Bank of South Carolina (BKSC)

Revisiting a micro cap bank

With shareholders’ equity of $58 million and a market cap of $88 million, BKSC is solidly in the microcap category.

The Bank of South Carolina came back on my radar after I first covered it in February 2023. What follows are some updates.

30,000 Foot Financial View

My starting point with any bank is:

Its size, measured in assets

Its profitability, as measured by return on assets

Asset size indicates the expected complexity, both in terms of business lines and branch network, and return on assets indicates basic profitability, independent of leverage.

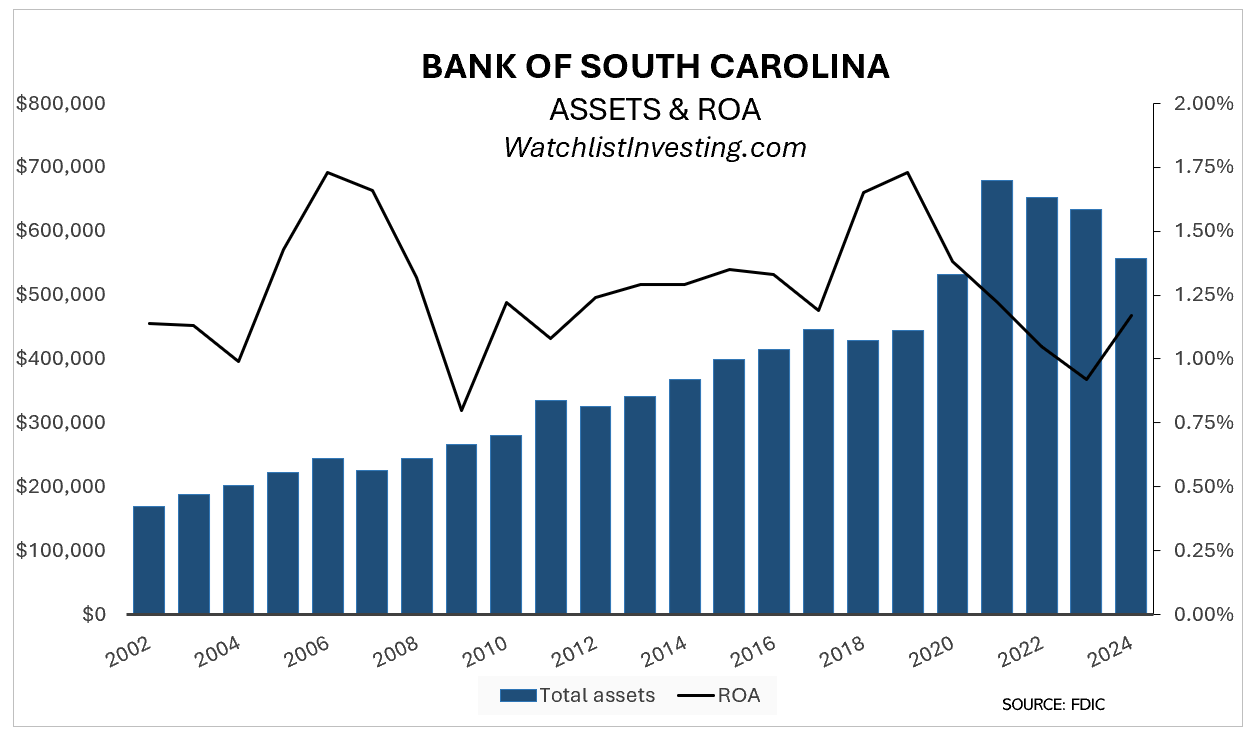

From 2002 through about the next 20 years, BKSC showed regular compounding of assets to about $500 million. Assets then jumped to $678 million in 2021 before slowly declining to $557 million in 2024. As of 3Q2025, BKSC had total assets of $580 million.

ROA has had its ups and downs, but has remained about the 1.25% mark before declining beginning in 2020.

A post-pandemic surge in deposits invested in lower-yielding US Treasuries that slowly bled off appears to answer the question about the decline in assets and profitability. We’ll dig into that in a moment.

Footprint

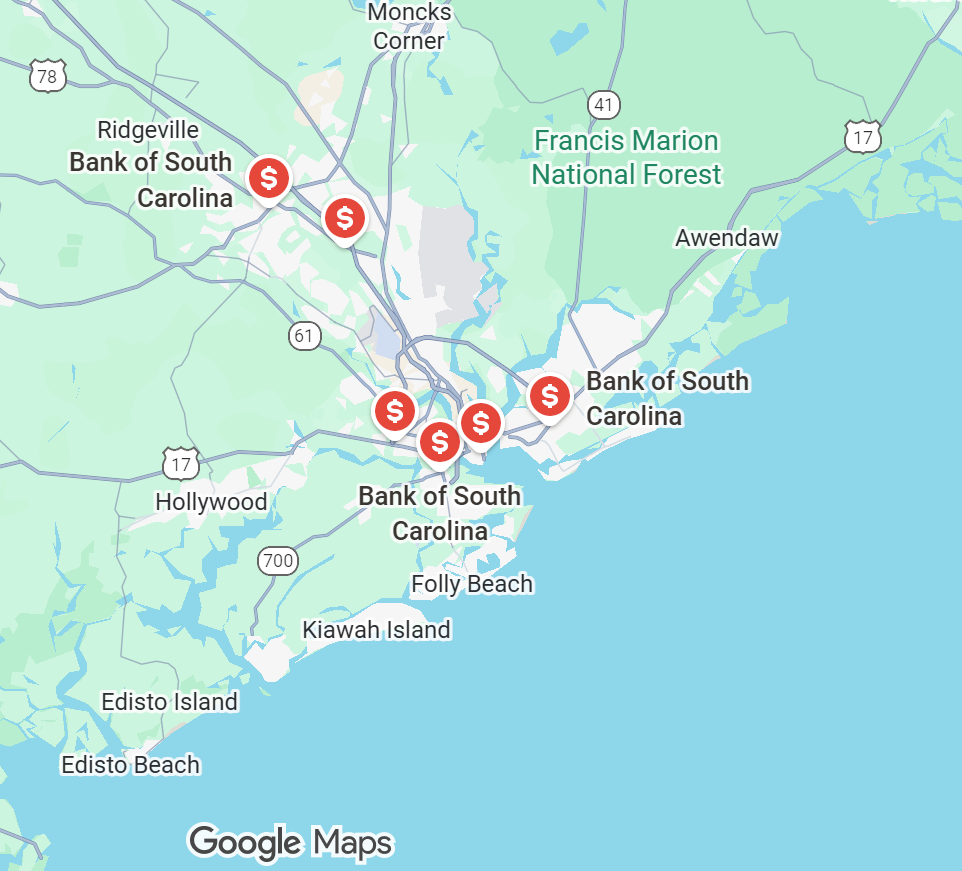

BKSC maintains a 6-branch network within a 10-mile radius of Charleston, South Carolina. As is typical of a smaller localized bank, BKSC offers a standard-diet array of deposit accounts and related services coupled with a real estate-focused loan portfolio.

Let’s dig into the details…