Boston Beer (SAM) Q2 Update

An important governance change and a compelling valuation

Disclosure: Long SAM

Prior Posts on Boston Beer

Substack

Legacy Analysis:

Q2 2025 Update

On August 1, 2025, the company announced that its current CEO and Board Member, Michael Spillane, would be stepping down. That he will remain on the Board of Directors is a positive sign, in my view. Founder and Chairman, Jim Koch, resumed the CEO role, which he held from 1984 to 2001.

1st Chart — Trailing twelve-month volume has settled around 7.5 million barrels (9 million hectoliters) after peaking at 8.8 million bbl (10.5m hL) in Q3 2021 with the hard seltzer craze.

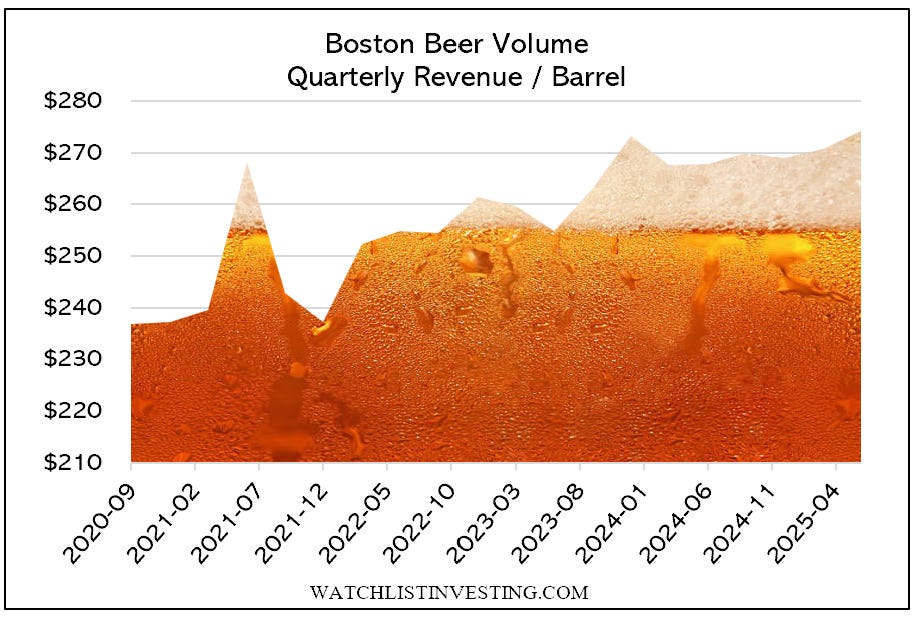

2nd Chart — While volume has plateaued, revenue per barrel continues to increase, showing the company’s pricing power and resiliency.

The balance sheet remains strong with $212mm cash and no debt (except for $43.8mm total lease liabilities).

The company has repurchased $102mm of stock YTD through Q2 2025, after spending $238.6mm in 2024 and $93mm in 2023.

Shares appear attractive at current levels (valuation discussion below).