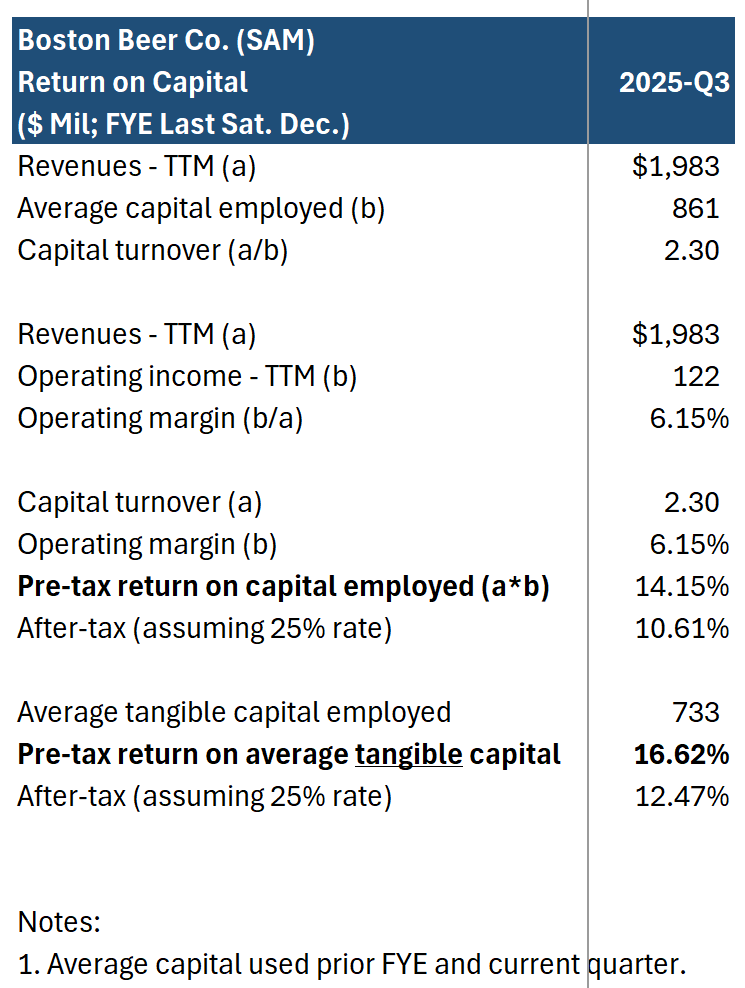

Valuation Update

With 10.8mm shares outstanding and a price of $225 (unchanged since the Q2 update), Boston Beer has a market value of $2.43 billion. Take off $210mm for net cash, and you’re at $2.22 billion.

The company employs tangible capital of $712 million, and with annual revenue at about $2 billion, it’s turning over its capital base 2.8x per year. Its pre-tax operating margin came in at 11.5% in Q3, which would put it below its 2013-20 average of 14.2%, meaning it’s very likely sustainable from here on out. Capital turnover of 2.8x and an 11.5% operating margin result in pre-tax returns on capital of 32.2% and about 24% after a 25% tax rate.

If we assume revenues stabilize at $2 billion and SAM can earn 15% normalized margins, it’ll earn $300 million pre-tax or $225 million after-tax. That’s about a 10% return on today’s market cap assuming no growth.

Stay Rational! (And Cheers!)

Adam

Good update on an interesting situation, thanks Adam!